The universal principles of group health insurance include risk pooling, where the costs of healthcare are spread across a group of people, and community rating, where premiums are set based on the average cost of healthcare for the group rather than the individual’s health status. The aim is to ensure that big, medium, and smaller enterprises can provide affordable and accessible health insurance coverage to a large number of people.

Here are universal insurance principles governing the group insurance policies –

1. The Principle of Uberrimae Fidei:

It is a Latin phrase that also means Principle of Utmost Good Faith. It’s the basic and primary principles of insurance that say both the parties to the insurance contract should sign it in good faith. The insurer must provide complete and clear detail of the subject matter. The insured should also disclose all the material facts pertaining to health, property, or any other information. That may impact the insurance contract clauses. The insurance company’s liability gets void (i.e., legally cancelled) if the policyholder intentionally hides any facts about the subject matter of insurance or presents it in a wrong manner.

Case on Principle of Uberrimae Fidei: Last year, M.S Engineering bought a group health insurance policy for its 150 employees. However, while buying the policy, the company doesn’t give correct information about the maximum age limit of its employees. A few months back, Anuradha Prasad, one of the employees, was hospitalized after a cardiac arrest. The insurer refused to settle the claim because M.S Engineering had hidden the true age of its employees. In this case, Anuradha Prasad was 58- years old. But at the time of the policy purchase, M.S Engineering said that all its employees were below 45.

Read more about: Types of Group Insurance Policies available in India

2. The Principle of Insurable Interest:

It states that the insured person must have an insurable interest in the insured item. A person will have an insurable interest when the physical existence of the insured object gives profit and non-existence will entail losses. This means that the policyholder must stand to suffer a loss if the insured property is damaged or destroyed, or if the person covered by the policy experiences harm or loss. Without an insurable interest, an insurance policy would essentially be a form of gambling, which is why this principle is important for protecting against fraudulent or excessive insurance claims.

Case on Principle of Insurable Interest: R.S Automobile bought a group gratuity policy to cover 200 employees. As the company has an insurable interest in the well-being of employees, the insurer issued the policy. In case R.S Automobile shuts down its business, the company will also lose insurable interest present in the group gratuity policy and they no longer need to pay premiums.

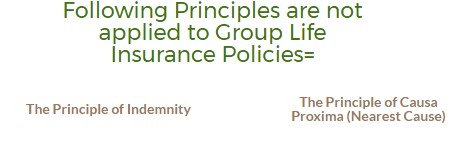

3. The Principle of Indemnity:

Here indemnity means protection, security, and compensation offered against loss or injury. As per this principle, the insurer signs contract for giving protection against unexpected financial losses arising due to future uncertainties. In any case, an insurance contract is not to earn a profit. Therefore, the policy limits the amount of compensation paid to the actual losses or the assured amount, whichever is less. In any case, compensation can’t be more than the actual amount. The insured won’t get compensation if the specified loss doesn’t happen due to an insured peril during the policy tenure.

Case on Principle of Indemnity: J.S Construction Ltd. has a group health insurance policy for its 600 employees. Last year, a hospital diagnosed one of the employees with dengue. A group health insurance policy covered the total medical expenses which came out to be Rs 40,000. In this case, the insurer covered only actual incurring medical expenses even when the coverage was more than that.

4. The Principle of Contribution:

It says, that if the policyholder has taken out more than one policy, he/she can claim to the extent of actual loss either from all the insurance companies or one insurer. This principle states that in such cases, each insurer is only liable to pay their proportionate share of the loss or claim, rather than the full amount. The purpose of this principle is to prevent an individual from receiving more than the actual amount of their loss, thereby avoiding the possibility of profiting from their misfortune. Essentially, the Principle of Contribution ensures that each insurer contributes to the settlement of the claim in proportion to the amount of coverage they have provided.

Case on Principle of Contribution: M.W Electrical Ltd. bought group personal accident insurance policies from two insurance companies— ABC Insurance for Rs 5 lakh and XYZ Insurance for Rs 2 lakh. In case one of its employees sustains an injury, he/she can approach any of the insurers. However, provided the expenses are within the sum insured available with the policies. In the case where an insurer has settled the entire claim amount, the employee can’t approach the second insurer for the claim settlement.

5. The Principle of Subrogation:

With subrogation, we mean substituting one creditor for another. As per the act, where the insurer settles the claim with respect to losses or damages to the insured property, the ownership right of such property shifts to the insurance company. However, the insurer can benefit from subrogation rights only to the extent of the amount that they have paid as a claim. An exception to this principle is in the case of life insurance, where subrogation does not apply as the payment is made directly to the beneficiary.

Case on Principle of Subrogation: R.J Associates has group health insurance coverage for its employees. Last year, the company sent one of its employees to M.J Mining on a contract basis. The employee sustained an injury while working. The group health insurer settled the claim of the injured employee and at the same time, the insurer filed a legal case against M.J Mining. As the injury happened because the company did not have proper safety measures.

Read More: How does Group Insurance Cover work?

The Principle of Loss Minimization: This principle says, that the insured must take all necessary steps to curtail the loss of insured property, in the case of events like fire, blast, etc. Just because the insured has an insurance policy, it doesn’t mean that he/she can act negligently. It’s the main responsibility of the insured to act diligently and take steps to cut losses to the insured property.

Case on Principle of Loss Minimization: Though the employer has provided coverage to Mrs. Kavita under the group travel insurance policy, she must try her level best to keep her vacation safe and secure. She must not act hastily, just because she has group travel insurance.

6. The Principle of Causa Proxima (Principle of proximate):

As per this Principle, when more than one clauses cause losses, the proximate or the nearest or the close cause should be considered. While deciding the insurer’s liability. To assess whether insurer is liable to recoup losses or not, the proximate (closest) should be considered.

Case on Principle of Causa Proxima (Nearest Cause): Mr. Rajiv Saxena was on his official trip to London when he came to know that his airline lost his luggage. It contained some important office documents. He immediately asked his Indian office to prepare new documents and courier them. Though the group travel insurance policy (bought by his company J.S Engineering) covered the loss of baggage, it didn’t cover the charges incurred in preparing and sending new documents. In this case, the nearest cause of the damage was a loss of baggage. Hence the insurance company settled the compensation.

There is a growing interest in the subject of insurance and understanding the different principles of insurance. Further, types of insurance and their coverage in today’s uncertain world is drawing considerable attention. Therefore, its is important to explore not only basic principles but also universal insurance principles, to get the best insurance plan for your organization.

These insurance has to be placed carefully because there are many extensions and caveats and small oversights can be costly when claims come up. Having a good understanding of universal insurance principles is important when buying a group policy to ensure that the policy aligns with the group’s needs and goals, and provides adequate coverage and benefits for its members.

If you have any queries, you can reach out to us at +91 96966 83999 or write to us at support@securenow.in. We at SecureNow can assist you in obtaining the best group insurance policies.