Explore the easy and hassle-free online buying process for Group Health Insurance for your employees. With few clicks SecureNow can help you buy group health insurance online, without much efforts and inconvenience.

- Determine your insurance needs: Think about what you want to be covered for when deciding types of GMC policy you need . This will help you narrow down your options and make the process of comparing quotes easier.

- Shop around: Look at multiple insurance companies, compare their Group Medical Insurance and prices. You can use websites like SecureNow to help you compare quotes.

- Check the company’s reputation: Make sure you choose a reputable insurance company. Look for insurance companies that have a good track record and are financially stable. While buying Group Health Insurance for Employees organisation can check the financial strength of an insurance company by looking at ratings from independent agencies.

- Understand the policy: Carefully read and understand the policy before you buy Corporate Health Insurance .

Ensure that you are aware of what is covered and what is not covered, as well as your responsibilities. - Buy online: Once you’ve found the right policy for you, you can usually purchase it online. Make sure to keep a copy of your policy for your records.

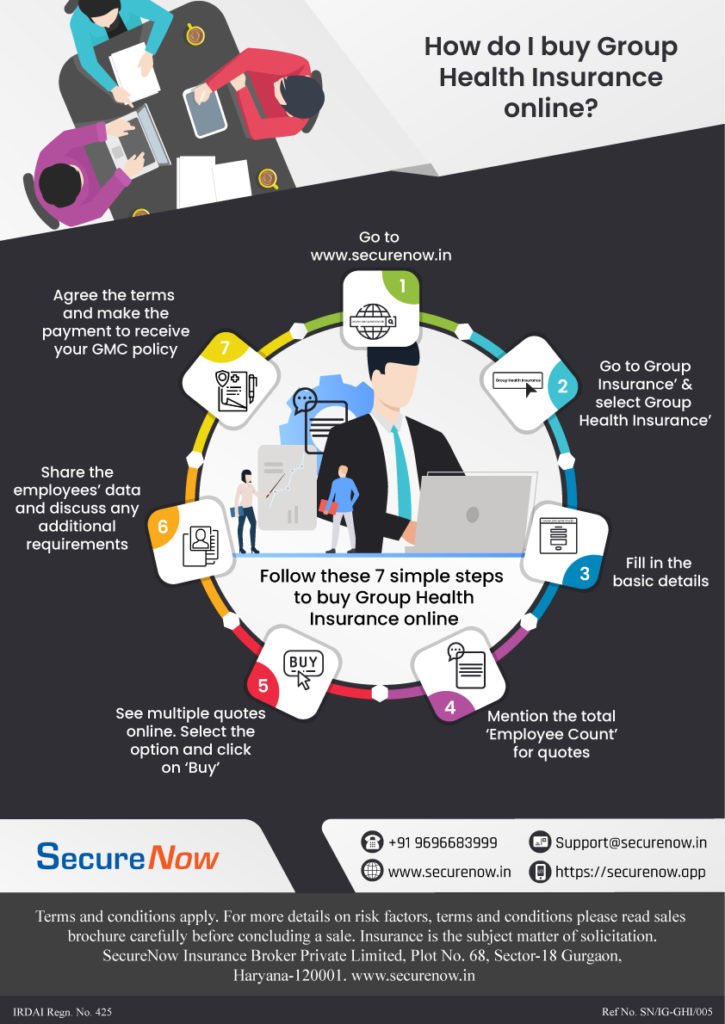

Group Health Insurance policy provides medical coverage to members of a group against unforeseen medical costs due to health issues. This policy can be availed Corporate Health Insurance online and offline. The below infographic explains the buying process of group health insurance online.

About The Author

Mayank Sharma

MBA Finance

He is a professional who brings extensive knowledge and expertise to the field of group health insurance. He has dedicated 7years to helping individuals and businesses navigate the complexities of insurance. Having worked closely with numerous clients and insurance providers, he deeply understands the nuances of group health insurance policies. With a reputation for providing insightful and informative content, he leverages his industry experience to educate readers about the importance of group health insurance and its benefits. Through their articles, Mayank Sharma aims to empower individuals and businesses to make informed decisions about their healthcare coverage, ultimately promoting healthier and more secure communities.