There are many in India that offer directors’ and officers’ liability insurance. These companies offer various benefits under the policy and charge different premium rates. Looking to secure the right insurer for directors and officers liability insurance? Here’s a comprehensive guide on how to shortlist and choose wisely.

There are couple of factors to take into account when choosing an insurer for a Directors and Officers Liability policy (D&O):

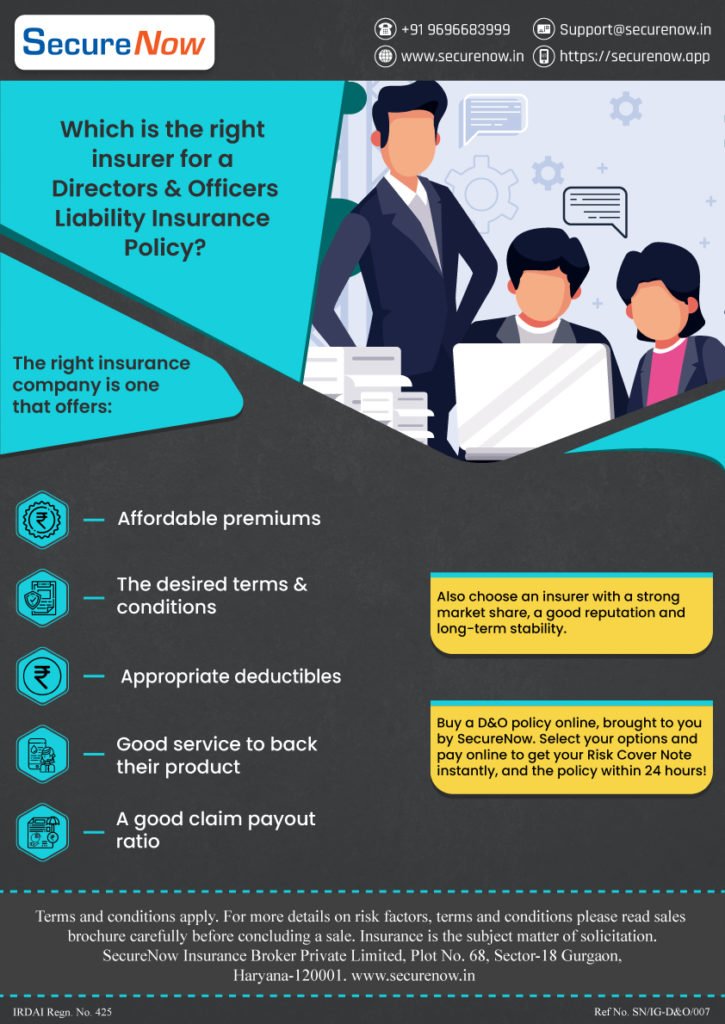

- Affordable Premiums– When buying D&O insurance, affordable premiums from insurers are a key consideration. It ensures cost-effectiveness without compromising on comprehensive coverage for your directors and officers.

- Desired Terms & Conditions- Examining the desired terms and conditions is crucial. Look for an insurer that offers favorable and comprehensive policy terms, providing adequate protection for your directors and officers.

- Appropriate Deductions– When considering D&O insurance, it is important to review the appropriate deductions offered by an insurer. Look for deductibles that align with your risk tolerance and budget, ensuring a balanced approach to coverage and cost.

- Customer service- Therefore, it is important to work with an insurer that has responsive and supportive customer service.

- Good claim Payout ratio– For Directors and Officers Liability Consider the claims process of each insurance provider and choose one with a simple and efficient process.

Additionally, one should also look at below aspect pertaining to insuers:

- Coverage- Compare different D&O Liability policies from different insurers to ensure that you are getting the best cover, at a price you can afford.

- Financial stability- Moreover, a financially stable insurance company will be able to pay out any claims that may arise.

- Reputation- Look for an insurer with a good performance history and reputation in the insurance industry and a track record of fair claim settlements.

In conclusion, when shortlisting the Right insurer for directors and officers liability insurance, carefully evaluate their expertise, financial stability, and policy terms. By conducting thorough research and seeking recommendations, you can ensure optimal protection for your directors and officers.

The below infographic explains how you can choose the right insurance company to buy a directors & officers liability policy.

Written By

Rajesh

MBA Finance

With a wealth of expertise in the insurance realm, Rajesh is a distinguished writer specializing in articles focusing on directors and officers insurance for SecureNow. Boasting 9 years of experience in the industry, he profoundly understands the complexities surrounding directors and officers liability coverage. Their articles delve into the intricacies of D&O insurance, providing readers with invaluable insights into risk mitigation strategies and policy considerations. Renowned for their comprehensive knowledge and attention to detail, Rajesh is dedicated to delivering informative and engaging content that empowers individuals and businesses to navigate the complexities of insurance with confidence.