Have you ever considered insuring the most important asset of your business—your employees? If not, then it is time to think about it.

The sudden demise, illness, or accident of any key person in your company can largely impact your profits. Most of us know that a term insurance policy helps in financially securing the family after the demise of the breadwinner. However, the fact is that term insurance can play a similar role in the form of ‘Key Person Insurance’ for businesses also.

As the name, implies, the key man is a major contributor to the business’s success, and his or her absence would obstruct the company’s growth. Also, known as key person insurance, Key Person insurance gives a financial safety net. The company receives the sum assured when the key employee dies, which is generally sufficient to hire another top-level executive and tide over the business downturn.

Protecting your most prized asset

The know-how judgment, skills, and expertise that become the foundation of any business are found in people and not in the technologies or facilities. Everyone in your team contributes to the success of the business, but there can be one or more individuals without whom your business can’t run. What would happen if that person dies? It could hinder your business. However, by buying keyman insurance, you would be more likely to survive and recover from the losses.

The motto of key person insurance is to compensate the employer for the losses that may arise from the loss of service of the key employee in case of sudden demise, sickness, or injury. In this case, the company can recover the losses from the compensation received from the insurer.

Here key man can be any employee who has special skills and manages huge responsibilities and plays an imperative role in the profits of the organization. Keyman insurance policy is a policy where both the proposer as well as the premium payer is the employer. It is the employee’s life that will be insured and the claim amount will go to the employer.

Keyman can be a woman also and a company can have more than one Keyman. The policy tenure coincides with the retirement age or the contract period of the employee. Further, loans against the policy and riders are not allowed. Also, the nomination can be done only in favor of the company.

It is important to note that a key man policy is applicable only in case of an employee and employer relationship. As a sole proprietor and partner is not an employee, and therefore, any policy bought on the lives of a proprietor or partner is not a key man policy.

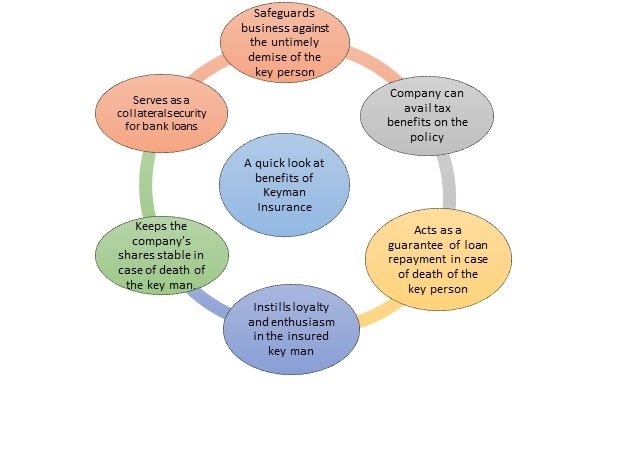

Advantages of Key Person Insurance for businesses

Irrespective of the size of the business, the death of a key person can make any company vulnerable. If the promoter dies, then the company is thrown into disarray and may not survive. Years of hard work can go in vain. The policy is essentially useful, particularly for family businesses that are highly dependent on a few people.

An additional benefit is that as premiums are paid by the company, they get tax benefits also. However, the death benefit received from the policy is taxable.

Basic eligibility requirements to buy Keyman insurance

To buy the insurance policy, the company must submit a comprehensive set of documents and a duly filled proposal form. Usually, documents include audited financial statements of the copy, a copy of the PAN card, filing IT returns, keyman’s salary slip, and the board resolution to the effect that the company has decided to purchase keyman insurance.

For insurance coverage, the company must be profitable. However, in certain cases, insurers make exceptions for loss-making, but well-funded start-up companies. Please consider the following aspects:

- Keyman insurance allows the purchase of only term insurance policies.

- The key man should hold less than 51% shares of the company

- The total number of shares held by the key man and his family should not be more than 70% of the total company’s shares

- The company has to submit some proofs to validate that the key man is playing an imperative role in the business

How much sum assured is sufficient?

Typically, the investor takes the sum assured equal to the invested money. In this way, the investor ensures that in the case of the death of the entrepreneur, the company has sufficient money to hire a replacement or lower the recovery costs.

The maximum sum assured is restricted as:

- Ten times the key man’s annual compensation package

- Three times the average gross profit of the company in the last three years

- Five times the average net profit of the company in the last three years

What if a key man quits the company?

In this case, the employer who has bought Keyman insurance can choose any of the following options:

- The first company can stop paying the premiums and let the policy lapse

- The first company can continue paying the premiums and receive the amount on a maturity

- The key man and the new employer can mutually agree upon terms to transfer the policy

- The key man can assign the policy in their favor

Taxation structure of Keyman Insurance

Prior to 2013, the surrender value and maturity proceedings received from Keyman insurance were tax-free. However, in 2013, the Income Tax Law made some changes. Now, the proceedings received from this insurance policy are taxable. Additionally, Keyman insurance allows the purchase of only term insurance policies.

For the company

The premium paid by the company for Keyman insurance is an allowable business expenditure and enjoys tax benefits under Section 37(1) of the Income Tax Act. Also, the claim proceedings are taxable as business income.

For the key man

The company pays the premiums for the policy, and it does not offer any tax benefit to the key man. If the key man assigns the policy, they can determine the nominee for the policy. Consequently, in case of the death of the insured during the policy tenure, his/her dependents would get death benefits which would be tax-free as per the Income Tax Act.

Conclusion

For any company, its employees are its valued assets. So, buy keyman insurance to protect your business from unforeseen events like the death, or sickness of a keyman, which are beyond your control.

In business, no one is irreplaceable, but some are invaluable and therefore, it makes complete sense to secure ‘those invaluable’ with the right insurance policy. After all, it is a matter of your business success and you can’t take it lightly, isn’t it?

About The Author

Subhash

MBA Insurance Management

With seven years of experience in the insurance industry, Subhash is a recognized expert in term life and keyman insurance. As a dedicated writer for SecureNow, he crafts insightful blogs and articles that demystify the complexities of these insurance policies. He is passionate about educating businesses and individuals on the importance of comprehensive life and keyman coverage, making technical details accessible and practical. Their deep understanding of insurance regulations and best practices ensures that readers receive up-to-date and valuable information, establishing Subhash as a trusted voice in the insurance community.