Published in Mint on 9th January, 2018.

Last month two important news items broke in the life insurance space. One was about misselling in the and the other was about consumer losing money due to high exit penalties. The case of misselling was reported on thewire.in. It said Rajasthan Police is investigating a case where bank officials allegedly sold insurance policies to customers who wanted to invest in fixed deposits.

Such a crime can hit you hard because, while fixed deposits are one-time investments and can be withdrawn by paying a penalty on the interest; regular premium life insurance policies need you to keep paying renewal premiums, else you can lose all the money. This is where the second news becomes relevant. In January 2017, the Insurance Regulatory and Development Authority of India (Irdai) constituted a committee of insurers to look into product regulations and recommend reforms. Its report was published in December 2017 and one of its concerns was high surrender cost in traditional plans, which bundle investment with insurance. “About 61% of the policies don’t stay till the end of 5 years, and with nearly 80% of the industry’s product mix sold in traditional product category, this (heavy surrender charge) has put industry’s reputation at risk affecting the viability of the business,” the report said.

However, as per the report, most insurers said that it wasn’t viable to reduce the surrender charge (exit load). Though the committee, in principle, favours reducing surrender costs, it put both points of view on the table. But why is reducing surrender costs important? To understand this, let’s look at the surrender charges in traditional plans.

Exit penalty

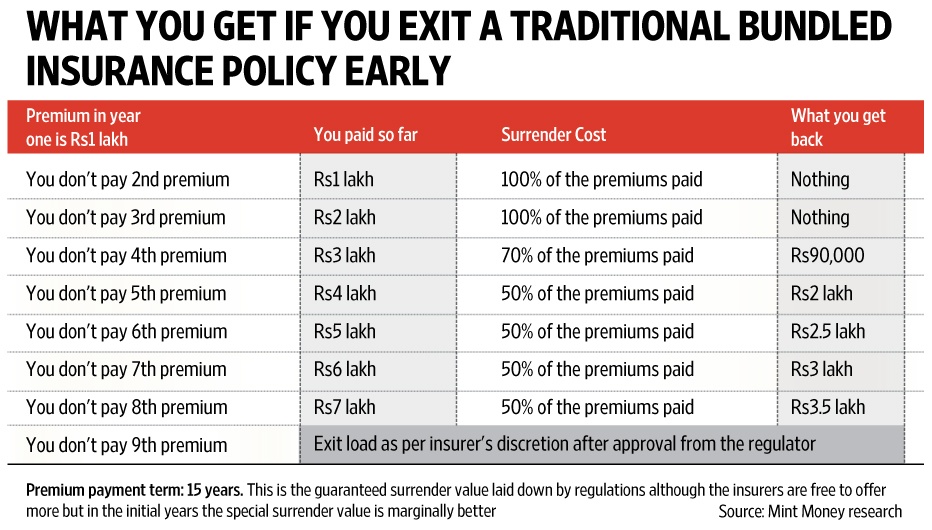

Irdai has defined the maximum that an insurer can charge for exiting a policy midway. For traditional policies, it depends on the premium payment term, but the exit load is 100% in initial years. There is no surrender value if at least 2-3 annual premiums have not been paid. If the policy’s premium payment term is more than 10 years, it acquires a surrender value after three annual premiums are paid. If you surrender a policy before that, you don’t get anything. If you surrender after 3 years, insurer has to pay back 30% of the total premiums: so the surrender charge is 70%. If premium paying term is less than 10 years, the policy acquires a surrender value after two annual premiums are paid and the guaranteed surrender value of 30% of the total premium is payable. Between fourth and the seventh year, in both cases, the surrender value is 50% of the premium paid. After seventh year, the insurer has to file a surrender charge and get it cleared by Irdai.

The exit penalties, said Kapil Mehta, co-founder, SecureNow.in, are very high and need to come down. “One can argue that high exit barriers encourage people to stay in a long-term product, but that’s a flawed model. To encourage people to stay in the policy, the industry needs to improve the return on investment on traditional plans, which is around 2-5%, and not through heavy surrender penalties. Penalties can’t be so high that they take away a huge portion of the capital of policyholders,” he said.

Ways to increase persistency

The committee report has not given a decisive recommendation to lower surrender costs. But given the poor persistency levels—more lapsation means more people pay huge surrender costs—and the fact that unit-linked insurance plans (Ulips) have capped the penalty to a bare minimum, the report is in favour of decreasing the surrender costs gradually. To this end, it has proposed two methods. The first recommends splitting risk and investment premium so that the first year premium or a large part of it can be utilised towards cost of mortality cover for the entire term, distribution costs and other expenses; while the subsequent premiums are earmarked for investment purposes. This way, high exit penalty is confined only to year one, but if you pay the second instalment then after a lock-in of 5 years, the second premium is refunded in full. Also, as you have paid for the insurance upfront, you would retain the risk cover through the policy term.

The second method comes with a longer waiting period but refunds 50% of the first-year premium and 100% in case of surrender in any subsequent year, but after a waiting period of 10 years. The committee recommends gradually decreasing this period to 7 years. In this case, risk cover is not available. According to Deepak Mittal, managing director and chief executive officer, Edelweiss Tokio Life Insurance Co. Ltd, there is merit in increasing the surrender value for customers “but it needs to be carried out in a phased manner.” The reason for high exit penalty in initial years is the acquisition cost that insurers incur. “However, one can explore returning the premium after a lock-in or on death or maturity,” he added.

The report also recommends streamlining the existing rules on surrender. For instance, it suggests a smooth progression of surrender values. So, instead of getting back 30% in the third year and 50% in fourth, it suggests a smooth progression of 30% of surrender value in year three, 35% in year four and so on. But this, for the customers, means higher penalty rather than lower.

What this means for you

Even under the two methods proposed by the committee, you would end up losing a substantial chunk of the first year premium. Whether the regulator moves to lower the costs, for you a high first-year exit penalty means you need to be careful. Our advice is to keep it simple and buy a term plan for your insurance needs. If you must buy a bundled plan, make sure you understand the product well and the kind of commitment it needs from you.