BUSINESS INSURANCE SIMPLIFIED

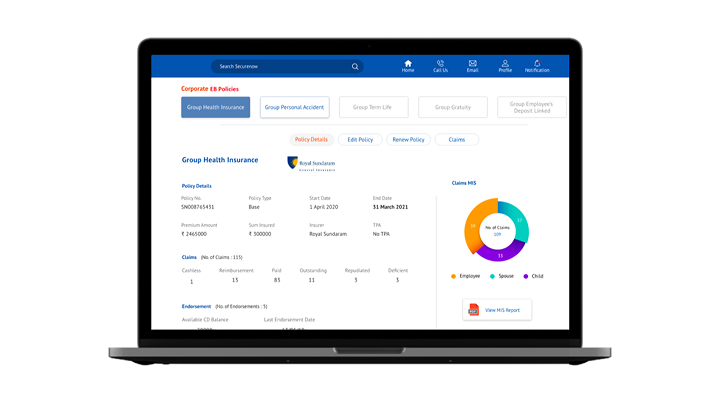

SecureNow helps businesses buy and manage corporate insurance. Get quick quotes, detailed comparisons and expert support all in one place.

Recognition

Our Experts in Action

A glimpse into our workplace culture, collaboration and milestones.

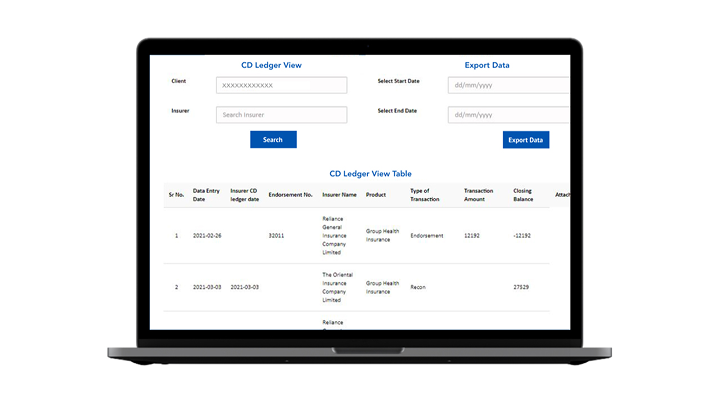

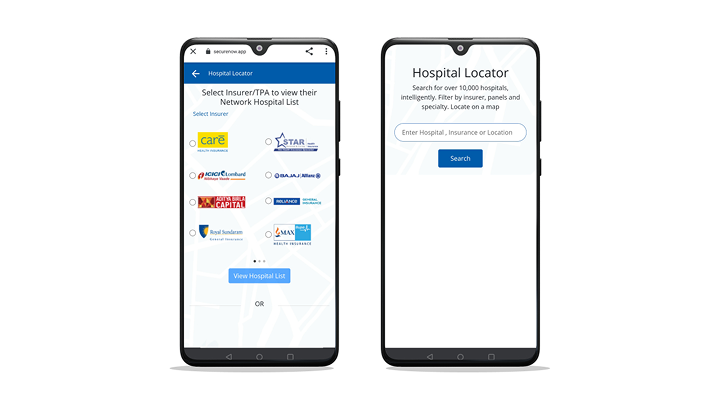

Tools to Buy and Renew Insurance Policy Online

Why SecureNow

Fast Quotes

Fast Quotes

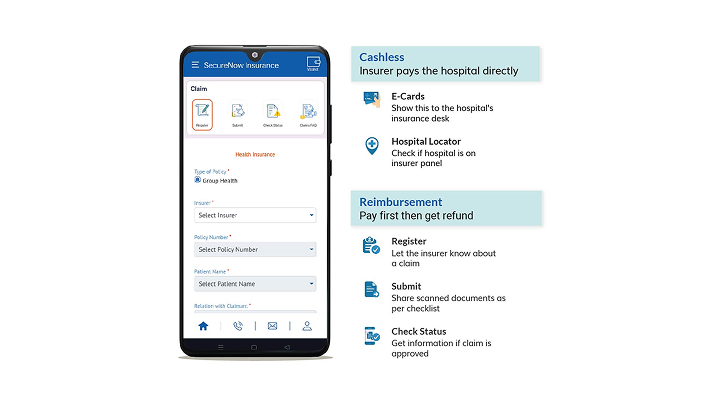

Value Added Services

Value Added Services

Fast Turnaround

Fast Turnaround

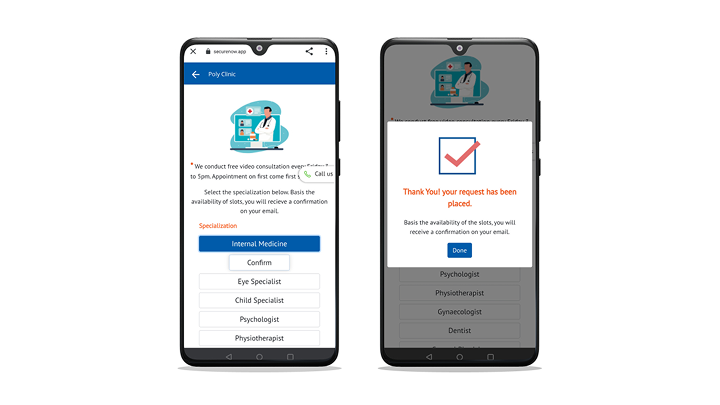

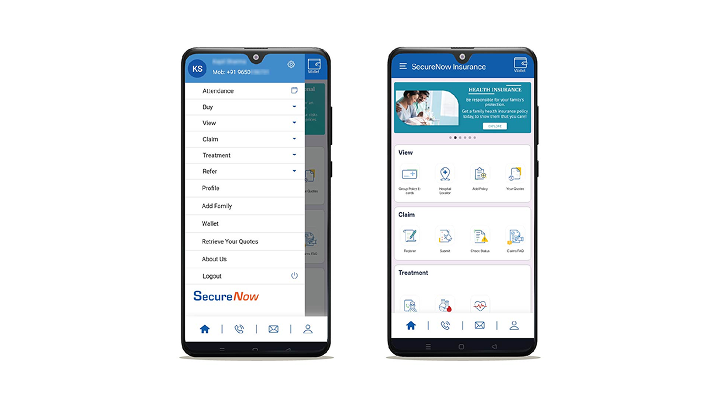

Mobile-Friendly Interaction

Mobile-Friendly Interaction

24/7 Cutomer Dedication

24/7 Cutomer Dedication

Integrated Policy Solutions

Integrated Policy Solutions

What Our Customers Are Saying

Frequently Asked Questions

Client Testimonials

Our Insurer Partners

Blog

Is it better to have an insurer with a TPA for my group mediclaim, or should one pick an insurer that processes claims in-house i.e. on their own?

Both in-house claim departments and TPAs provide effective processes for health insurance claim settlements. The in-house claim process allows the insurance company to exert better control. This includes easier claims handling and a lower turn-around time (TAT) for policyholders. TPAs have their own cashless hospital networks which are ge....

Read More...

Why should I buy my group insurance through Securenow Insurance Broker and not directly from the insurer? Further, how is Securenow better than other brokers?

Planning to buy a group insurance cover? We have got you covered with some of the exclusive benefits that you could avail yourself of while buying the insurance cover for your employees. Listed below are some of the salient features available in the SecureNow platform : Securenow is a leading, award-winning, tech-enabled insurance br....

Read More...

I am offered an option between choosing a Public Sector (PSU) or a private insurer for my group health insurance. How do I decide? What are the benefits I can enjoy if I choose either type of insurer?

There are unique benefits to choosing either type of group health insurer. A few private insurers provide faster claim settlements as compared to PSUs. However, PSUs offer GIPSA (General Insurance Public Sector Association) packages through PPN-listed hospitals which brings in a greater rationalization of the claims cost structure in bill....

Read More...

Why should I buy group health insurance if my previous claims have driven up my renewal premium?

High claims indicate high utilization of the policy by employees. This actually indicates that the purpose with which you bought the policy is getting served well. It is natural that if a certain group claims more than others, it will also have to bear a higher share of the burden of premium. Despite an increase, group health insurance p....

Read More...

Certifications

ISO 27001

IRDA Cyber Security Audit

Information Systems Audit (ISNP)

Secure Socket Layer Encryption

IRDA License

Shop & Establishment