In the intricate world of healthcare, finding the right price for a Medical Establishment’s Professional Indemnity Policy is paramount. Join us in this enlightening infographic as we dissect the factors that determine the ideal cost, ensuring comprehensive coverage without breaking the bank. The right price for a Medical Establishment’s Indemnity Policy balances coverage and affordability, ensuring comprehensive protection within budget constraints.

There are various insurance companies in India which offers professional indemnity insurance for medical establishments at different premiums. In this insightful infographic, we unravel the key factors that determine the right price for a Medical Establishment’s Indemnity Policy. Explore medical indemnity insurance, balancing coverage and budget.

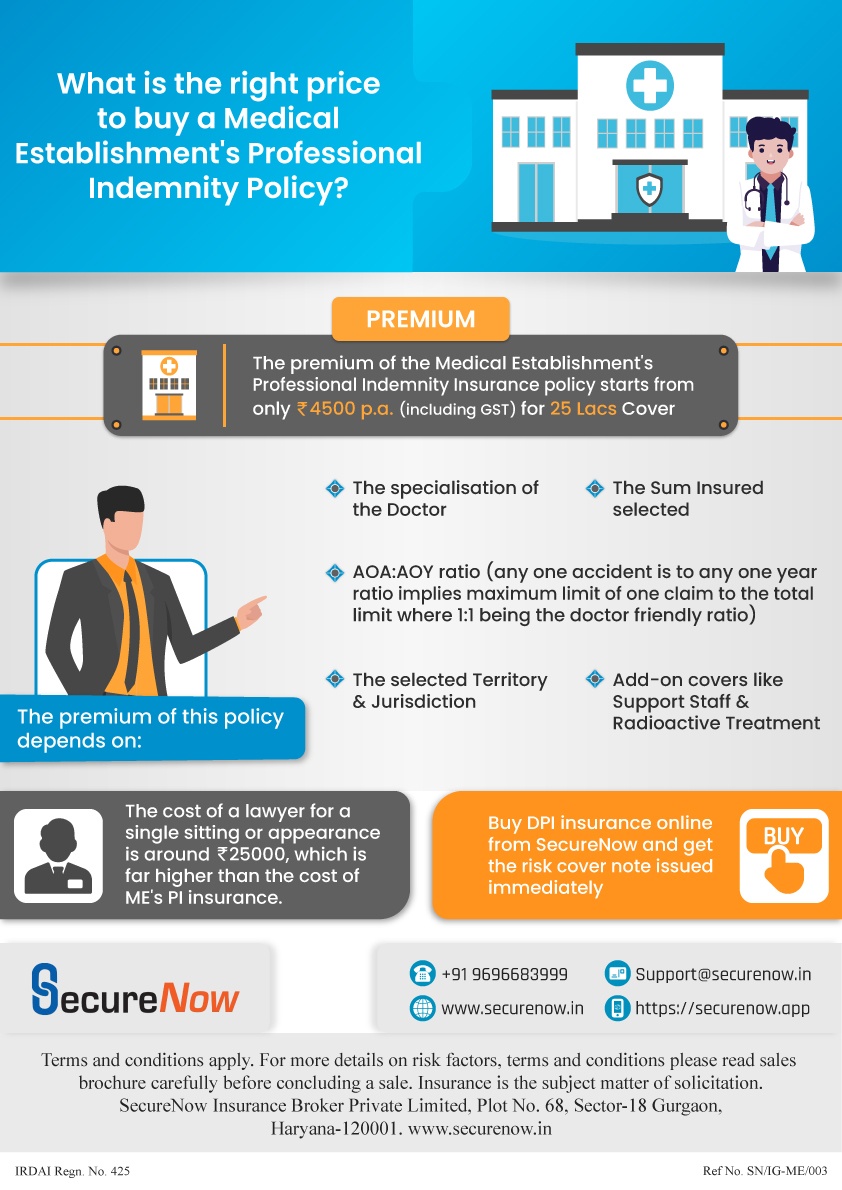

A few factors to consider when determining the right price to pay for a doctors professional indemnity insurance policy include the:

- Size of the medical establishment: Establishment size (number of employees) affects insurance cost. Larger establishments will typically require more coverage and therefore a higher premium.

- Type of medical services provided: The type of medical services provided by the establishment will also impact the cost of the insurance. Some types of professional indemnity insurance in India may be considered riskier and therefore cost more to insure.

- Coverage needs: Consider the specific coverage needs of the medical establishment. Do you need coverage for claims related to medical errors, treatment injuries, or HIPAA violations? The more coverage you need, the higher the premium will be.

- Deductibles: Opting for higher deductibles lowers premiums; however, it’s vital to select a deductible that suits the establishment’s claim affordability.

It is important to shop around and get quotes from multiple insurers to find the best price for the coverage your medical establishment’s professional indemnity.

Below infographic explains various factors which affects medical establisment’s professional indemnity insurance premium and also the right price to buy the policy. Once can get great deals when buying doctors professional indemnity insurance online from SecureNow.

About The Author

Sonal Singh

MBA Insurance and Risk

With six years of specialized experience in the insurance industry, Sonal has emerged as a leading expert in medical establishments insurance. As a dedicated writer for SecureNow, she creates insightful and informative blogs and articles that illuminate the complexities of insurance tailored for medical institutions. Throughout her career, Sonal has developed an in-depth understanding of the unique risks and insurance needs of medical establishments, from hospitals and clinics to specialized medical practices. Her expertise allows them to break down complex insurance concepts into clear, practical advice, making their content invaluable for healthcare providers seeking to protect their operations and assets.