Here’s a look at some of the advantages and disadvantages of the Corona Kavach policy and top-up/super top-up insurance plans.

Corona Kavach is a policy that specifically provides insurance only for the treatment of the novel coronavirus disease. After the Insurance Regulatory and Development Authority of India’s (IRDAI) issued a directive, many insurance companies have launched this standard cover.

Advantages

• Enhanced policy coverage: Corona Kavach policy covers you for hospitalisation expenses including co-morbidities, PPE costs, room rent, nursing cost, ICU cost, surgeon’s fee, doctor’s consultation fees etc. Considering the shortage of rooms in hospitals, there is no capping on the room rent in the Kavach policy.

• One-time payment cover: You only have to pay the premium for Corona Kavach policy once at the time of purchase, unlike periodic payment of premiums for other medical insurance covers.

• Short waiting period: The waiting period for the Corona Kavach cover is 15-days only, i.e., you can make a claim and benefit from the cover after 15 days of its purchase.

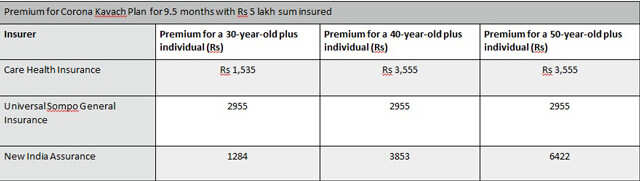

• Affordable premium: As the Corona Kavach provides insurance against only COVID-19 and that too only till March 31, 2020, the premium cost is low as compared to a full-fledged annually renewable multi-disease cover medical insurance. The table below gives an idea of the premium payable for the Kavach.

• Covers AYUSH treatment: AYUSH treatment expenses are covered under the Corona Kavach, including Ayurveda, Unani, Siddha, and homoeopathy.

Image: ET Wealth

Note: The Corona Kavach policy is available for individuals and as a floater for families which will provide coverage of up to Rs 5 lakh for hospitalisation expenses related to COVID-19 treatment only.

Disadvantages

• It is a short-term cover: The Corona Kavach cover is specifically designed for the short-term and hence the payment too, is one-time. “As per the IRDAI guidelines, the Corona Kavach policy can be issued until March 31, 2021. From a customer perspective, the policy can be purchased on or before March 31 and will continue until the end of the policy period. i.e. 9.5 months, 6.5 months or 3.5 months based on the policy period chosen by the customer,” Mahesh Balasubramanian, MD & CEO, Kotak Mahindra General Insurance said.

• Treatment limited to COVID-19: The Corona Kavach cover is only designed to cover treatment and hospitalisation costs for COVID-19, no other illnesses/ diseases are covered.

• Limited sum insured: Since the Corona Kavach covers treatment and hospitalisation costs for only COVID-19, the sum insured is limited to a maximum of Rs 5 lakh.

• The Kavach policy is nonrenewable: In case someone wants to have health insurance post-March 2021, then he/she needs to get a regular health policy which also covers other ailments like heart, liver, kidney, cancer etc. or accidental injuries leading to hospitalisation including COVID-19 treatment costs.

All existing indemnity/mediclaim type health insurance policies cover the treatment costs of COVID-19. However, having an adequate sum insured is necessary, and to enhance the sum insured of the base policy one can buy additional insurance via top-up/super top-up policies/plans.

Advantages

• Wider coverage: A health insurance top-up/super top-up plan offers coverage against several medical emergencies, including coronavirus. It provides financial backup in case the limit of your base policy is exhausted.

• Helps deal with growing inflation rate: A top-up/super top-up plan helps in dealing with the growing inflation rate as it allows you to have a high sum assured at an affordable premium.

• Cover pre-existing disease (PED): Even if your existing health insurance policy doesn’t cover pre-existing illnesses, a super top-up plan can provide coverage for PEDs, subject to PED terms and conditions. In such a case, the plans are likely to come with a higher premium.

• Lifelong renewability: A super top-up plan covers the COVID-19 disease apart from other ailments and offers lifelong renewability.

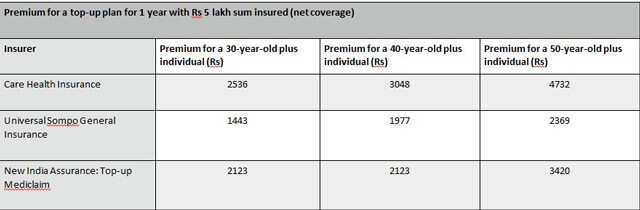

Image: ET Wealth

Note: The above indemnity-type top-up policies will provide net coverage of Rs 5 lakh sum insured after paying the threshold limit/deductible of Rs 5 lakh from your base health policy. This means the maximum coverage of the top-up policies is for sum assured of Rs 10 lakh each. Net coverage = Maximum coverage – Deductible

Disadvantage

• Waiting period: Top-up/Super top-up plans generally come with a waiting period of 30 days.

• Deductible: The top-up/super top-up plan comes with a compulsory deductible. This means that you can claim a top-up plan only once the medical expenses cross the deductible amount. However, the deductible works differently for a top-up plan and a super top-up plan while settling multiple claims in a year.

Under a top-up plan, the deductible limit applies afresh to each claim. However, in the case of the super top-up plans, the deductible limit applies to the total admissible medical expense incurred during the year.

Looking at the current scenario, policyholders should evaluate their current health policy and decide whether they would like to opt for a specific disease cover for a short duration or a super top-up plan depending on their risk outlook. Experts say that if you have a regular health insurance policy for you and your family members with a reasonable sum assured, then the Corona Kavach may not make much sense for you as your current health insurance too will cover for COVID-19 treatment.

However, they also say that if you do not have a reasonable sum insured, you may then consider buying a super top-up plan instead of a top-up plan either from the same insurer or different insurer, as per the availability of the plans. Chandan D S Dang, Executive Director, SecureNow.in, a Delhi-based online insurance broking firm, said, “If you have a regular health policy with a sum assured of Rs 10 lakh or less, then you can add a super top-up to increase the effective sum assured available to you. I suggest buying a super top-up of Rs 5 to 10 lakh so that your total cover increases to Rs 15 to 20 lakh amid the current situation.” This way, you can have sufficient coverage to protect your family members.

“The super top-up plan becomes active when you have incurred expenses equal to the deductible/threshold limit (as per the policy). It does not matter who paid for the initial expenses – it could be the patient or their base insurance health policy. Therefore, you can consider buying a super top-up with base health policy to avoid confusion related to deductible,” Dang said.

Balasubramanian said, “A top-up plan is a comprehensive health policy and pays the claim amount over a deductible. It is useful for paying high-value claims. Usually, the deductible starts from Rs 2-3 lakh. Usually, in the case of COVID-19 claims, the average claim size is around Rs 80,000 to Rs 1 lakh (per person). In such a scenario, very few claims would reach an amount higher than the deductible.” This way, most of the claims would fall under the base policy.

Further, Sanjiv Bajaj, Joint Chairman & MD, Bajaj Capital explained, “For instance, if you have both a top-up plan and a super top-up plan with a sum insured of Rs 10 lakh (assuming a deductible of Rs 5 lakh). Now, say, two claim arises in a year – the first one of Rs 3 lakh and the second one of Rs 4 lakh. The top-up policy, due to its nature, will not help settle any of your claims because in both cases your claim did not exceed the deductible limit of Rs 5 lakh. However, in super top-up, the total of both claims will be considered for the deductible, and hence in the second claim Rs 2 lakh (Rs 3 lakh + Rs 4 lakh – Rs 5 lakh) will be paid out.”

Adding to it, Nikhil Apte, Chief Product Officer, Product Factory (Health Insurance), Royal Sundaram General Insurance said, “We do not recommend you to buy a basic top-up plan as it works only when the regular base policy pays. Moreover, in the case of the Corona Kavach policy, it will pay only for COVID-19 treatment and that too only for less than one year while the risk of health will remain throughout.” Hence, choose your plan wisely.

Who Should Ideally Buy Corona Kavach Policy?

Balasubramanian said, “Ideally Corona Kavach policy should not replace a comprehensive health insurance policy but can be purchased by someone who doesn’t have any form of health insurance.” Adding to this, Amit Chabbra, Head – Health Insurance Policybazaar.com said, “If you do not have any health insurance at present and you cannot afford a comprehensive health insurance policy in the current situation then without a doubt you should go for the COVID-19 specific policy especially Corona Kavach policy. These are the most affordable plans available.”

Corona Kavach insurance is specifically designed to cover the expenses incurred due to treatment of COVID-19, whereas a top-up health plan provides coverage for all types of illnesses and treatments. Corona Kavach has a lower waiting period compared to a top-up plan and is more affordable for those seeking coverage specifically for COVID-19. It also offers a higher sum insured for a lower premium compared to a top-up plan. Additionally, some insurance providers offer additional benefits such as home quarantine cover and Arogya Sanjeevani cover with Corona Kavach insurance. In conclusion, it depends on individual needs and priorities, but Corona Kavach insurance may be a better option for those primarily seeking coverage for COVID-19 treatment.