Why should you buy a marine insurance policy? The answer is— because you are a shipper. If the answer is not enough to convince you, then keep reading.

Marine insurance covers losses or damages caused to ships, cargo, and terminals. Simply, it is an insurance cover while in transit.

Comprehensive marine insurance curtails shippers’ exposure to financial losses or damages. Unfortunately, many shippers import or export their goods without marine insurance. However, they have suffered a loss for taking such kind of risk.

Still, if you are looking for reasons to buy marine insurance, then here it goes:

1. Rise in cargo theft –

Cargo theft continues to hamper global supply chains, resulting in the loss of billions of dollars in direct losses and downstream costs. Cargo theft, especially, through fictitious pickups and a fake identity, is increasing at an alarming rate. What if your cargo also becomes the target of thieves? It is better to buy marine insurance now than repent later when the loss already strikes.

2. Increase cases related to containers lost at sea every year –

With the rising trend of carrying huge stacks of shipping containers, an upsurge has been recorded in cargo containers overboard. It means, more containers are lost at sea every year. According to the surveys conducted by the World Shipping Council, approximately 733 containers were lost at sea during 2011- 2013, which was more than double the number of containers lost between 2008-2010. Considering this alarming rise, it is useful to go with a marine insurance

3. Disasters can strike anywhere –

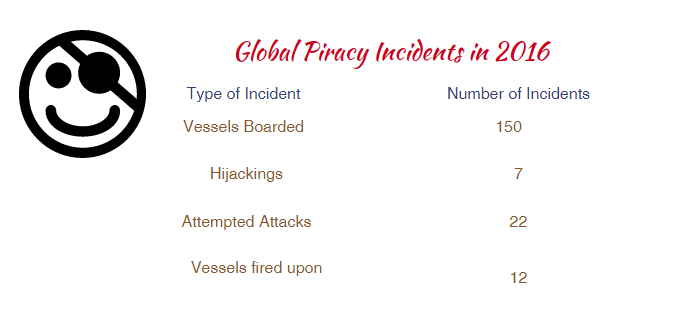

Incidents, like a storm, shipwrecks, pirate attacks, etc.; strike anywhere and cause multi-billion economic losses. For instance, the number of ships hijacked by pirates almost doubled in 2014 as compared to the previous years.

See: Exclusions in Marine Insurance Policy

4. Cargo damages–

Like theft, damage to cargo is also common. Even after taking all safety measures, cargo damages happen due to reasons like faulty export packaging, inadequate ventilation, wrong choice of container, poor condition of the container, overloading, etc. Though many reasons could lead to cargo damage, you would have to suffer financially if you have no Cargo insurance.

5. Contractual requirement–

Shippers’ sale contracts may obligate you to buy marine insurance to safeguard the interests of buyers. Failure to buy marine insurance when a shipper is contractually obligated to do so, will not only make the shipper vulnerable to financial loss if there is a loss or damage to goods, but non-compliance with the terms and conditions of the contract means that you will lose the trust of your buyers.

6 . Carriers can’t be held responsible for the loss–

Carriers, by law, can’t be responsible for various common causes of losses like natural disasters, low average, etc. Even in those situations, where carriers are responsible, restrict the liability. Therefore, shippers should never depend on the carrier which is shipping their goods or services in case of any loss or damage that may occur during the transit and buy a marine insurance policy.

Such events financially affect those companies that have no marine insurance policies.

Read more: Why should you buy Marine Cargo Insurance Policy While Trading Across nations?

7. Customisation option is available–

Though, you can rely on the buyer’s or seller’s insurance, buying your marine insurance is a good idea. In this way, you can customize your cover as per your needs. On top of that, if a claim arises, handled by a foreign insurance company, perhaps in a different language, it can kill both your time and efforts. Shippers who buy marine insurance themselves are usually in a much better place than shippers who rely on third parties for their marine insurance requirements.

About The Author

Simran

MBA Insurance and Risk

With extensive experience in the insurance industry, Simran is a seasoned writer specializing in articles on marine insurance for SecureNow. Drawing from 5 years of expertise in the field, she possesses a comprehensive understanding of the complexities and nuances of marine insurance policies. Her articles offer valuable insights into various aspects of marine insurance, including cargo protection, hull insurance, and liability coverage for marine-related risks. Renowned for their insightful analysis and informative content, Simran is committed to providing readers with actionable information that helps them navigate the intricacies of marine insurance with confidence.