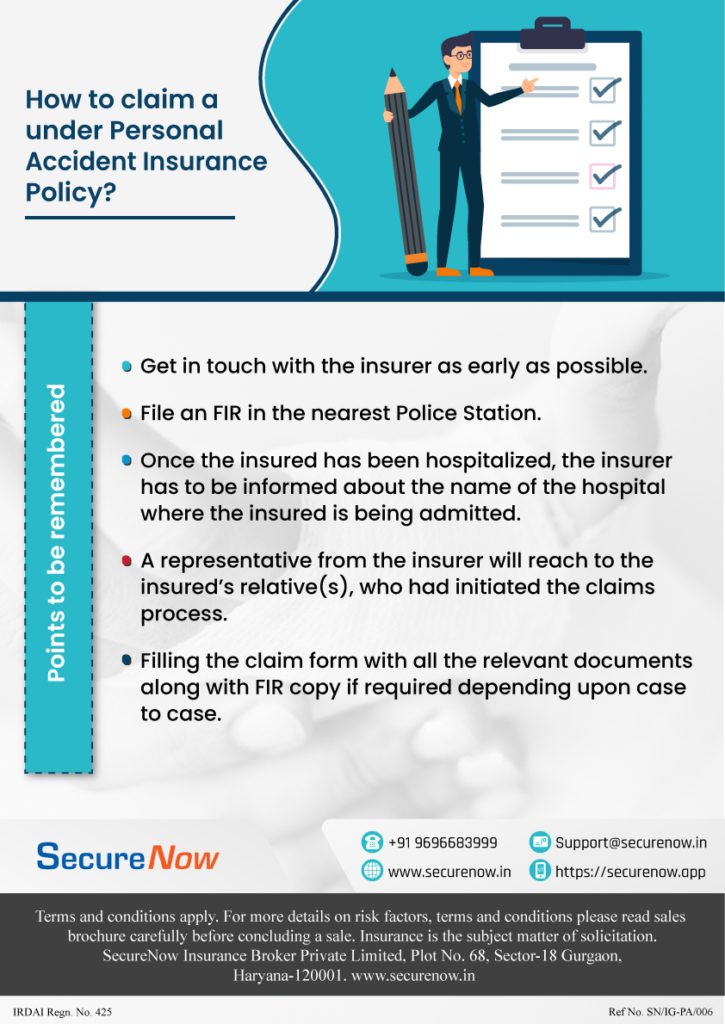

While making a claim under group personal accident insurance, the employer needs to give complete personal information with the required documents. Claims can be rejected if the documentation is incorrect, or the claim involves an excluded condition. The infographic below explains how SecureNow offers an easy claims process, under Group Personal Accident insurance:

Claims process under Group Personal Accident Insurance can be hassle-free, if:

1.One immediately intimate the insurer about the incident.

2.Complete and accurate documentation should be provided by the insured at the time of the claim. This includes FIR in the nearest Police station.

3. Insured must inform their insurance company details of the hospital they are admitted to.

4.Insurer’s representative reach out and coordinates with the representatives of the Indured.

While buying this policy, it is important to carefully plan and understand various add-ons and exclusions. Negligence or misunderstanding can cause hurdles during the claim process. Insurers commonly reject claims for reasons they consider genuine. These include accidents due to intoxication, gross negligence, and accidents that occur while not at work.

To conclude, by understanding the key tasks involved in the claims intimation and filing process, you can navigate it with ease and ensure a smooth and efficient claims experience.”

Written By-

Gunjan Saxena

MBA Insurance Management

With a robust background in the insurance industry, Gunjan is a seasoned professional who brings 10 years of expertise to group personal accident insurance. Throughout her career, she has demonstrated a deep understanding of the intricacies and nuances of insurance products, particularly in personal accident coverage. Having worked closely with both individuals and businesses, she has gained valuable insights into the diverse needs and challenges faced by clients seeking insurance protection. Her experience encompasses designing tailored insurance solutions, providing expert advice, and guiding clients through the insurance process with confidence and clarity.

Through her articles, Gunjan aims to educate and inform readers about the importance of group personal accident insurance and the benefits it offers in safeguarding against unforeseen events.