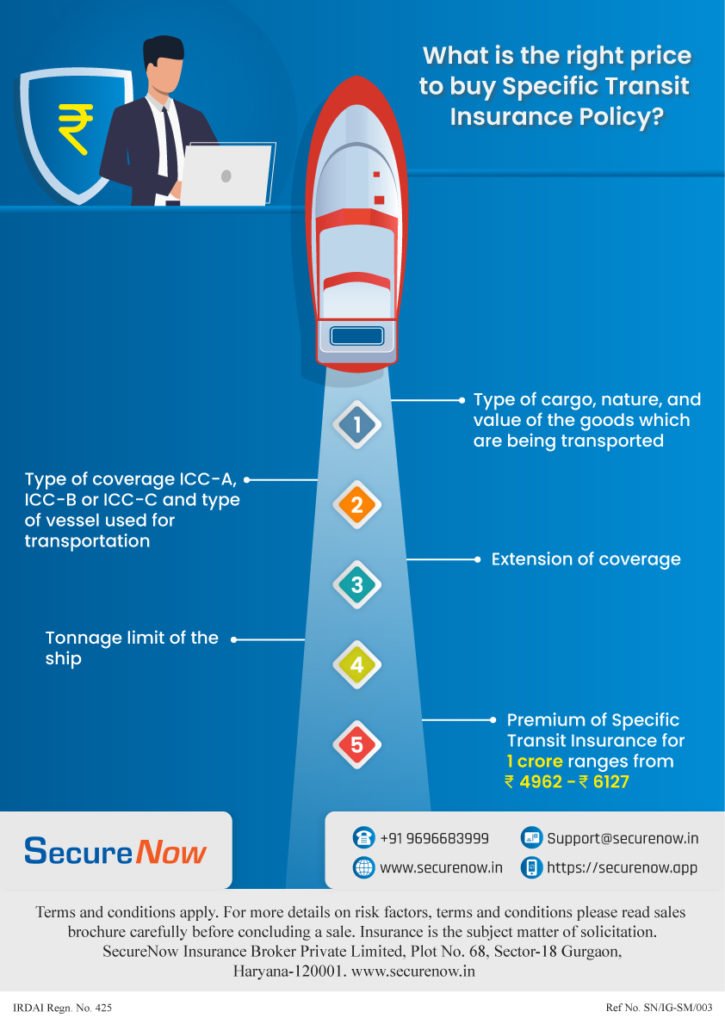

There are many general insurance companies which offer specific transit insurance. These companies charge different premiums based on the coverage and benefits opted for. There are a few factors to consider when determining right price to purchase Transit Insurance:

- Value of the goods being transported: The value of the goods being transported will impact the cost of the insurance. Higher value goods will require more coverage and therefore a higher premium.

- Mode of transportation: The tonnage limit of a ship can affect the premium cost of marine insurance based on the vessel’s size and capacity. The mode of transportation will also affect the price of the insurance. For example, shipping by air will typically be more expensive to insure than shipping by ground. Also the type of cargo can impact the premium of transit insurance due to varying risk factors.

- ICC Policy Type: Marine insurance types ICC-A, B, and C offer different levels of coverage and the premium price varies accordingly. ICC-A provides the broadest coverage with a higher premium, while ICC-C offers limited coverage at a lower premium. ICC-B falls in between in terms of coverage and premium cost.

- Coverage needs: Consider your specific transit coverage needs of your shipment. Do you need coverage for damage, theft, or loss? The more the coverage you need, the higher would be the premium. Extensions in marine insurance are additional coverage options that can impact the premium based on the desired level of protection.

- Convenience: Once can buy Transit Insurance Online through reputed insurance broking firm SecureNow.

It’s very important to shop around and get quotes from multiple insurers to find the best price for the coverage you need. Buying Online Transit Insurance policy is now a days most viable method of buying Marine insurance online.

The below infographic explains various factors that affect specific transit insurance premiums and right price to purchase Transit Insurance:

About The Author

Simran

MBA Insurance and Risk

With extensive experience in the insurance industry, Simran is a seasoned writer specializing in articles on marine insurance for SecureNow. Drawing from 5 years of expertise in the field, she possesses a comprehensive understanding of the complexities and nuances of marine insurance policies. Her articles offer valuable insights into various aspects of marine insurance, including cargo protection, hull insurance, and liability coverage for marine-related risks. Renowned for their insightful analysis and informative content, Simran is committed to providing readers with actionable information that helps them navigate the intricacies of marine insurance with confidence.