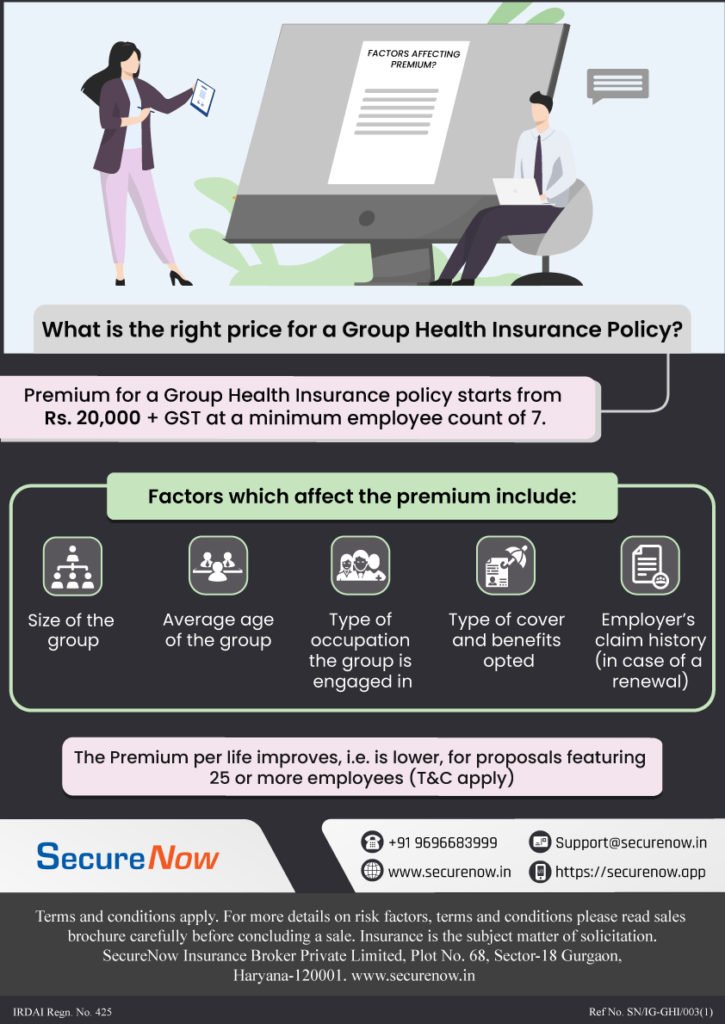

Group health insurance policy or Group medical insurance offers health coverage to employees of an organization at affordable premium rates. Right price for Group health insurance policy (premium) is calculated after taking various factors into consideration at the time of buying Group Health Insurance Policy.

To obtain the right price for group health insurance for employees , it is recommended to gather quotes from multiple insurers. This will allow you to compare prices and coverage options, and find the best option for your group. It’s important to consider specific needs of your group, such as its size, any pre-existing conditions, business’s location etc. It’s also a good idea to work with an insurance broker or agent, who can help you navigate the different options and find a group health insurance plan that fits your budget and coverage needs. Once you have gathered all the quotes and evaluated them, you can then select the best plan that offers the best value for money.

A wrong or hastily determined pricing for a Corporate health insurance plan can have significant financial ramifications for an organization. Underpricing may lead to insufficient coverage and limited benefits, resulting in inadequate healthcare for employees. This can lead to increased out-of-pocket expenses, reduced employee satisfaction, and higher turnover rates. On the other hand, overpricing can strain the organization’s financial resources unnecessarily, potentially impacting profitability and competitiveness. Careful consideration of pricing ensures the right balance between affordability for the organization and adequate coverage for employees. This ultimately fosters a healthy workforce and maintain financial stability.

The below infographic explains these factors which affect the premium rates and the right price to buy this policy.

About The Author

Mayank Sharma

MBA Finance

He is a professional who brings extensive knowledge and expertise to the field of group health insurance. He has dedicated 7years to helping individuals and businesses navigate the complexities of insurance. Having worked closely with numerous clients and insurance providers, he deeply understands the nuances of group health insurance policies. With a reputation for providing insightful and informative content, he leverages his industry experience to educate readers about the importance of group health insurance and its benefits. Through their articles, Mayank Sharma aims to empower individuals and businesses to make informed decisions about their healthcare coverage, ultimately promoting healthier and more secure communities.