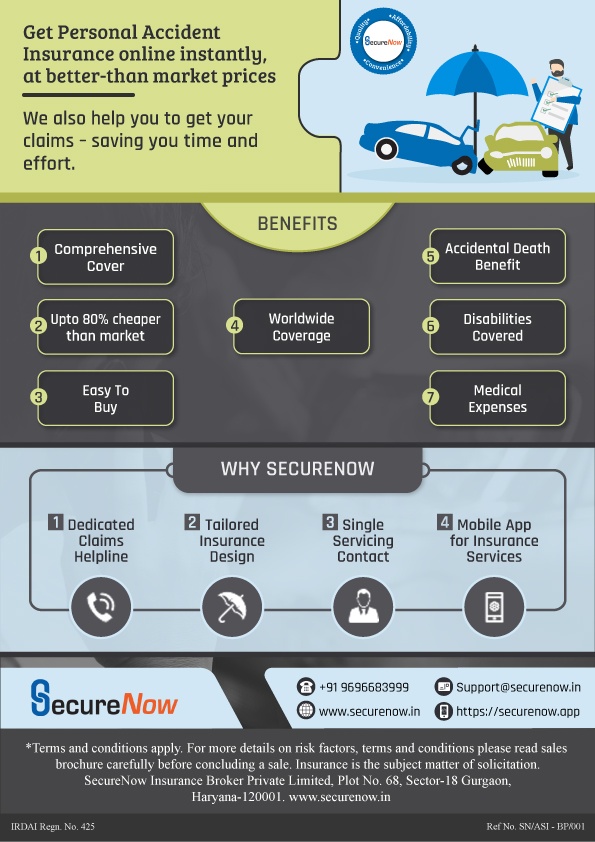

When an employee has an accident there is an important expectation that the employer will pay compensation. If the accident is on company premises or company work then the law may also require compensation to be paid. A Group personal accident insurance pays a pre-determined amount when an employee has an accident. Insurance is important to insure a company’s cost in such accidents. Insurance can also be viewed as a benefit for employees. Below is the infographic which will help you understand how group personal accident is useful for your organization.

Written By-

Gunjan Saxena

MBA Insurance Management

With a robust background in the insurance industry, Gunjan is a seasoned professional who brings 10 years of expertise to group personal accident insurance. Throughout her career, she has demonstrated a deep understanding of the intricacies and nuances of insurance products, particularly in personal accident coverage. Having worked closely with both individuals and businesses, she has gained valuable insights into the diverse needs and challenges faced by clients seeking insurance protection. Her experience encompasses designing tailored insurance solutions, providing expert advice, and guiding clients through the insurance process with confidence and clarity.

Through her articles, Gunjan aims to educate and inform readers about the importance of group personal accident insurance and the benefits it offers in safeguarding against unforeseen events.