Why protect house property and contents?

There is no place like Home, it’s our most valued possession and our heaven on earth. Few things in life matter as much to us, as our home does. After all, it’s the heart of our family, our possessions, our priceless investment, and our memories. From a long-term perspective, owning a home is a financial investment that can ensure your security in years to come. Having an insurance policy in place to protect that investment should be at the top of your list of priorities. Having a home insurance policy won’t prevent random acts of nature, but it does put a safety net between you and catastrophe. As long as you have that in place, you can rest assured that you’ll be better equipped to weather a storm or crisis. A home insurance policy brings peace of mind and also in the current scenario it is the need of the hour.

What is Home Insurance?

Home Insurance is a form of property insurance designed to protect an individual’s home against damages to the house itself, or to possessions in the home.

Home insurance – what can be covered & what cannot?

What is covered?

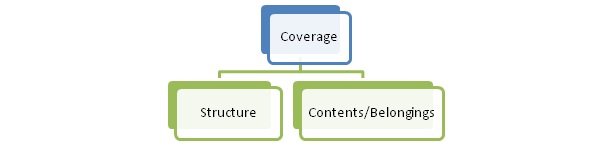

You can choose to buy insurance for only the building (structure) of your home, only the contents (belongings), or both.

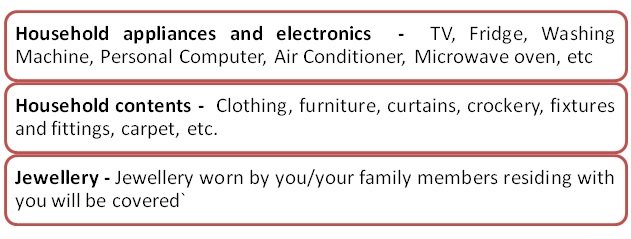

Contents/Belongings Covered

One of the main features of the policy is that your Household contents will get replaced by new ones in case of any damage or loss happens due to any natural or man-made calamities.

The natural calamities covered are:

• Fire

• Lightning

• Impact Damage

• Aircraft damage

• Explosion / implosion

• Storm, Cyclone, Typhoon, Tempest, Hurricane, Tornado, and Flood

• Riots, Strike, Malicious and Terrorism Damage

• Subsidence and Landslide including Rockslide

• Bursting and/or overflowing of water tanks, apparatus, and pipes

• Missile testing operations

• Leakage from automatic sprinkler installations

• Bush Fire

• Earthquake

Man-made Calamities are:

• Burglary & Theft

• Cover for Terrorism

Exclusions

• Willful destruction of property.

• Loss, damage, and destruction caused by war, wear and tear, etc.

• Damage that is pre-existing in nature (applicable to contents and building).

• Manufacturing defects in electrical, mechanical, and electronic items.

Some recent natural calamities and their impact on House Property

The recurrent earthquakes and floods are good reminders of how vulnerable and exposed our houses are to natural calamities.

Nepal Earthquakes

Those who have suffered in the earthquake in Nepal and parts of India stand testimony to how easily houses can get destroyed and how difficult it is to rebuild. As per the report in “Hindu” around 1.4 lakh buildings were completely destroyed in Nepal due to the powerful 7.9-magnitude recent earthquake. The earthquake completely damaged 1,38,182 houses across Nepal and partially damaged 1,22,694.

Chennai Floods

Recent floods in Chennai have also caused huge damage to people’s homes as well as their belongings. Also, it was reported that burglars tried to break in the locked houses as people left their houses and moved to the safer area. People suffered huge losses of their belongings as well as damages to their houses due to the floods. Also, in some areas people cannot live in their houses till they are fully repaired, so they are living on rent. This cost of rental accommodation can also be covered under the Home Insurance policy.

Future Dangers

As per the Ministry of Earth Science, India is vulnerable in varying degrees to a large number of hazards. More than 58.6 percent of the landmass is prone to earthquakes of moderate to very high intensity; over 40 million hectares (12%) of its land is prone to floods and river erosion; close to 5,700 km, India’s 7,516 km, the long coastline is prone to cyclones and tsunamis; and, its hilly areas are at risk from landslides and avalanches. Moreover, India is also vulnerable to chemical, biological, radiological, and nuclear (CBRN) emergencies and other man-made hazards.

Our Metro cities are also not safe, every year we have earthquake tremors in Delhi and danger of floods in Mumbai. In Northern India, earthquake tremors are felt regularly and in Southern India, there is always a danger of floods. While there is little we can do against natural disasters, we can reduce some of the consequent hardships by having home insurance, which protects against any damage to the house and valuables in it.

SOME FACTS

As per Skymet Weather Wise, India’s capital city ranks third in the most earthquake-prone areas of India after Guwahati and Srinagar. Since 1720, the city has been hit by earthquakes higher than magnitude 5. On the sides of the Yamuna River, the Ridge and the Chhatarpur basin are the two most earthquake-prone neighborhoods.

If Delhi is hit by a similar earthquake that hit Nepal, then it is expected that it will damage half of the capital’s buildings.

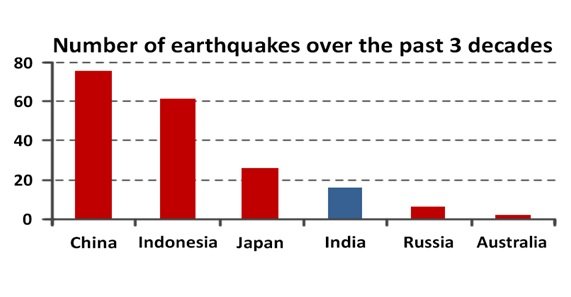

India ranks fourth amongst the countries hit by earthquakes in the past 3 decades, in the Asia Pacific region.

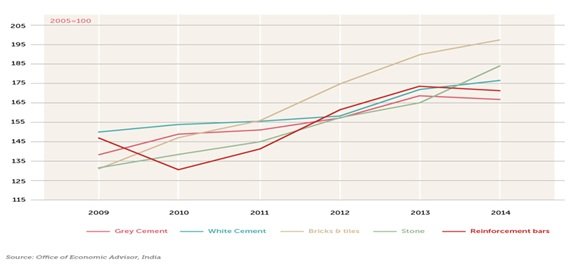

The construction cost is also increasing at a rapid rate. In order to reconstruct a house 10 years later, you will have to pay almost double amount from now.

FAQs

What risks are covered in a home insurance policy?

The structure of your home is insured as per the reinstatement value. The policy covers the losses to the structure of your home due to any natural and man-made calamities.

The calamities covered are:

• Fire

• Riot, strike & malicious damage

• Theft, burglary, or attempted burglary

• Explosion & implosion

• Earthquake

• Lightning

• Storm, cyclone, tempest, tornado, hurricane, flood & inundation

• Damage due to impact by vehicles

• Missile testing operation

• Subsidence, landslides, and rockslides

• Leakage from automatic Sprinkler installations

• Aircraft damage

• Bursting and/or overflowing of water tanks, apparatus, and pipes

What are the eligibility criteria to avail of a Home Insurance policy?

For individuals – Any resident Indian who is the owner and/or occupant of the property can purchase a Home Insurance Policy. However Home Insurance – a multiyear policy can be issued only to house / flat owners and not to tenants.

For Society – Any authorized member of society’s managing committee can buy a policy to cover society building & common utilities wherein policy needs to be issued in name of society.

How the valuation of property and contents is done for home insurance?

The value of your home structure is assessed as per the area of your home multiplied by the rate of construction per. sq. feet, as of the date of taking the policy. For example, if your home is 1000 sq. feet and the construction rate per sq. feet is Rs. 800/-, then the sum insured for your home’s building structure is Rs. 8,00,000.

On the other hand, the contents are assessed on the market value of the items. This means that if there were a loss, the claim would be paid on the value of purchasing a similar new item, with less depreciation for the usage.

Which are the types of properties which are not covered under home insurance?

The following properties are not covered under the Policy:

• Property Under construction

• Resident cum offices

• Land

• Shops

On what basis are the structure and contents insured?

The structure of your home is insured as per the reinstatement value and the contents are insured as per the market value. The reinstatement value is the cost incurred to reconstruct the home if it is damaged. The market value is the cost of buying a similar new item after deducting appropriate depreciation on the basis of the age of the item.

What perils/risks are not covered in home insurance?

• Willful destruction of property.

• Loss, damage, and destruction caused by war, wear and tear, etc.

• Damage that is pre-existing in nature (applicable to contents and building).

• Manufacturing defects in electrical, mechanical, and electronic items.

Which contents can be covered in home insurance?

• Content such as furniture, clothing, etc are covered against fire, burglary (excluding theft), and natural calamities.

• Contents such as jewelry (gold & silver) and valuables (cameras, watches, etc.) are covered against fire, burglary, theft, waylaying, snatching, and natural calamities.

• Domestic appliances such as refrigerators, washing machines, etc. are covered against fire, burglary (excluding theft), natural calamities, and breakdowns.

Can I cover my mobile phone or laptop with Home Insurance?

Yes, you can cover your mobile phone or laptop with home insurance.

Can I cover my jewelry with Home Insurance?

Yes, you can cover your jewelry with Home Insurance. But, there are some limitations on the amount to be covered.

Is it compulsory to cover contents in home insurance?

No, it is not compulsory to cover contents in Home Insurance. Some insurance companies allow ensuring your structure only.

Can I choose the contents to be covered in HI? Is it compulsory to cover all the contents in HI?

Yes, you have the option to cover any of your Content. The Home Insurance policy can cover your:

• Household appliances

• Jewellery

• Furniture & fixtures

• Personal items at your home against fire and allied perils

Would I need to take additional Insurance if I live in a building insured by my society?

The insurance that your society provides may offer you limited cover and generally includes only structure and not contents.

You should buy home content insurance cover for your belongings if the building structure of your house is insured by society.

Will my tenants be also covered under Home Insurance if I rent out my house?

The person who is the rightful owner can take Insurance Cover for an asset. If you own the building, you will have to take Building Insurance for the Civil Structure. In case your tenants want to insure their belongings, they have to buy insurance for the Contents separately.

What happens to the Home insurance policy if the insured house is sold?

From the time the transfer of ownership becomes effective, the policy stands canceled & the insured ceases to be an insured under the policy. The premium for the balance insured period will be refunded.

Will the losses be covered if losses are incurred due to an incident like the garden catching fire and spreading to the premises?

Yes, the spread of fire to the insured premises is covered but the fire should not be a deliberate act of the insured.

Can an entire society or building be covered under a home insurance policy?

Yes, an entire society building can be covered for the policy period of 1 year excluding commercial occupancy like a shop/office forming part of a society building.

What is terrorism cover? Can it be covered by Home Insurance?

Terrorism cover insures your home and its contents against any damages/ losses caused due to any acts of terrorism (TERRORISTS).

What if I have a home insurance policy with two different companies will I be benefited from both?

If you have a policy with two insurance companies, at the time of a claim both insurance companies will pay on a proportionate basis.

What will be the start date of my insurance policy?

Your insurance cover will start from the commencement date indicated by you or receipt of premium by the insurance company, whichever is later.

What do I do in case of a claim?

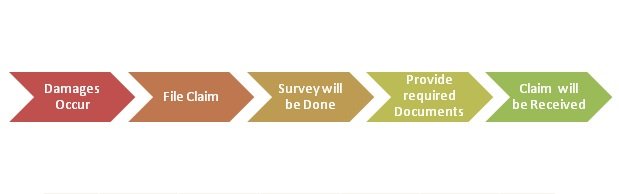

In case of a claim:

• Inform the Call Centre of the policy details

• The insurer company authenticates the claim request

• Surveyor onsite within 48 hours

• Surveyor submits report to the insurer company within 72 hours of returning from the site.

• The documents are processed by the company within 7 days.

• On approval, payment is sent to the insured.

Is FIR necessary for property damage claims?

FIR is mandatory in case of Malicious Damage Riot and Strike Terrorism, Burglary, or theft However it is not necessary in cases of:

• Flood

• Storm

• Earthquake

• Lightning

• Subsidence

• Impact Damage due to Aircraft Losses

What happens to the Home insurance policy if the insured house is sold?

From the time the transfer of ownership becomes effective, the policy stands canceled & the insured ceases to be an insured under the policy. The premium for the balance insured period will be refunded.

Do I need original papers for contents in case of a claim?

Yes, original documents for contents are needed for a successful claim.

How a burglary claim is processed?

In case of burglary claims, amounts up to 75% of the claim payable (as assessed by the company-appointed surveyor) will be paid on receipt of a copy of the first information report (FIR). The balance settlement will be made only upon receiving the final police investigation report.

What documents I need to submit in case of a claim?

Documents required for filing a claim are:

• Claim Form of the company duly completed and signed

• other evidence of the event occurring, nature, and extent of loss such as:

1) First Information Report

2) Fire Brigade Report

3) Estimate of the repairers

4) Rent Agreement

5) Transport details for baggage loss

Claim settlement process

In the event of any claim, you can either call the customer care of the insurer company or register the claim online with details of the equipment damaged, location of loss, cause of loss and amount of loss (approx. estimation), and policy Number for reference.

On claim registration, a surveyor would be appointed to estimate the loss/ damage, depending on the type of loss viz. Fire/Burglary etc.

Once the insurer company receives full and final documentation, they would process the claim with prompt turnaround time.

Claim Settlement Process

Documents required for Claims:

For any losses/damage due to Fire:-

• Reconstruction cost of the Residence which has been damaged.

• Fire brigade Report if applicable.

• FIR if applicable.

• Repair bills or replacement bills as desired by the Surveyor.

• Any other documents the Surveyor thinks appropriate.

• In the case of highly valued items Original Purchase Invoice giving details of Make, Manufacturing year, etc is required to arrive at the depreciation and basis of Indemnity, etc.

For Losses due to Burglary:-

• Original invoice giving the value of the item stolen

• Replacement cost / Repair cost.

• FIR

• Final Police Report

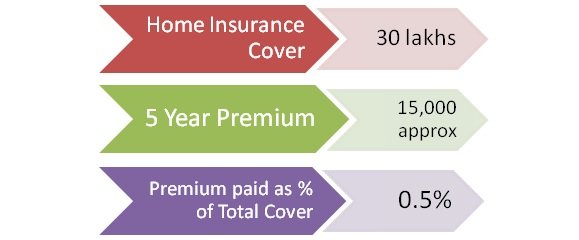

Example of Basic Home Insurance Policy