Published in Moneycontrol.

COVID-19 has made everyone sit up and take notice of the importance of having adequate health insurance coverage. But if you are a senior citizen, you may be more vulnerable to the pandemic. If you don’t have sufficient health insurance coverage, then there is a way out.

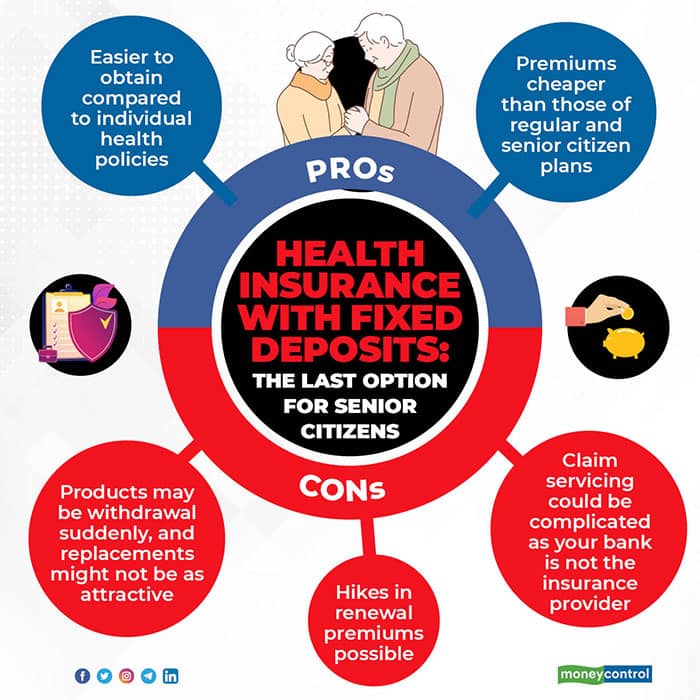

Many banks offer customised group health covers for their customers. This is only available to account holders, depositors and borrowers, depending on the bank’s policy. Unlike some group insurance covers attached to fixed deposits or credit cards, which are complimentary to customers, here, you have to pay the premiums for purchase and renewal. For senior citizens, it’s good to know if your bank offers a group insurance cover, as buying fresh health insurance or enhancing existing covers beyond an age is difficult and costly. Insurers are reluctant to offer regular health coverage at affordable rates to senior citizens given their advanced age and the likelihood of having developed pre-existing diseases such as diabetes and hypertension. Even if insurers do offer policies to senior citizens, they come with prohibitively high premiums or limitations such as co-pay.

Attractive price points, smoother purchase

The biggest attraction for senior citizens to buy such policies through their banks is the premium, which tends to be far cheaper than individual covers.

For example, Union Bank of India’s group health insurance is offered through New India Assurance for its accountholders and their family members. For a Rs 10-lakh cover, a senior citizen couple over the age of 55 years will have to pay a premium of Rs 56,256, including GST, as per information available on its website. The annual premium for the group cover offered by Punjab National Bank to its customers over the age of 61 is Rs 25,219 for a Rs 10-lakh cover from Oriental Insurance. Axis Bank, through Aditya Birla Health Insurance, offers a group health cover to its customers, but the maximum entry age is 55 years. The premium for two adults aged 55 years will work out to Rs 12,799 for a Rs 10-lakh cover.

The amounts are low compared to the health insurance premiums for senior citizens under regular, individual policies, which can go up to as high as Rs 91,000 for a Rs 10-lakh cover. “Families which cannot afford individual health plans or senior citizen insurance plans due to high premiums, should cover senior citizens in their group plans. Even if a group plan does not offer exhaustive benefits like individual health plans, it is better than not having any health coverage for the elderly,” Bhalchander Sekhar, CEO, Renewbuy.com

The maximum age at entry, which is 65 years in the case of individual policies, tends to be much higher in the case of group policies, which are tailor-made by insurers for bank customers.

For example, PNB’s policy has a liberal maximum entry age of 79 years. “For people who do not have any other coverage, either individually or from their employer, such plans can be a good way to get coverage. Generally, these do not require a pre-issuance medical check-up,” says Abhishek Bondia, Co-founder, Securenow.in. Some might insist on such check-ups if your self-declaration of your health status reveals any pre-existing ailments such as diabetes, hypertension, heart issues and so on. It will finally boil down to the policy terms that the bank and the insurance company have mutually decided on. Whether or not the insurer insists on medical check-ups, ensure that you disclose your pre-existing ailments upfront to avoid claim rejections later.

You can buy these policies after enquiring with your branches or online if your bank offers the option.

The flip side of cheap health policies

While pricing is better, you still need to understand other clauses before you take a call. For one, check the waiting periods – the period when the insurer will not pay your claims if you are hospitalised for treatment of pre-existing diseases. Employers’ group health insurance policies do not specify any waiting periods, which is not the case with bank-facilitated group covers for customers.

For example, PNB customers’ policy specifies a waiting period of 36 months for pre-existing ailments, while disease-wise waiting periods range from one to three years. Certain diseases such as Type-1 Diabetes will be completely excluded from coverage.

Such policies will also come with room rent sub-limits as well – usually, up to 1 per cent of the sum insured, and 2 per cent for intensive care unit (ICU) admissions.

“You can look at buying these policies as the last resort. Unlike an individual policy, this cover can be withdrawn by the insurance company in the subsequent years if they find the premiums to be unviable,” says Mahavir Chopra, Founder, of Beshak.org, a consumer awareness platform for insurance. While these are ordinarily renewable, they could be withdrawn if there is a sharp spike in claims or the bank and the insurer decide to part ways. Then, there could be other unexpected causes too.

In fact, many bank customers did suffer last year when covers were withdrawn due to multiple bank mergers. While IRDAI stepped in, it is a pointer to the possibility of unforeseen circumstances that can throw a spanner in the works.

Also, premiums can go up steeply in a particular year if the claims are too high – they could turn affordable, leaving you without a cover. “The possibility of substantial renewal premium hikes and lack of no claim bonus in case of health indemnity plan can also be shortcomings. More importantly, customers should know who the service provider will be in case of a claim. That could be a challenge as banks will not be able to handhold at the time of claim,” explains Bondia.

Also, such covers will cease to exist if you decide to close your bank account. Now, you do have the choice of migrating to the same insurer’s retail policy while retaining the continuity benefits if the latter accepts your proposal. However, the premiums are likely to be much higher than those of your group cover.

Put simply, your first preference should be a regular individual or dedicated senior citizen health insurance policy, as a group cover’s long-term continuity will be uncertain. If you have no choice but to buy group insurance covers meant for bank customers, ensure you enquire about the claim settlement process and keep your insurer’s customer service contacts at hand.