Published in Mint on Jan 27 2016

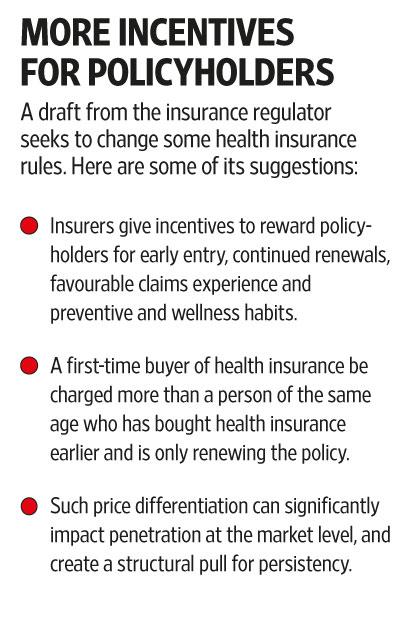

The Insurance Regulatory and Development Authority of India (Irdai) released a draft exposure on health insurance regulations on 19 January 2016, seeking to make minor changes to the existing health insurance regulations of 2013. The draft is a result of the recommendations of the insurance committee that was constituted in December 2014 to examine health insurance framework. One of the key recommendations of the committee was to introduce entry age-based pricing. This means a first-time buyer of health insurance would be charged more than a person of the same age who had bought health insurance earlier and is only renewing the policy. According to the report, the price differentiation can significantly impact penetration at the market level, and create a structural pull for persistency.

Accordingly, the draft exposure has stated that insurers may devise mechanisms or incentives to reward policyholders for early entry, continued renewals, favourable claims experience and preventive and wellness habits. Insurers will need to disclose such incentives upfront in policy brochures and documents. “With incentives and rewards explicitly defined, more insurers will come up with programmes to reward customers for health and well-being. Additional incentives related to purchase of health insurance at an early age and continued renewals will help drive penetration with younger consumers as well as support continued persistency. Currently, irrespective of when you buy health insurance, the price is fixed according to the age band,” said Sandeep Patel, chief executive officer and managing director, Cigna TTK Health Insurance Co. Ltd.

At present, a customer who has been covered by a health insurance policy for the past 10 years and a customer who buys a health insurance plan for the first time, pay the same premium if they are of the same age. The draft aims to change that by giving incentives, which could also be in the form of price discounts, to early policyholders.

Existing regulations

The draft has not altered the existing health insurance regulations a lot, which means the basic rules around health insurance still hold. All health insurance policies, unless customised for a certain age group, have to offer health insurance to first-time buyers up to 65 years of age and once bought, the policy is renewable for life. Further, the insurers also can’t load your policy based on your claims record. In fact, insurers can’t alter premiums in the first three years.

“The draft further allows the insurer to load or discount a policy. Till now, there was no provision to remove the loading on a policy. But now, if the policyholder improves her health, the insurers can actually remove the loading to reward her,” added Patel. Health insurance policies for retail offered by non-life insurers and standalone health insurance companies can be for a minimum duration of a year and a maximum of three years, and this has not gone down well with the industry. “The health insurance committee was favourable towards bundled health savings-type products, which help policyholders save money, but with maximum tenor of three years, innovation in savings cum health insurance products is unlikely,” added Patel. In comparison, health insurance policies offered by life insurance companies can be offered for a longer duration.

To encourage innovation, the committee had recommended the use of pilot products, which the draft has incorporated. “Pilot products referred herein can be offered only under the ‘Short Term’ category for a term not exceeding five years. After five years, the product needs to get converted into a regular product or based on valid reasons may be withdrawn subject to the insured being given an option to migrate to another product subject to portability conditions,” the report stated.

“The draft is in the right direction as it encourages innovation by allowing to pilot test products. Products can now be need based catering to a particular strata and the insurer will have an opportunity to pilot test it and make sure it’s sustainable,” said Sanjay Datta, chief-underwriting and claims, ICICI Lombard General Insurance Co. Ltd.

Sharper data

Another important change that the draft proposes is that no claims will be closed in the books of the insurers. In health insurance, unsettled claims are divided into two categories: claims repudiated and claims closed. Repudiation claims are self-explanatory, but insurers draw up another category of closed claims. These are claims that couldn’t be paid for lack of documents or follow-up from the policyholder. The number of closed claims should ideally be minuscule given the definition, but for some insurers, that is not so. And if insurers show a low percentage of claims rejection, it doesn’t convey the true picture, especially if the number of closed claims is huge.

Mint has repeatedly pointed out that closed claims are diluting the number of rejected claims and why they should be clubbed with rejected claims. The draft has asked for this category to be removed—the insurer either settles the claim or it doesn’t. The Mint Mediclaim Ratings (MMR), in order to get a better handle on claims, looks at the claims paid versus the total number of claims on which the insurer has taken a decision.

The regulations also state that except in cases where a fraud is suspected, documents not listed in policy terms and conditions will be necessary and the insurer will ensure that all the documents required for claims processing are called for in one go and not in a piecemeal manner. “This is important as we often see policyholders made to run around for documents. First, insurers ask for the discharge summary and then the hospital’s internal case notes, and then again operation theatre papers, and so on. This tires policyholders and some may decide to just drop the process leading to closed claims,” said Kapil Mehta, executive director, SecureNow Insurance Broker Pvt. Ltd.

The draft says that the insurer will have to settle claims, even if it is a rejection, within 30 days of getting all the necessary documents. Going further into this, the draft has called for product specific claims settlement data. Mint has pointed out this gap in the past. “Currently, insurers report this data on an aggregate basis—by clubbing retail and group claims settlements. But now they will need to specify this number on a product basis. The insurance regulator should publish the breakup on a product basis and this should also be published on retail brochures for the customer,” said Mehta.

More to be done

The industry sees the draft as a step in the right direction since it allows insurers to reward early entry of policyholders. Insurers, other than wanting long-term plans, also wanted the option of premium payment in instalments. This was not mentioned in the draft. “In the case of life insurance policies, policyholders are allowed to pay premiums on a monthly and quarterly mode, but in health insurance, they are only allowed annual premiums. This makes health insurance unaffordable. If instalments are allowed, customers can buy adequate health cover,” added Patel.

For customers, this draft could actually mean price discounts on early entry. More precise data entries will help them better analyse insurers and their claims records. The full draft can be read on the regulator’s website, www.irdai.gov.in. Irdai has invited comments before 1 February.