There is a growing trend of term insurance covers being bought for ages beyond 70. This is fueled by two factors:

- One, the basic construct and exclusions of term insurance do not vary across insurers. So, in a bid to offer a differentiated proposition, insurers have increased the maximum age of coverage, going up to the magical number of 100.

- Second, several insurance platforms advocate maximizing the

duration. This leads to a significantly higher premium over a longer period of time.

An argument often made for long-duration cover is that it assures a payout. That is because as you grow older the possibility of death becomes very real. This flawed argument leads to policyholders making a poor choice that ends with sub-optimal coverage.

Purpose of Term Insurance

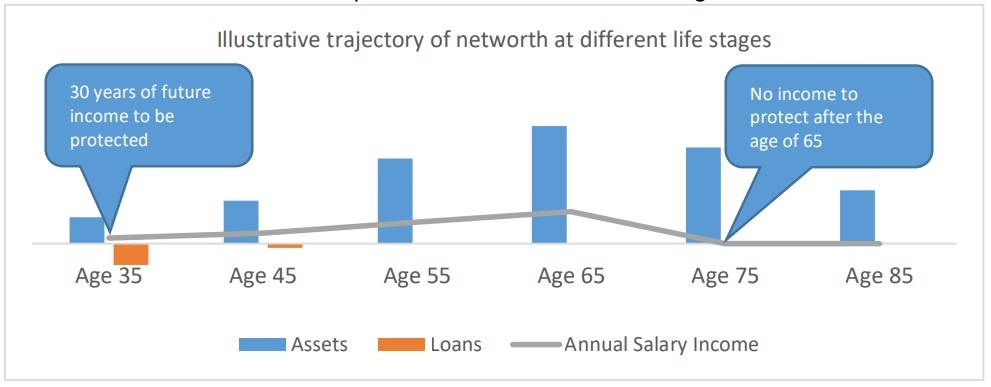

The purpose of a term insurance policy is to replace the future salary or earnings of a wage earner, in case the policyholder dies early. The dependents or nominees of such policyholders can then use the proceeds to meet the financial obligations, which the policyholder would have fulfilled with their income. But the retirement age varies from 58 to 65 across organizations and most stop active work by 65. So, a cover after retirement does not serve any purpose as there is no income to replace it. After retirement, a person may still earn passive income through their assets e.g., dividends or interest income.

However, such income does not need replacement, as these continue to accrue to nominees due to inheritance. The right coverage amount for term insurance decreases with age. Term life insurance has gaining ground post-COVID as people have become more aware of the importance of financial security and protection. It provides a simple and affordable way to ensure that loved ones are financially protected in the event of the policyholder’s death.

Additional Read: Keyman insurance and its importance

Optimal Maximum Age for Protection and the right coverage amount for Term Insurance

At 35, the future financial responsibilities of an individual are at their peak. If a person dies at the age of 35, then the sum assured should be sufficient to cover children’s education, loans, living expenses for the family, retirement corpus for the spouse, and any future obligations such as children’s marriage. Until 35, people have a limited earnings history and meagre savings. In the absence of term insurance, the family would eat into these limited savings and trim planned family milestones. With age, individuals keep fulfilling their commitments and build a savings corpus. If a person dies at 75, all the family milestones would have been completed, some assets would be in place and retirement savings built up. At this age, even without term insurance, the family could meet its financial obligations.

In fact, buying long-tenure covers can be detrimental. The term insurance premium is majorly dependent on the age of the policyholder, the duration of coverage, and the sum assured. For example, for a 35- year-old, the cost of 1 crore term insurance till the age of 60 would be about Rupees 16,500. The same coverage would cost Rupees 29,000 to extend coverage to 85 years. For the first 25 years of the plan, despite the coverage being identical, the individual ends up paying an 80% higher premium. Instead, this extra premium can be used to buy enhanced coverage till the age of 60, which is the period that matters most to the nominees. For a 35-year-old, a Rupees 2 crore cover till the age of 60 would cost less than Rupees 25,000.

Additional Read: Claim Settlement Ratio of Life Insurers

Summary

In summary, buy term insurance until the age of 60 or 65 and maximize the sum assured. A rule of

thumb is to buy coverage equal to ten times one’s annual income. Term insurance should be seen

as a protection scheme and not a savings plan. So, it should not be designed to assure a payout.

The chart below shows how the requirement for term insurance changes over time.

About The Author

Subhash

MBA Insurance Management

With seven years of experience in the insurance industry, Subhash is a recognized expert in term life and keyman insurance. As a dedicated writer for SecureNow, he crafts insightful blogs and articles that demystify the complexities of these insurance policies. He is passionate about educating businesses and individuals on the importance of comprehensive life and keyman coverage, making technical details accessible and practical. Their deep understanding of insurance regulations and best practices ensures that readers receive up-to-date and valuable information, establishing Subhash as a trusted voice in the insurance community.