The age at which you should get health insurance and the cover size you will need

It’s a common perception, and one that is probably responsible for the vastly underinsured Indian population. Health insurance, people believe, is mostly required in old age or for critical illnesses like cancer and cardiac diseases. The rise in incidence of these illnesses and the escalating treatment costs have strengthened this belief. However, claims data from the health insurance industry dispels this notion. It points to the need for health insurance at a younger age. Besides, the rising future cost of treatment and list of ailments that account for the biggest share of claims serves as an indicator for the size of insurance you should have as well as the illnesses you need to cover.

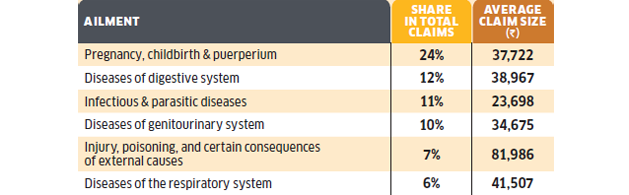

Most common ailments

Buy basic health plans

The need for basic health plans in your insurance portfolio is clearly indicated by the industry data. According to the ICICI Lombard claims figures, digestive, genitourinary and infectious diseases accounted for over 45% of all claims in 2018-19 in terms of volume. For Bajaj Allianz, fever of unknown origin, infectious gastroenteritis, classical dengue fever and cataract accounted for the maximum number of claims. Fever and infectious diseases comprised 30% of all Royal Sundaram General Insurance’s claims.

So, while critical ailments can place a huge financial burden on families, it’s the relatively unheeded diseases that you are likely to contract, emphasising the indispensability of regular health covers. Such illnesses can also recur during a policy year and more than one family member can contract these in a year. Infections figure in five common ailments across most age groups, as per the data from Securenow. in, an insurance advisory firm (see Biggest claims for different age groups). In fact, injuries, along with digestive and infectious diseases, account for one-third of the total claims, pointing to the drain on resources resulting from non-critical ailments.

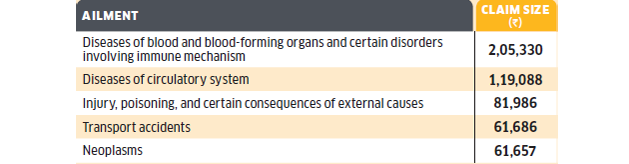

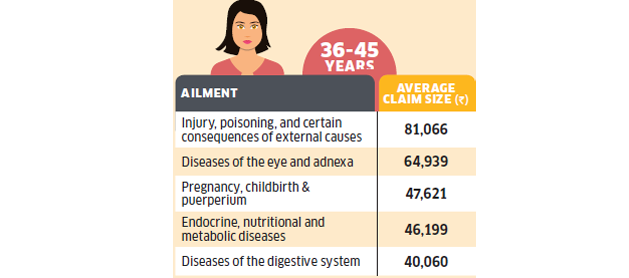

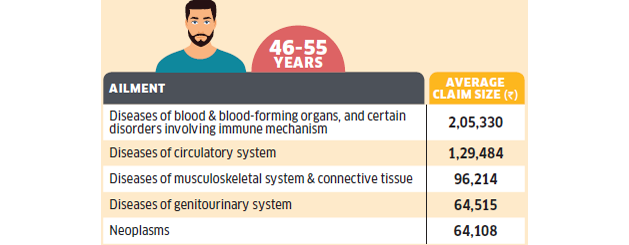

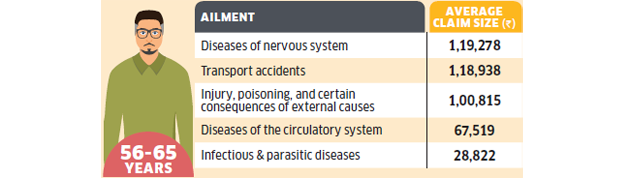

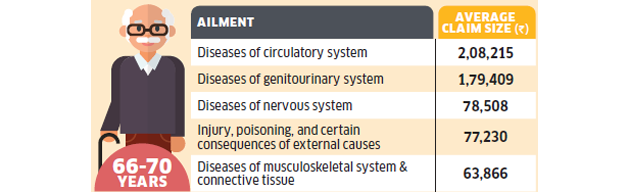

Ailments with highest claims

Source: Securenow.in

Neoplasms are essentially cancers (benign or malignant); diseases of circulatory system include heart ailments, stroke, hypertension, etc; musculoskeletal diseases include arthritis, joint and spine issues, etc. For financial year 2019-20; up to 31 August 2019 | Claim base: 531

Moreover, the average claim sizes of common ailments that are not seen as life threatening or terminal in nature, show that the financial dent they can cause is significant (see Most common ailments). In fact, for those over the age of 65 years, musculoskeletal disorders, such as osteoporosis, spine issues, and joint replacements, entail higher spends than even cancerrelated procedures. As per ICICI Lombard, against an average claim size of Rs 77,000 for cancer treatment, the average payout for musculoskeletal disorders was Rs 1.26 lakh in 2018-19.

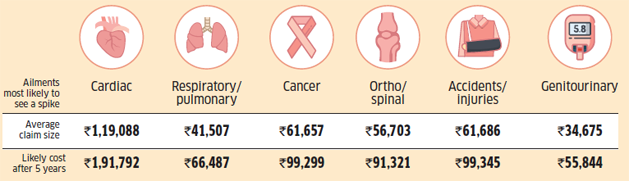

Ailments likely to see the steepest rise in incidence

Data for spike in ailments is based on forecast by ICICI Lombard, Bajaj Allianz, SBI General, Royal Sundaram and Religare Health. Average claim size data from Securenow.in. Healthcare inflation assumed to be 10%.

Insure at a younger age

In India, many tend to wake up to the need for health insurance only as they grow older and contract lifestyle diseases. “Many do not feel the need for a health cover, while others assume that their employers’ group medical covers are adequate,” says Kapil Mehta, Founder and CEO, Securenow.in.

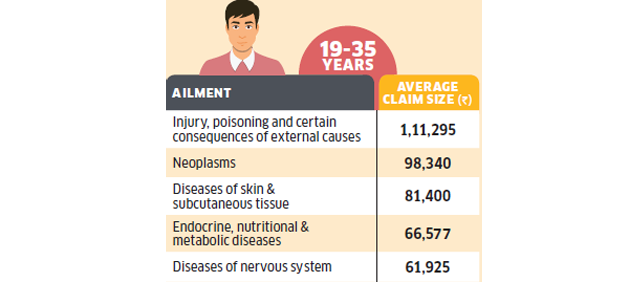

Biggest claims for different age groups

For financial year 2019-20; up to 31 August 2019. Claim base: 531. Source: Securenow.in

Policyholders in the 19-35 year category account for nearly 43% of total claims for injuries and poisoning, an expense category completely unrelated to age. They also account for around 42% of the infectious diseases claims.

Another major cause of claims by youngsters is accidents. “Customers under 25 years of age have higher tendency to meet with accidents. This age group comprises 30% of accidental claims, with an average claim size of Rs 55,000,” says Nikhil Apte, Chief Product Officer, Health Insurance, Royal Sundaram. If a health cover seems expensive, given the relatively lower income at a younger age, buy cheaper personal accident policies that cover hospitalisation, compensation in case of disabilities, and loss of income.

Common ailments in younger age groups—26-35 years and 36-45 years—also include genitourinary ailments, otherwise associated with senior citizens. “Younger and working population is exposed to external environment and public facilities, unlike people in older age groups who are largely at home. We do not view infections as an age-related problem,” says Sanjay Datta, Chief, Underwriting, Claims and Reinsurance, ICICI Lombard. “Younger individuals are vulnerable to infectious diseases as they tend to step out more often than those in the older age groups. However, younger individuals rarely buy independent health covers proactively,” says Mehta.

Buying insurance early also ensures that pre-existing diseases, which come with a four-year waiting period, are covered when claims arise.

Consider future costs

Most insurers predict a spike in respiratory diseases, cardiac diseases, musculoskeletal disorders, cancer, accidents and genitourinary ailments in the next five years (see Ailments likely to see…). “We have seen a sudden hike of100% in pulmonary-related ailments in the past two financial years. The most common ailments in this category are lower respiratory tract infection, pneumonia, bronchitis and asthma. This shows the effect of rising air pollution and poor air quality in most parts of country,” says Apte. Due to sedentary lifestyles, incidence of ortho-related ailments like arthritis and joint replacements is also expected to rise.

Cancer and heart ailments, which figure among the top five money guzzlers, will attract even higher expenses in the future as medical advancements boost chances of cure and management. Hospitalisation costs apart, you also need to factor in recurring expenses over the long term. For instance, the cost of follow-up checkups after cancer treatment can go up to Rs 15,000 per test. Depending on doctor’s advice, you might have to go for these tests quarterly or annually. In case of heart ailments, follow-up visits can rack up bills of up to Rs 1,000 per visit. CT Scans could cost Rs 10,000-15,000 per year. In case of organ transplants, monthly expenses related to immuno suppresants, steroids and supplements can amount to Rs 5,000 per month.

The optimum cover

Newer ailments, higher cost of hospitalisation and long-term care expenses necessitate an adequate health insurance portfolio. Yet, health insurance penetration in India remains low. “Health insurance is typically used as a tax-saving instrument rather than a risk coverage option. However, this mindset is changing among millennials, who are exploring the risk cover aspect,” says Sukhesh P. Bhave, Head, Accident & Health Claims, SBI General Insurance.

Despite growing awareness, the average sum insured across companies continues to be around Rs 3.5-5 lakh. “Most major illnesses will easily wipe out a sum assured of Rs 3-4 lakh. Therefore, along with a basic individual health insurance policy worth Rs 5 lakh, one must consider buying a super top-up policy,” says Bhaskar Nerurkar, Head of Health Claims, Bajaj Allianz General Insurance. Top-up policies take care of expenses after the basic health insurance policy’s sum insured is exhausted. Apte recommends a cover of at least Rs 10 lakh. “Due to medical advancements, Indian hospitals are now fully equipped to perform complex treatments, such has organ transplants, bypass surgery and cancer treatment. It is important to have adequate sum insured to take advantage of such facilities,” says Apte.

A family of five, where the eldest member is 40 years old, can start with a basic cover of Rs 5 lakh and enhance it every five years after a review. A critical illness policy can come in handy to fund long-term recovery, rehabilitation and lifestyle modification expenses because such products hand out a lump sum on diagnosis. Alternatively, you can create a dedicated health fund over a period of time to take care of supplementary expenses. The priority, however, should be to have a full-fledged base health cover, while addons can be included depending on your income and the premium you can afford.