National Pension Scheme (NPS) is a Government program under The National Pension System of India. The scheme looks forward to securing employees post retirement. The Government of India adopted the system from 1st January 2004. Under the NPS, every candidate has to acquire a PRAN (permanent retirement account number) for the allotment of eligibility.

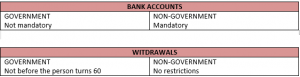

In the year 2009, The Government of India made the National Pension Scheme, a retirement saving scheme for all government as well as private sector employees.

The functioning of NPS

Case on National Pension Scheme

Giriraj Singh, is the HR head of a fast-growing Private Limited firm. He has suggested the NPS as the permanent retirement solution for the employees of the organization as, it has the potential to reduce the burden of contribution to employee’s PF on the firm, and offers higher tax benefits for the contribution years.

This feature gives tremendous growth advantage to the investors. Furthermore, National Pension Scheme will make employees stay longer, as the rules may be introduced for the employees to spend at least five years with the employer in order to receive tax-free contribution of the employer.

Overall, NPS is potentially the best choice for them as employer and for their hard-working employees’ retirement.

About The Author

Trisha

MBA Finance

With seven years of experience in the insurance industry, Trisha is a recognized expert in group superannuation. As a dedicated writer for SecureNow, she crafts insightful blogs and articles that clarify the complexities of group superannuation schemes. She is passionate about educating businesses on the benefits and management of retirement plans, making technical details accessible and practical. Their deep understanding of superannuation regulations and best practices ensures that readers receive up-to-date and valuable information, establishing Trisha as a trusted voice in the insurance community.