Cyber Insurance Policy – Online Claim Process

In the dynamic and ever-connected digital landscape, even the most fortified businesses can fall victim to cyber threats. This is where the resilience of a robust cyber insurance policy comes into play. When the unforeseen strikes, knowing how to file a Cyber Insurance claim online can make all the difference in restoring normalcy swiftly. So, let’s dive into a step-by-step guide to help you navigate the process with ease.

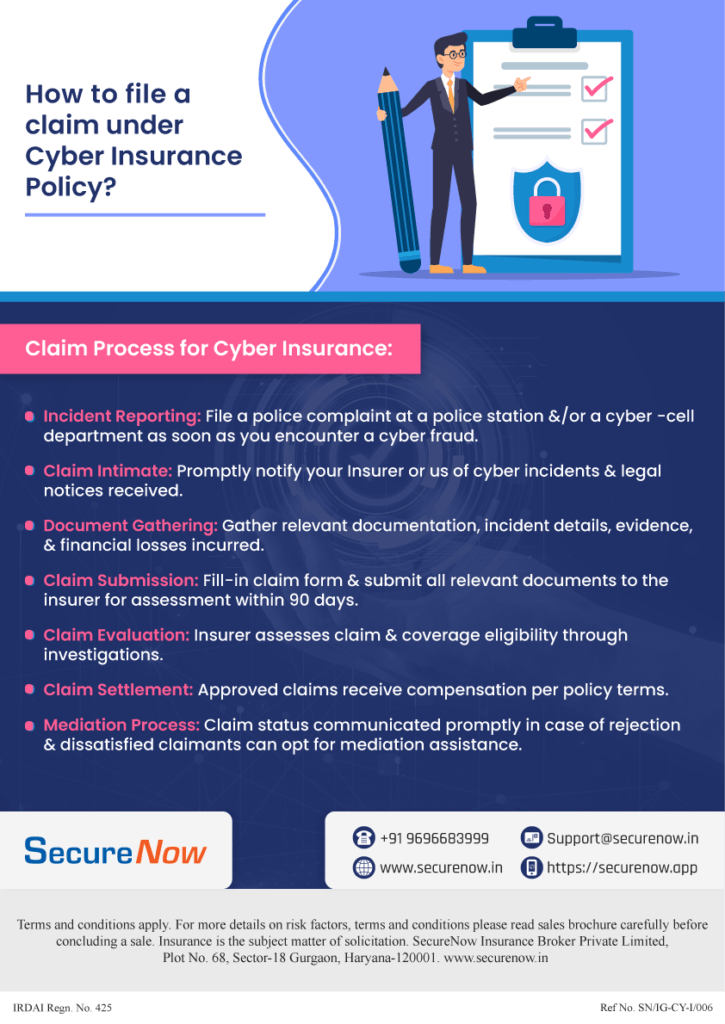

1. Notify Your Insurer:

At the first sign of a cyber incident, notify your insurer immediately. In fact, most policies have a specified timeframe for reporting. This prompt action initiates the claims process and demonstrates your commitment to mitigation.

2. Gather Evidence:

In the meantime, compile detailed evidence of the incident, including the nature of the breach, affected systems, and the extent of the damage. This documentation indeed serves as a vital foundation for your claim.

3. Engage Incident Response Team:

If your policy includes incident response services, engage the team provided by your insurer. They’ll guide you through containment, analysis, and recovery steps, ensuring a well-coordinated response.

4. Contact Law Enforcement (if necessary):

In certain cases however, involving law enforcement is crucial. Coordinate with legal authorities if the incident involves criminal activity, as this strengthens your claim.

5. Complete Claim Form:

Your insurer will provide a claim form. Complete it with accuracy and thoroughness, including all required information and supporting documentation.

6. Submit Claim Documentation:

Attach all relevant documents to your claim, such as incident reports, evidence, and any communication with affected parties or law enforcement.

7. Evaluate Damages:

Subsequently, your insurer will assess the extent of damages and the financial impact of the cyber incident. Eventually, their evaluation determines the coverage amount you’re eligible to receive.

8. Claims Review:

The insurer’s claims department reviews your submission, cross-referencing it with the policy terms and coverage. Notably, they may request additional information if needed.

9. Settlement and Payment:

Once the claim is approved, your insurer will provide a settlement offer. Lastly, after mutual agreement, the payment is processed, helping you recover financially.

10. Rebuilding and Recovery:

Finally, utilize the settlement to restore affected systems, implement enhanced cybersecurity measures, and rebuild your business’s operations.

To conclude, in the aftermath of a cyber incident, filing a claim under your cyber insurance policy can be a lifeline. Thus, by following these steps, you’re not just reclaiming financial stability – you’re demonstrating resilience and fortitude in the face of a digital challenge. Also, with the right cyber insurance policy and a clear claims process, your business is poised to navigate the road to recovery with confidence.