Selecting the right insurer for your Personal Cyber Insurance or Personal Cyber Risk Insurance is paramount. In this infographic guide, we therefore unveil the key qualities to seek in an insurance provider. From cybersecurity expertise to prompt claim settlements, we’ll empower you to make an informed choice, ensuring your digital world stays protected with the best partner by your side.

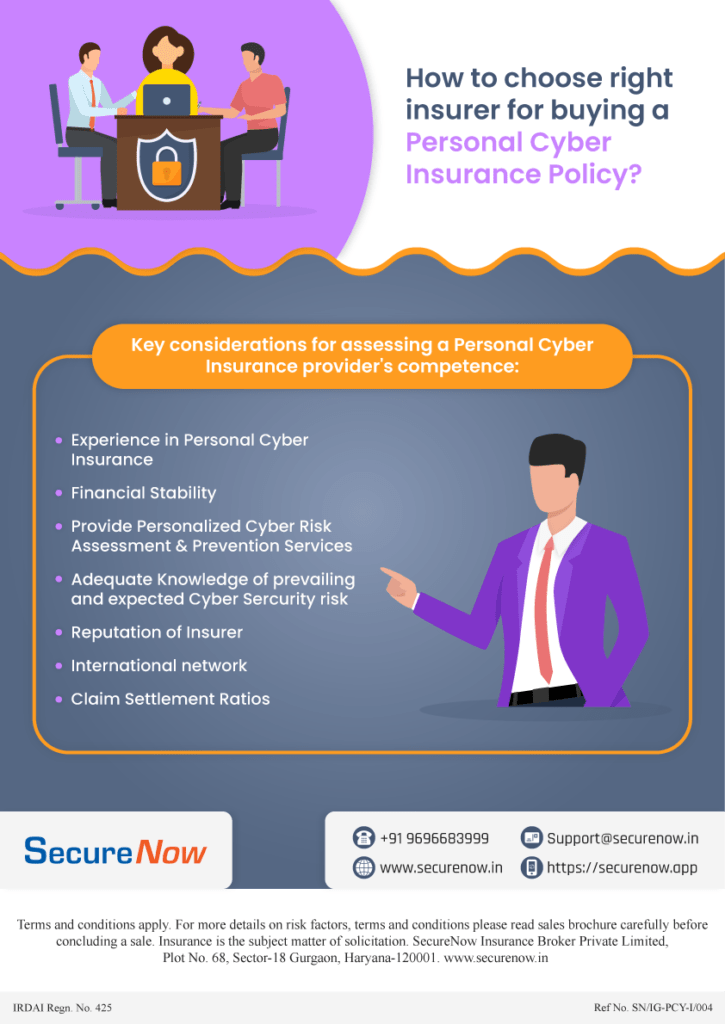

How to choose right insurer for buying a Personal Cyber Insurance Policy?

Key considerations for assessing a Personal Cyber Insurance provider’s competence:

- Experience in Personal Cyber Insurance: A seasoned insurer understands the nuances of cyber risks, offering tailored solutions and expert guidance.

- Financial Stability: A financially stable insurer ensures they can fulfill claims, providing further confidence and security to policyholders.

- Personalized Cyber Risk Assessment & Prevention Services: Insurers customize risk assessments, empowering clients to proactively protect their digital assets.

- Adequate Knowledge of Prevailing and Expected Cybersecurity Risks: In-depth knowledge allows insurers to further adapt policies to evolving cyber threats, enhancing protection.

- Reputation of Insurer: Strong reputation signifies trustworthiness, reliability, and customer satisfaction, equally important factors when choosing an insurer.

- International Network: A global network likewise enables insurers to provide support and resources worldwide, vital for today’s interconnected digital landscape.

- Claim Settlement Ratios: High claim settlement ratios prioritize customer service by swiftly and fairly resolving legitimate claims, reflecting commitment.

Choosing the right insurer brings peace of mind like no other. With a trusted partner, your digital life remains safeguarded, and in times of need, their support becomes your shield against cyber threats. Embrace the assurance of a good insurer for a secure digital future.

If you have any query, you can reach out to us at +91 96966 83999 or write to us at support@securenow.in

The infographic below further explains the factors that determine the competence of an insurance provider for individual cyber safe insurance.

About The Author

Arshdeep

MBA Insurance Management

Arshdeep is a seasoned insurance expert with 7 years of experience, specializing in Cyber Risk Insurance. As a writer for SecureNow, he delivers insightful blogs and articles that demystify the complexities of cyber risk coverage. His content is designed to help businesses understand the importance of protecting against cyber threats and data breaches. With a focus on practical advice and the latest industry trends, Arshdeep empowers readers to make informed decisions about their cyber insurance needs, ensuring robust protection in an increasingly digital world.