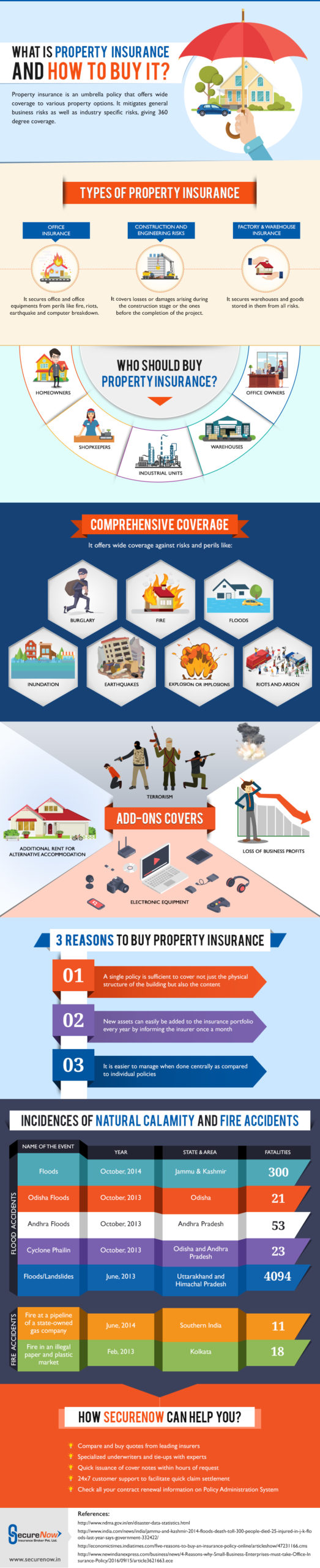

Property insurance is an umbrella policy that covers various assets fixed or movable against the risk of damage. Plants, machinery, and stock in the warehouse are valuable properties for business and can be vulnerable to many risks. The financial burden of such risks can be reduced with the help of property insurance. Know about the perils and types of assets covered by property insurance policies.

Property insurance is a type of insurance that protects individuals and businesses from financial loss due to damage or destruction of their property. This can include homes, buildings, and personal possessions. The policy typically covers losses caused by events such as fire, theft, and natural disasters. To buy online property insurance, one typically needs to provide details about the property being insured, including its location, age, and condition. It is also important to provide information about any security features that are in place, such as alarm systems or fire extinguishers. When buying property insurance, especially commercial property insurance, it is important to work with a reputable insurance agent or broker who can help you compare different policies and choose one that is best suited to your needs and budget. Additionally, it’s important to make sure the policy has enough coverage to repair or replace the property in case of a loss.

An add-on cover in property insurance is an additional protection that can be purchased in addition to the standard coverage provided by a property insurance policy. These add-ons are also known as riders or endorsements, and they can help to tailor the policy to meet the specific needs of the policyholder.

Some common add-on covers in property insurance include:

- Natural calamities cover: This add-on covers damages caused by natural disasters like earthquakes, floods, hurricanes, or tornadoes, which may not be covered under the standard policy.

- Terrorism cover: This add-on provides coverage against damages caused by acts of terrorism.

- Home appliance cover: This add-on covers the repair or replacement costs of household appliances like refrigerators, air conditioners, washing machines, etc.

- Personal accident cover: This add-on provides compensation for accidental injuries or death that occur within the insured property.

- Burglary and theft cover: This add-on provides coverage against damages caused by theft, burglary, or any other type of theft.

- Loss of rent cover: This add-on provides compensation for the loss of rent if the property becomes uninhabitable due to a covered event.

It is important to carefully review the terms and conditions of each add-on cover to ensure that it meets your needs and fits your budget. Additionally, you should always ensure that you are purchasing add-ons from a reputable insurance provider, and that you understand the premiums and deductibles associated with each coverage option. With the right add-on covers, you can enjoy greater peace of mind knowing that your property is protected against a range of potential risks and threats.

Natural calamities cover is an important add-on cover in property insurance because it provides protection against damages caused by natural disasters that are beyond our control. Natural calamities such as floods, earthquakes, hurricanes, and wildfires can cause significant damage to homes and property, leading to high repair or replacement costs. Having this cover in your property insurance policy can help to mitigate these costs and provide you with financial protection.

Property insurance, on the other hand, is important because it provides coverage against a wide range of risks and threats that can damage or destroy your property. This includes not only natural calamities but also theft, vandalism, and accidental damage. By having a property insurance policy, you can rest assured that you have financial protection in case of any unexpected events.

Overall, having a natural calamities cover and property insurance policy is crucial for any homeowner as it provides financial security and peace of mind. It is important to carefully review the terms and conditions of your policy and ensure that it meets your specific needs and budget.

About The Author

Shivani

MBA Insurance and Risk

She has a passion for property insurance and a wealth of experience in the field, Shivani has been a valuable contributor to SecureNow for the past six years. As a seasoned writer, they specialize in crafting insightful articles and engaging blogs that educate and inform readers about the intricacies of property insurance. She brings a unique blend of expertise and practical knowledge to their writing, drawing from her extensive background in the insurance industry. Having worked in various capacities within the sector, she deeply understands the challenges and opportunities facing property owners and insurers alike.