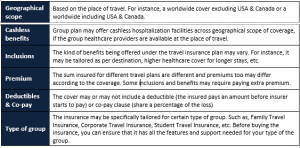

Below is a brief comparison of the different features of group travel policy to look out for.

A Case of comparing Business Travel Insurance

- Rajiv has planned an elaborate summer vacations to Europe with his family (wife and 2 children) plus brother’s family, sister’s family, seniors in the family and few cousins. The total group count adds up to 20 people and they will all be travelling together from Mumbai. While consulting with the travel agent he has also taken a company travel insurance cover instead of an individual one for each member as that works out cheaper for all. The scope of the insurance is across Europe. Since the children plan on indulging in water sports like scuba diving, etc. He has opted for a slightly higher premium for the added cover. Also, as the plan offers cashless hospitalization facility at major European hospitals at the destination they are travelling to.

- Texa Solutions is an IT company sending 10 employees for a conference to Singapore. The company opts for a corporate travel insurance cover which will cover the employees through the length of the trip. The cover is applicable across most major Asian countries including Singapore.

See – Different types of group insurance policies available in India

About The Author

Divyanshu

MBA Finance

Author Bio:

With seven years of experience in the insurance industry, Divyanshu is a recognized expert in group travel insurance. As a dedicated writer for SecureNow, he crafts insightful blogs and articles that elucidate the complexities of group travel insurance policies. He is passionate about educating businesses on the benefits and management of travel coverage, making technical details accessible and practical. His deep understanding of travel insurance regulations and best practices ensures that readers receive up-to-date and valuable information, establishing Divyanshu as a trusted voice in the insurance community.