Professional indemnity insurance for medical establishments offers wide coverage to hospitals and clinics for claims made by patients for medical negligence. This policy offers coverage for defense costs, court fees, and settlements. Therefore, the importance of Indemnity insurance for Doctors in medical facilities is critical.

Doctors Professional indemnity insurance is a type of liability insurance that protects a wide range of professionals, including medical establishments, any errors or omissions in their work or against claims of negligence. It also covers legal costs and damages awarded in the event that a client sues for alleged professional wrongdoing. Professional indemnity insurance is a must-have for medical establishments as it can protect the insured against costly court-awarded damages. It ensures the financial stability of the medical services and business operations.

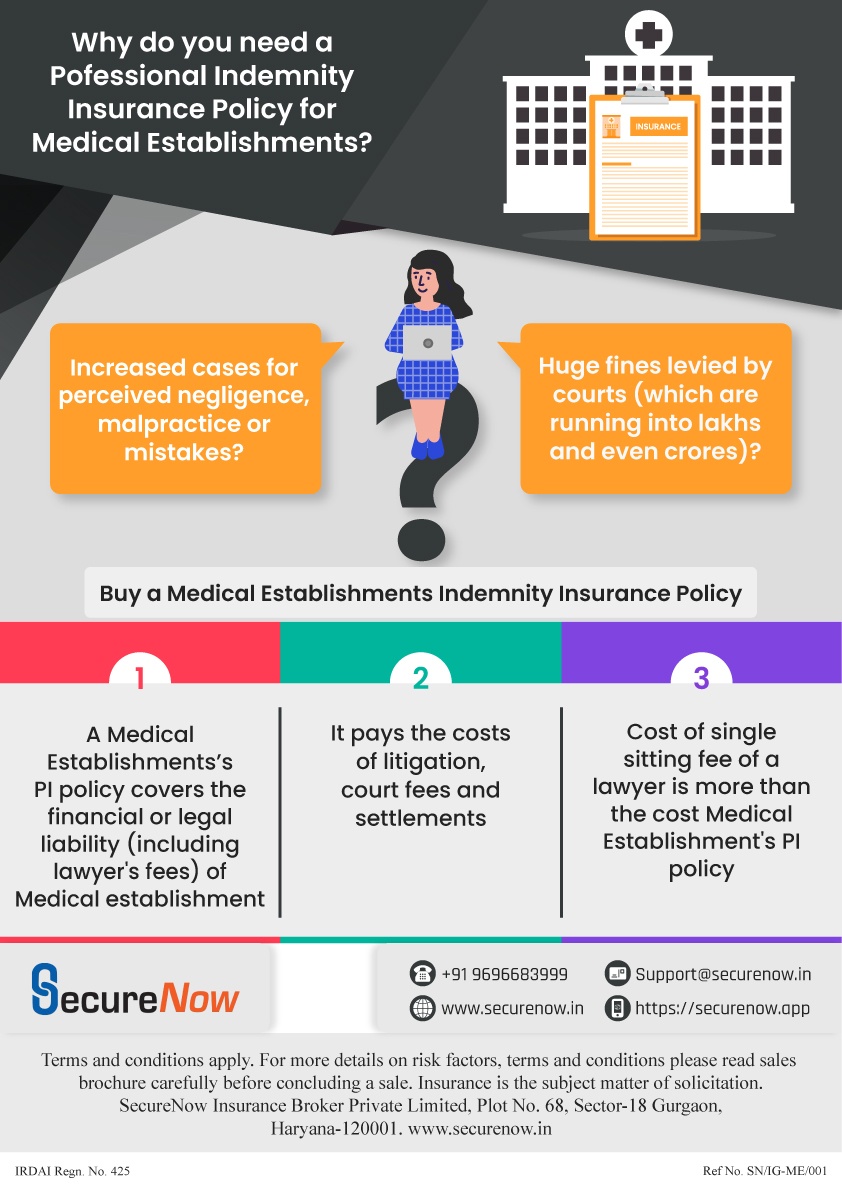

We highlight the key reasons why doctors require professional indemnity insurance:

With increased consumer awareness levels, patients today are very assertive and can sue doctors for any perceived negligence, malpractice, or unintentional mistake. Courts have also been imposing fines on doctors, ranging from lakhs and even crores. Professional indemnity insurance for doctors covers the costs of litigation, court fees, and settlements. This medical malpractice insurance even includes coverage for lawyers’ fees, fines, and out-of-court settlements.

The below infographic explains the importance of Indemnity insurance for Doctors in Medical Facilities and they should consider buying professional indemnity insurance for them.

Make an informed decision and secure Indemnity insurance for Doctors in your medical establishments. For any queries, reach out to us at +91 96966 83999 or email us at support@securenow.in. Trust SecureNow for the best professional indemnity insurance in India that safeguards your establishment against exorbitant claims.

About The Author

Sonal Singh

MBA Insurance and Risk

With six years of specialized experience in the insurance industry, Sonal has emerged as a leading expert in medical establishments insurance. As a dedicated writer for SecureNow, she creates insightful and informative blogs and articles that illuminate the complexities of insurance tailored for medical institutions. Throughout her career, Sonal has developed an in-depth understanding of the unique risks and insurance needs of medical establishments, from hospitals and clinics to specialized medical practices. Her expertise allows them to break down complex insurance concepts into clear, practical advice, making their content invaluable for healthcare providers seeking to protect their operations and assets.