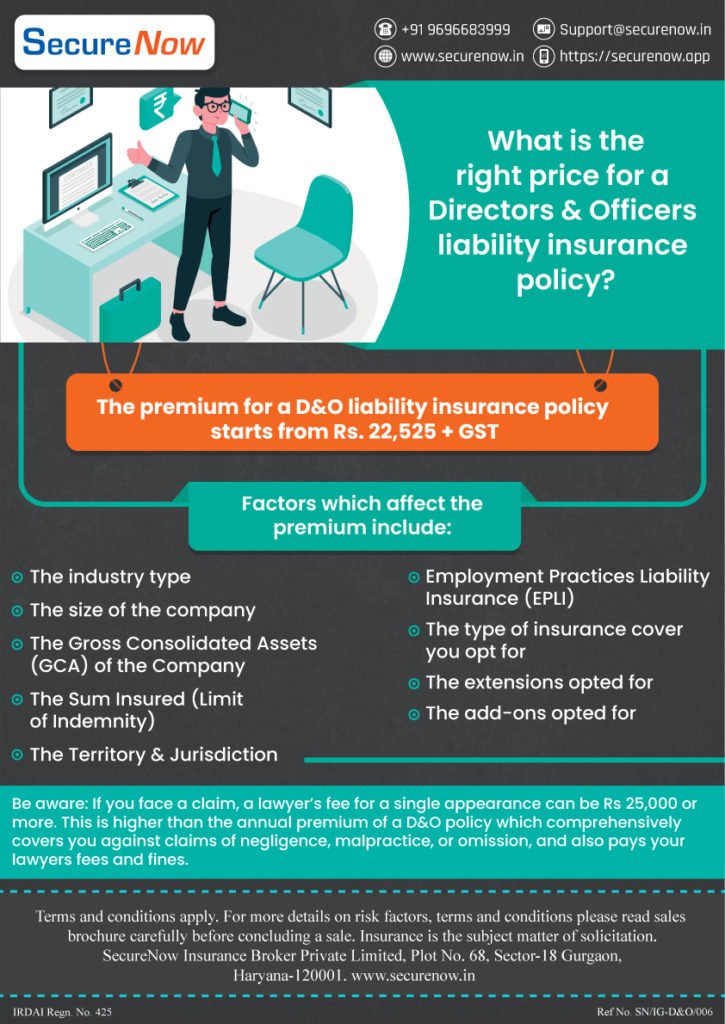

Directors’ and officers’ liability insurance covers directors against legal liability arising from wrongful practices in their managerial capacity. The D&O insurance premium depends on a variety of factors. Deciding on the right price for Directors and Officers liability insurance requires obtaining multiple quotes. Additionally, conducting a thorough analysis of prices and coverage options is essential.

Moreover, the price of D&O insurance varies based on factors like company size, industry, directors, and coverage needs. Other factors influencing D&O insurance price include location, claims history, and chosen policies and endorsements.

Factor that affect price of D and O Insurance:

- The Industry type

- The size of the Company

- The Gross Consolidated Assets (GCA) of Company

- The sum Insured or limit of indemnity

- Territory & Jurisdiction

- Employment Practices Liability Insurance (EPLI)

- Type of Insurance cover sought

- Extensions and add-ons opted for in the policy.

Some few key steps you can take to help determine the right price for D&O insurance for your company are:

- Assess your company’s needs– Consider the specific risks and exposures your company and its directors and officers are prone to, and what coverage you need to protect against those risks.

- Shop around– To make an informed decision, get quotes from multiple insurers and conduct a comparative analysis of prices and coverage.

- Negotiate– Work closely with your insurance broker or agent to negotiate the best price and coverage for your enterprise.

- Review your coverage regularly– Review D&O insurance regularly to ensure it meets evolving company needs effectively.

When purchasing D&O liability insurance for your organization’s directors, several key factors can help you determine the right price. Consider the size and nature of your organization, industry or sector, claims history, coverage needs, and the type and number of directors. Additionally, the location and policies chosen also impact the price. By evaluating these factors, you can make an informed decision. This will help you secure the appropriate coverage at the right price for your organization’s directors’ liability insurance needs.

Furthermore, it would also be a good idea to work with an experienced insurance broker or agent. They can help you assess your company’s needs and find the right D&O insurance policy within your company budget.

Below infographic explains factors that determine right price for Directors and officers liability insurance.