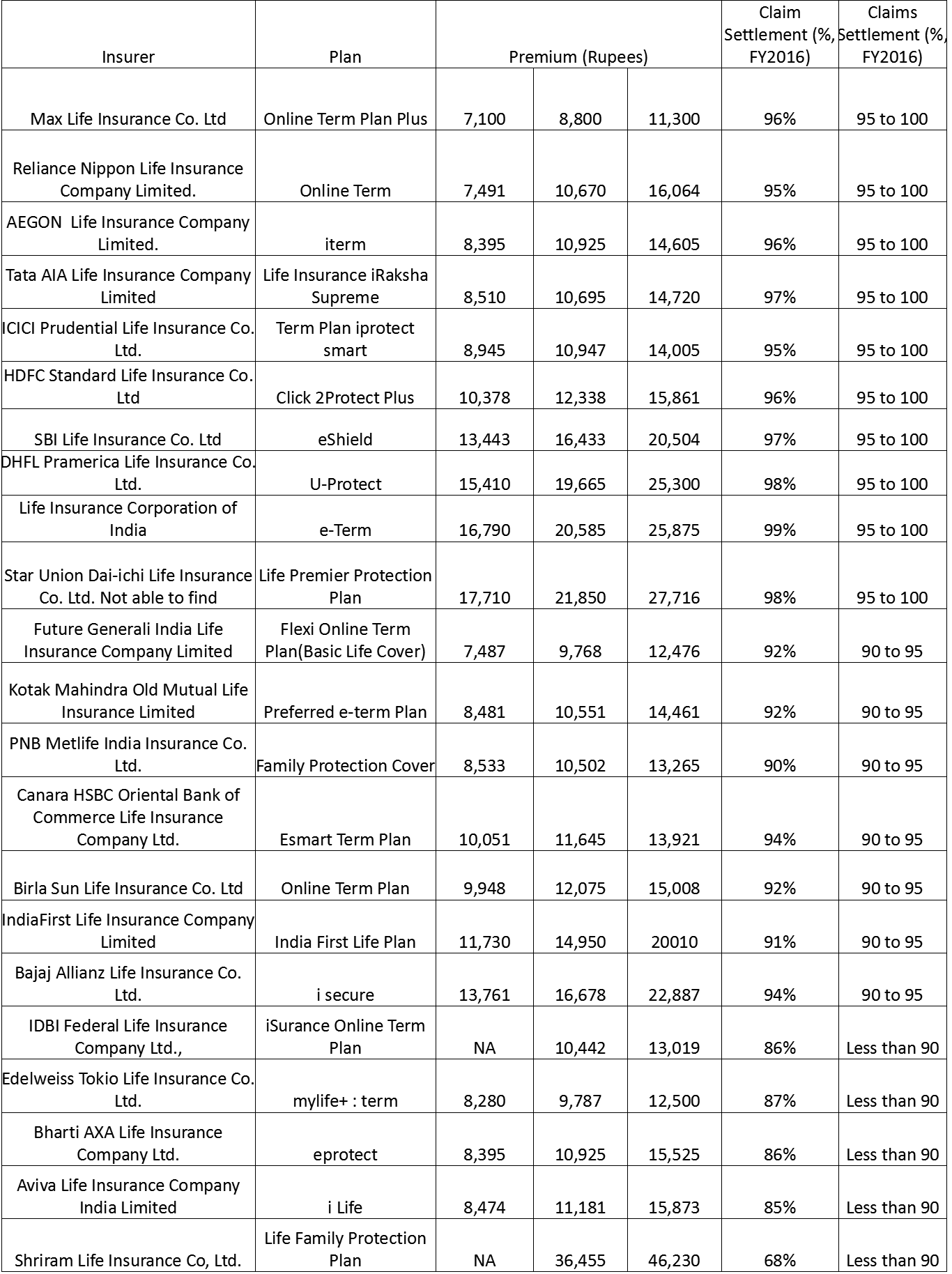

Term insurance is a type of life insurance that provides coverage for a specific period of time. The best rates for term life insurance in India will vary depending on factors such as the age of the policyholder, the amount of coverage desired, and the length of the policy term. Some of the top insurance providers in India that offer term insurance include LIC (Life Insurance Corporation of India), HDFC Life, and SBI Life. When shopping for term insurance, it is important to compare rates and policies from multiple providers to ensure that you are getting the best deal. Additionally, you may want to consider consulting with a financial advisor or insurance agent to help you find the right policy for your needs and budget.

Footnotes:

1. Date of birth has been assumed to be April 1st in the respective year for each. age group

2. Rates are for a male, non-smoker, Delhi-based.

3. DHFL Pramerica and Star Union Dai-chi Insurance Co Ltd. are offline plans.

4. Claim settlement = Claims settled/(claims settled + claims rejected+ claims repudiated).

5. Exide Life and Sahara Life do not offer pure term insurance plans.

6. Claims data is for death claims company-wide, including individual and group for LIC, ICICI Prudential, SBI Life, PNBMetlife, Shriram Life, DHFL Pramerica, IndiaFirst, Kotak Life, and Star Union Daichi. For all other insurers, only individual death claims have been considered.

7. In ICICI prudential waiver for a premium of disability is included

About The Author

Subhash

MBA Insurance Management

With seven years of experience in the insurance industry, Subhash is a recognized expert in term life and keyman insurance. As a dedicated writer for SecureNow, he crafts insightful blogs and articles that demystify the complexities of these insurance policies. He is passionate about educating businesses and individuals on the importance of comprehensive life and keyman coverage, making technical details accessible and practical. Their deep understanding of insurance regulations and best practices ensures that readers receive up-to-date and valuable information, establishing Subhash as a trusted voice in the insurance community.