Conceptually and legally, Insurance is of two types – life and general insurance. Any insurance policy insuring anything other than risk to a person’s life is a ‘general insurance’ or ‘non-life insurance policy.’

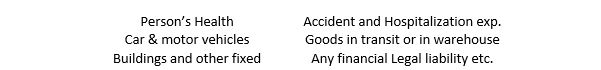

General insurance policies will insure anything other than the life of an individual. For example:

Depending on what (the asset which is at risk or the risk itself) is protected, general insurance policies are classified as follows:

Details:

General insurance policies are designed to provide financial protection against unexpected losses or damages to assets or liabilities. It may arise due to natural disasters, accidents, thefts, and other unforeseen events. These policies provide coverage to a wide range of assets including homes, vehicles, businesses, health, and travel.

Home insurance policies provide coverage against damages or losses to a house or its contents due to natural calamities. That can be floods, earthquakes, fire, or theft. Auto insurance policies provide coverage against damage or loss to the insured vehicle, third-party liabilities, personal injuries, or death due to an accident.

Business insurance policies provide coverage to protect a business against financial losses due to unforeseen events like theft, natural calamities, legal liabilities, and employee-related issues. Health insurance policies provide coverage for medical expenses incurred during hospitalization, surgeries, and other treatments. Travel insurance policies provide coverage for loss or damage of baggage, trip cancellation, medical emergencies, and other travel-related mishaps.

General insurance policies are classified based on the type of risks they cover, such as fire insurance, marine insurance, motor insurance, health insurance, and travel insurance. These policies can be purchased from insurance companies or through insurance brokers, who provide guidance and assistance in choosing the right policy based on the needs and budget of the customer.

A Case of General Insurance Uses in Real Life

Rajiv Sarath, is a businessman, has a house, a car, and two kids. Apart from life insurance he and his wife, Kriti Sarath, can use different types of general insurance policies as follows:

Health & Critical Insurance

Other Insurance Policies Available to Rajiv & Family

Rajiv’s home insurance policy provided about 70% of the losses (Approximately Rs. 5 lakh) caused to the house and its contents by an earthquake a few years ago.

Rajiv’s car insurance also benefitted him by reducing the cost of repair from Rs. 25,000 to Rs. 5000, when his vehicle needed a major repair after being accidently hit by a construction vehicle on a construction site.

Going further, Rajiv and family go for an international vacation, they have insured their travel plan with a travel insurance. It will provide cash in case they lose their luggage, passport or currency in the foreign country.

Marine & Commercial Insurance

These insurance policies help Rajiv in his business at various levels. For example: Whenever he sends a shipment to his clients, he wants to ensure that any financial loss arising out of damage to the goods on the way to them, does not fall entirely on his pocket. To ensure this, he uses a marine transit insurance policy. He also has different commercial liability policies which cover his legal liabilities in case any damage is caused to a third party or employees by his goods or in daily operations.