Published in Mint on Sep 16 2015

Mint Money has always advised you to avoid traditional insurance policies that double up as investment products. This is primarily because of three reasons: high costs, opaque structures and poor investment returns from these policies. But if recommendations of the Sumit Bose committee are implemented, most of these shortcomings will be addressed and you will have a product that you can understand, compare and consider.

The committee, chaired by the former Union finance secretary, Bose, was set up to identify why financial products are missold and offer solutions.

The report correctly identifies distributor’s incentives as a root cause for misselling as products with a fat commission structure —such as insurance—get sold more. The report suggests that all financial products with the same function should have the same incentives so that the distributor becomes commission neutral. “It’s the differential commission structure in financial products that leads to misselling. The recommendations rightly address the problem by asking to rationalise commissions according to the function of the product. However, one must be careful while deciding the incentives for long-term products because more often than not they are push products,” said Vighnesh Shahane, chief executive officer and whole time director, IDBI Federal Life Insurance Co. Ltd. “The report also rightly recommends that products should be regulated according to their function and not form,” he added.

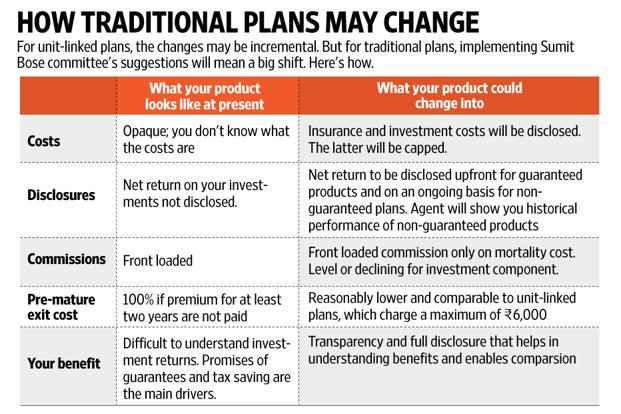

In life insurance commission as well as product structure lead to misselling. Badly constructed products and disclosures that obfuscate hamper clear understanding. The report recommends greater transparency in product construct by segregating insurance and investment components. It also recommends developing suitable benchmarks for the investment component. But before going further into the recommendations, let’s look at the basic structure of popular insurance plans.

Types of insurance

There are broadly two types of insurance policies, traditional and unit-linked insurance plans (Ulips). Ulips are transparent, market-linked products that invest your money (the premium) in funds of your choice and bundle this with an insurance cover. They are popularly explained as mutual funds wrapped with a crust of insurance. In Ulips, the costs are visible and can be divided into four heads. The first is premium allocation charge, which is a straight deduction from the premium before any money goes to work for either insurance or investment. Balance is then invested in the funds of your choice and from the fund value the policy deducts a mortality charge, cost of life insurance, fund management charge (capped at 1.35% of fund value) and policy administration charge. These are further capped by a maximum reduction in yield. So, a Ulip with a policy term of more than 10 years can’t have costs that drag the net yield on maturity down by more than 2.25%.

The other category, and also the one popular currently, is the opaque bundled insurance product that you also know as traditional insurance plans. Both costs and investments are not visible. This category can be further split into participating and non-participating plans.

Participating plans guarantee a certain minimum amount, typically, the sum assured, and promise periodic additions, which insurers call reversionary bonuses. These bonuses, once declared, become guaranteed to be paid either on death of policyholder or on maturity of policy. The committee recommends not using the term ‘bonus’ since these are investment benefits and instead call them ‘net return’. The premiums go to the participating fund, which is a common pool for all the participating plans of the insurer. The bonuses come from the surplus generated by this fund after all costs are factored in. The insurer is free to exercise its discretion while declaring the surplus. But once declared, the policyholder is entitled to get 90% of the surplus, whereas the shareholders can keep up to 10%.

This is the process, but what is visible to you is the bonus, which is mentioned as a percentage of the sum assured, that accrues ever year.

In non-participating plans, returns are guaranteed. This means what you get on maturity is declared upfront. These are products that spell out the benefits right at the time of buying the policy. But the problem is that these policies mention the benefits in absolute terms—you pay X for 10 years and the policy will pay Y on maturity. Or, they mention it as a percentage of, say, the sum assured—pay premiums for 10 years and the policy will pay X% of the sum assured for the next 10 years. The rate of return is not disclosed—you pay X and the policy will pay Y after 10 years and this is a net return of Z%. Not knowing the net return makes it difficult for a layperson to understand her return on investment, and compare across products.

Traditional insurance plans are undergoing significant changes. One of the most notable changes is the shift towards high deductible plans, which required policyholders to pay more out of pocket before insurance coverage kicked in. This change is driven by rising healthcare costs and the desire to encourage individuals to be more proactive in managing their healthcare expenses. Additionally, there is an increased emphasis on preventative care and wellness programs, with many plans offering free or discounted screenings and checkups. Overall, these changes represent a move towards a more consumer-driven healthcare system, with individuals taking on more responsibility for their own healthcare decisions and expenses.

Product structure: The report recommends simplifying product structures by splitting the premium into mortality and investments.

Accordingly, costs should also be bifurcated into mortality costs and investment costs. For Ulips, this is easier to implement as the costs are visible. But for traditional plans, this may translate into a big actuarial exercise. “Premiums can be segregated into investments and costs. When insurers price the product, they look at individual components. But to incorporate that into the product structure will be a huge exercise as the entire product communication will change. Companies with significant traditional portfolio are bound to resist,” said Kapil Mehta, executive director, SecureNow Insurance Broker Pvt. Ltd.

Further, the committee recommends that the costs of the investment component should be comparable to other similar products in the market. “Investment costs should be capped keeping in view the best practices in the rest of the market. For example, for non-participating plans, costs should be benchmarked to best practices in banking or other small savings products that invest in similar products that give guaranteed returns. For participating plans, costs should be benchmarked to similar asset allocation products in the mutual fund space or the NPS (National Pension System),” suggested the report.

Insurers say cost can’t be benchmarked. “In a bank, the business model is based on net interest margins (NIMs), CASA (current accounts and savings accounts) deposits, retail credit, retail deposits and a whole host of other parameters. The fixed deposit interest rate is not based on the earnings in the debt or equity market,” said a senior executive of a private insurance company who did not wish to be named. “For mutual funds, revenue is largely driven by short-term liquid fund management, which is an extended arm of treasury. Retail component is small,” the executive added.

Disclosures: The committee also emphasised on disclosures, particularly for traditional plans. An important recommendation was that insurance policies need to disclose the net return on a product to the customer. For non-participating plans with guaranteed benefits, this is very important. Even as a large section of the industry maintains that these are goal-oriented products and should be seen as a product with guaranteed benefits to fulfil long-term goals, it remains important to declare the rate of return.

Doing so allows the customer to compare or reconsider settling for a long-term guaranteed product (most of these plans return around 4%) versus other debt products that offer higher returns. Even in participating plans, disclosing the net return is very important. The variable additions, also known as bonuses, are mentioned as a percentage of the sum assured and further described in rupee terms. But this doesn’t complete the picture for the customer because it doesn’t disclose all the three things in one place: amount invested, amount accumulated and net return.

The recommendations suggest that the product should not only disclose the internal rate of return on an ongoing basis but also historical performance. This is important given that most people in the industry put the actual returns from these participating funds at 3-6%.

Incentives: In terms of distributor incentives, the committee has made two major recommendations: bifurcate the commission according to function and make it similar for products with similar functions. It suggests that upfront commissions should be allowed for the mortality part of the premium, but not for the investment part.

The report recommends level or declining trail commissions. So, in the case of guaranteed products, it should be a percentage of the premium, and in participating traditional plans and Ulips, commission should be a percentage of assets under management (as an AUM trail fee).

Insurers hold a different view. “The industry is cognizant of the fact that insurance products have been missold and is now taking significant steps in distributor training. The industry is aware that there is a direct correlation between right sale and persistency, which, in turn, is important for profitability and valuation,” said Sandeep Ghosh, managing director and chief executive officer, Bharti AXA Life Insurance Co. Ltd. “And there have been many regulatory changes. The Insurance Laws (Amendment) Act, 2015 also increases the penalties significantly. But one must acknowledge that insurance is a push product and needs adequate incentive to be sold,” he added.

Some say that even benchmarking costs or returns to other products such as in banking is not appropriate.

“It is difficult to state that all investment products should be benchmarked when they are different in structure and are used for different purposes: short-term, medium-term and long-term,” said R.M. Vishakha, managing director and chief executive officer, IndiaFirst Life Insurance Co. Ltd. “There are aspects such as cost of guarantee and solvency margins that are specifically applicable to insurance products. Each product has its own merits and demerits, and is suitable for different customer segments. It’s not possible to benchmark one against the other,” she added.

The other point that may pose an operational challenge is dual regulators. “The broad principles of the report are in the right direction but if two regulators are going to have a view on the same product, it’s going to pose a huge operational challenge for the industry,” said Mehta. “The focus should be more on levelling commissions, controlling costs and making products transparent,” he added.

While the recommendations of the committee may pose challenges, they will also make insurance policies more customer friendly and put greater onus on the industry.