It is the legal responsibility of employers to make the workplace safe for their employees. However, mishaps can occur even at a safe location and when every safest measure has been taken care of. For instance, a few months ago, an operator of a tower crane lost his life and three workers got injured when the crane broke down and its heavy parts fell at a construction site in Hinjewadi, Pune.

Read More: Who Should Buy Workers Compensation Policy?

In the case of accidents, employers are legally responsible for paying the compensation, which in certain cases could be a hefty amount.

Therefore, to safeguard employers from lawsuits resulting from workplace accidents and to give complete medical care and compensation for lost income to employees, it is necessary to buy a workmen compensation insurance policy.

Purpose of a Worker’s Compensation Insurance Policy.

Offering legal liability coverage to employees, a worker’s compensation insurance plan covers both work-related accidents and illnesses. This ‘no fault’ insurance policy rewards injured workers and their families. Even, safeguards policyholders from potentially big suits, filed by the injured employee or their family in case of any mishap. The compensation is payable as per the scheme detailed in the Workmen’s Compensation Act of India. Monitored by the Ministry of Labour. Its name has been changed to the Employees’ Compensation Act, 1923.

A workmen’s compensation insurance plan is useful as it gives payments to injured workers. Without regard to whose fault was it, for time lost from work and various medical and rehabilitation services. Insurance is useful as it also gives various benefits to surviving spouses and dependents.

Relevant Statutes and Laws which fall under the Workmen’s Compensation Act of India

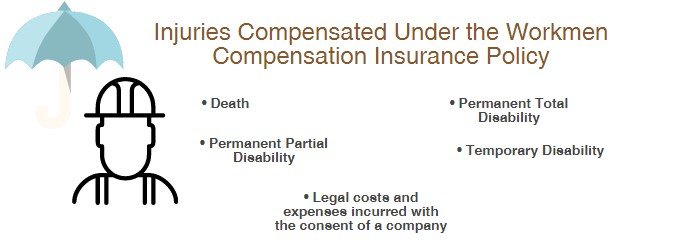

This insurance policy covers the legal liability of any employer as per the following –

- Workmen’s Compensation Act, 1923 and subsequent amendments to the Act before the date of the policy issuance

- Indian Fatal Accidents Act, 1855 and subsequent amendments to the action prior to the date of the policy issuance

- Common-Law

Usually, having this insurance cover means that employees give up their rights to sue your business for negligence. In return, they also get complete peace of mind knowing that they will get the necessary compensation amount without going through the intricacies of the law.

While a workers’ compensation policy offers the basic cover, you can extend it with the following coverages:

- Actual medical, surgical, and hospital expenditures incurred along with the cost of transporting to the hospital for treating the accidental work injuries

- Occupational ailments, mentioned in Part ‘C’ of Schedule III of the Workmen’s Compensation Act, 1923

Note, an employee is liable to get compensation only if the accident happened out of or in the course of employment. It means, the accident should occur when the employee is in employment and linked to employment.

See: What is covered under Workmen Compensation Insurance Policy?

In 2016, the Lok Sabha passed the Employee’s Compensation (Amendment) Bill. Which increased the cap on the compensation amount the high courts take. Section 30 of the Employees’ Compensation Act, 1923, allows an appeal in high courts. Whenever the disputed amount of compensation increases to Rs 300. Now, the bill has increased this limit to Rs 10,000. Further, the bill has also made the provision of an increase in the penalty for contravention of the Act from Rs 5,000 to Rs 50,000. Which may raise to Rs 1 lakh.

So, reiterating what we said above, “Yes, you need a workmen compensation insurance policy. In order, to save you and your business from hefty claims that may arise in the case of injury caused by your worker”.

About The Author

Rahul Kumar

MBA Finance

With a wealth of experience in the insurance industry, Rahul is a seasoned writer specializing in articles related to workmen compensation policies (WC policies) for SecureNow. With 12 years of experience in the field, he has acquired in-depth knowledge and expertise in workmen compensation insurance, understanding its complexities and nuances. Their insightful articles provide valuable insights into the importance of WC policies for businesses and employees alike, offering practical advice and guidance on navigating the intricacies of insurance coverage. Trust him to deliver informative and engaging content, backed by years of experience and a passion for educating readers about insurance-related topics.