Important Features of a Cyber Insurance Policy

In today’s fast-paced digital landscape, where data breaches and cyber threats lurk around every virtual corner, safeguarding your business with a robust cyber insurance policy has become non-negotiable. But what exactly should you look for when choosing the perfect cyber insurance policy? Let’s dive into the crucial features that can make all the difference in securing your digital assets and reputation.

1. Comprehensive Coverage:

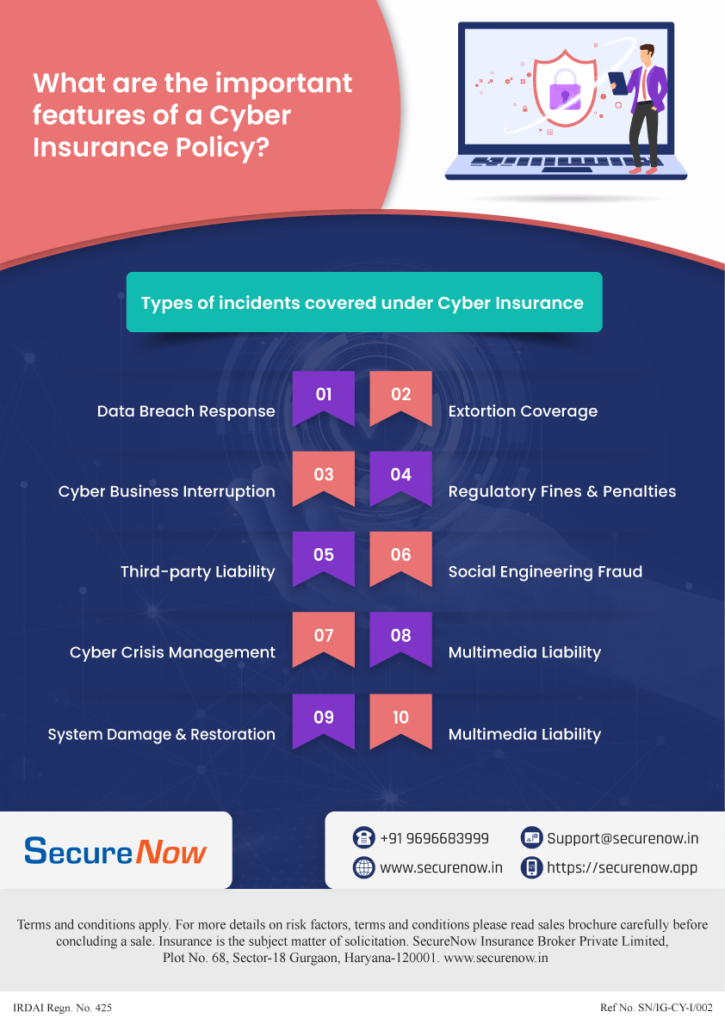

A top-tier cyber insurance policy should provide comprehensive coverage that encompasses a wide range of cyber incidents. Thus, from data breaches and hacking attacks to ransomware and business interruption, make sure your policy shields you against the full spectrum of cyber risks.

2. Legal and Regulatory Support:

In the aftermath of a cyber incident, navigating the legal and regulatory landscape can be a labyrinth. Hence, look for a policy that not only covers legal fees but also provides expert guidance to help you steer through the complexities of data privacy laws and regulations.

3. Incident Response Plan:

A proactive cyber insurance policy includes an incident response plan. This crucial feature outlines the steps you need to take in the event of a cyber incident, ensuring a swift and coordinated response that minimizes damage and maximizes recovery.

4. Third-Party Liability:

Cyber incidents can have a ripple effect, affecting not just your business but also third parties. A comprehensive policy should cover third-party liability, protecting you from potential legal action and financial repercussions due to breaches involving your suppliers, partners, or customers.

5. Business Interruption Coverage:

Cyberattacks can bring your operations to a screeching halt. Look for a policy that offers business interruption coverage, compensating you for lost income and extra expenses incurred as a result of a cyber incident.

6. Reputation Management:

Your business’s reputation is priceless. Therefore, an effective cyber insurance includes coverage for reputation management and public relations efforts to rebuild trust and credibility in the wake of a breach.

7. Cybersecurity Training and Education:

Prevention is better than cure. So, seek a policy that goes beyond financial protection by offering cybersecurity training and education resources to empower your team to recognize and respond to potential threats.

In a digital landscape where cyber threats are ever-evolving, a robust cyber insurance policy is your armor against the unknown. In other words, by ensuring your policy includes these essential features, you’re not just protecting your business – you’re equipping yourself with the tools to thrive securely in the digital realm. So, choose wisely, and navigate the complexities of cyberspace with confidence.

About The Author

Arshdeep

MBA Insurance Management

Arshdeep is a seasoned insurance expert with 7 years of experience, specializing in Cyber Risk Insurance. As a writer for SecureNow, he delivers insightful blogs and articles that demystify the complexities of cyber risk coverage. His content is designed to help businesses understand the importance of protecting against cyber threats and data breaches. With a focus on practical advice and the latest industry trends, Arshdeep empowers readers to make informed decisions about their cyber insurance needs, ensuring robust protection in an increasingly digital world.