Medical Establishment’s Professional Indemnity

Navigating the complexities of healthcare comes with its own set of challenges and potential risks. In this infographic, we delve into the critical features of a Medical Establishment indemnity insurance. Discover how this insurance coverage safeguards healthcare providers and their facilities against liability claims arising from medical errors or negligence. Explore the peace of mind it offers, ensuring financial stability while upholding the commitment to delivering top-notch patient care. From coverage options to claims processing efficiency, we unravel the essential components that help you make informed decisions about protecting your healthcare practice. Dive into the world of medical indemnity insurance with us.

Medical establishment’s professional indemnity insurance offers coverage to hospitals and clinics against the malpractice claims made by the patients.

Key Features Medical Establishment indemnity insurance

Professional indemnity insurance is a type of insurance that helps protect medical professionals, such as doctors, nurses, and other healthcare providers, against the financial consequences of mistakes or errors made in their professional capacity. Some key features of a Doctor professional indemnity insurance plan for a medical establishment may include:

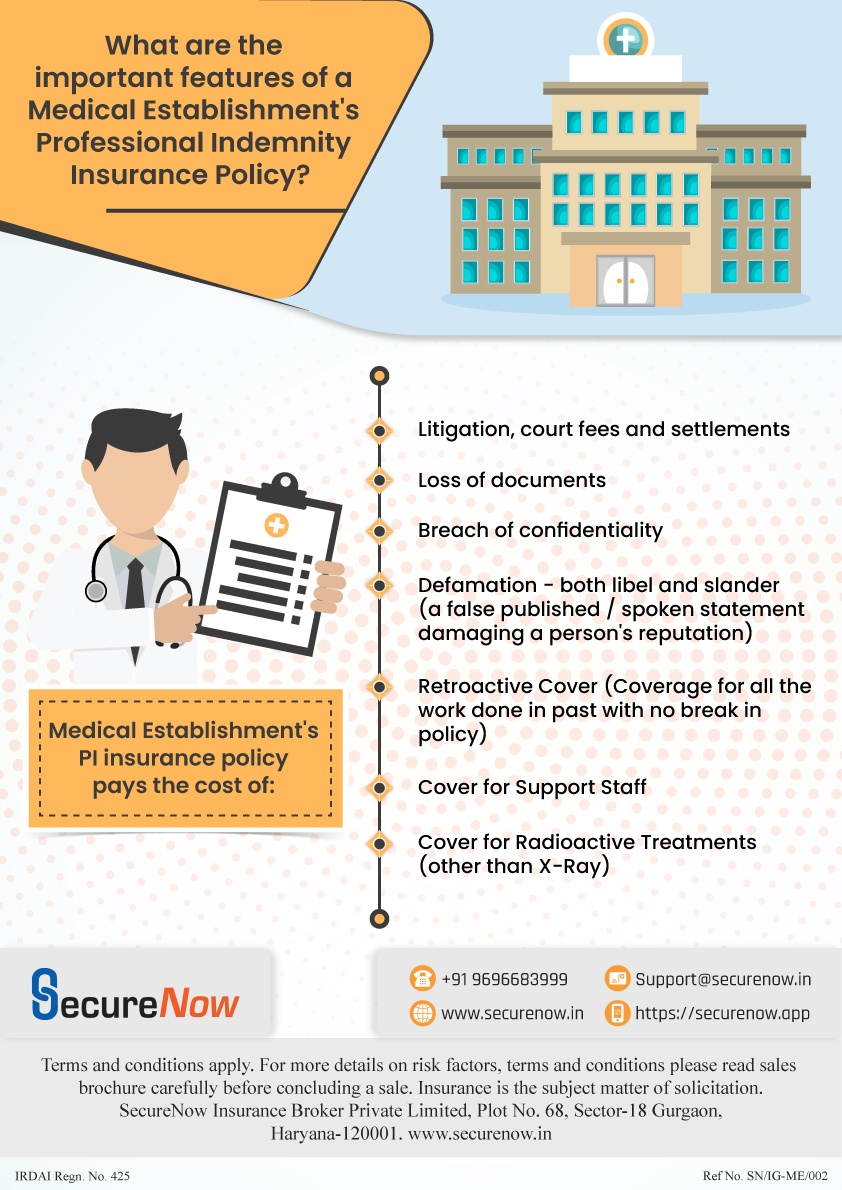

- Coverage for legal fees and other costs associated with defending against a professional liability claim

- Compensation for damages or settlements resulting from a professional liability claim

- Coverage for claims made by patients, clients, or other third parties

- Protection against a wide range of potential claims, including those related to medical malpractice, errors and omissions, and negligence

- The ability to customize the coverage to meet the specific needs of the medical establishment

- An option for retroactive coverage to protect against claims that may arise from past incidents

- A deductible, which is an amount that the policyholder must pay out of pocket before the insurance coverage kicks in

Buy online Doctor’s professional indemnity insurance through SecureNow App.

Below infographic explains the important features of Medical Establishment Professional indemnity insurance.

About The Author

Sonal Singh

MBA Insurance and Risk

With six years of specialized experience in the insurance industry, Sonal has emerged as a leading expert in medical establishments insurance. As a dedicated writer for SecureNow, she creates insightful and informative blogs and articles that illuminate the complexities of insurance tailored for medical institutions. Throughout her career, Sonal has developed an in-depth understanding of the unique risks and insurance needs of medical establishments, from hospitals and clinics to specialized medical practices. Her expertise allows them to break down complex insurance concepts into clear, practical advice, making their content invaluable for healthcare providers seeking to protect their operations and assets.