Right price for Cyber Insurance

In a digital age where cyber threats lurk around every virtual corner, investing in a robust cyber insurance policy is akin to fortifying the walls of your business’s digital fortress. However, the question remains: What’s the right price to pay for this essential protection? Let’s unravel the factors that determine the price tag of a Cyber Insurance Protection, empowering you to make an informed decision.

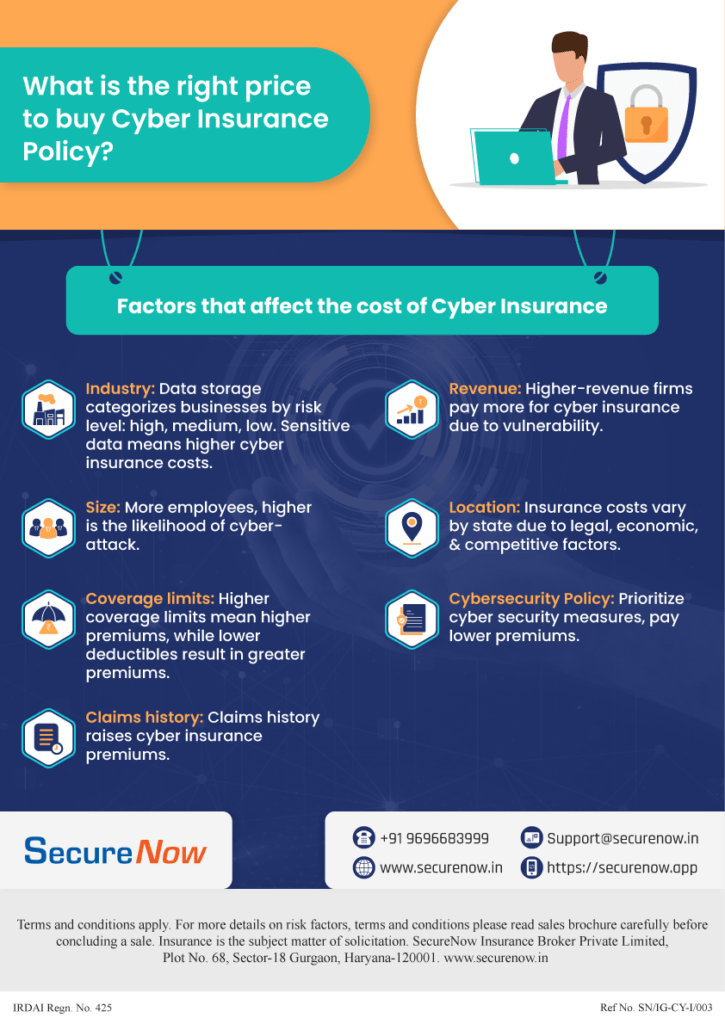

1. Risk Profile:

Your business’s unique risk profile serves as the foundation for pricing. Hence, factors such as industry, size, revenue, and cybersecurity measures all play a role in assessing your risk exposure.

2. Coverage Limits:

The scope of coverage you opt for directly impacts the premium. Comprehensive coverage that addresses a wide range of cyber risks might come at a higher cost, while more focused coverage options can be budget-friendly.

3. Deductibles:

Deductibles represent the amount you agree to pay out of pocket before the insurer kicks in. Therefore, opting for a higher deductible can lower your premium but may require you to cover more costs in the event of a claim.

4. Cybersecurity Measures:

Insurers often consider your existing cybersecurity measures. Demonstrating robust cyber defenses through encryption, multi-factor authentication, and regular security assessments can lead to more favorable pricing.

5. Business Operations:

The nature of your business and its digital operations influence pricing. E-commerce platforms dealing with sensitive customer data might face different pricing than a consultancy firm.

6. Policy Features:

The breadth of features you choose, including incident response services, legal support, and public relations efforts, contributes to the overall cyber insurance cost.

7. Claims History:

A history of past claims or cyber incidents can impact pricing. A clean record might lead to more competitive premiums.

8. Market Trends:

The ever-evolving cyber landscape can influence pricing. As cyber threats evolve, insurers might adjust pricing to reflect emerging risks.

9. Comparative Quotes:

Seek quotes from multiple insurers to compare pricing and coverage options. In other words, this empowers you to make a well-informed decision that aligns with your budget and cyber insurance protection needs.

Bottom Line

To conclude, in the realm of cyber insurance, the right price is a delicate balance between comprehensive coverage and budget considerations. By understanding the factors that influence pricing, you’re equipped to embark on your cybersecurity journey with clarity and confidence, ensuring that your business’s digital realm remains fortified against the unforeseen.

About The Author

Arshdeep

MBA Insurance Management

Arshdeep is a seasoned insurance expert with 7 years of experience, specializing in Cyber Risk Insurance. As a writer for SecureNow, he delivers insightful blogs and articles that demystify the complexities of cyber risk coverage. His content is designed to help businesses understand the importance of protecting against cyber threats and data breaches. With a focus on practical advice and the latest industry trends, Arshdeep empowers readers to make informed decisions about their cyber insurance needs, ensuring robust protection in an increasingly digital world.