Published in Mint on Apr 30 2015

Nitya Narayanan, a Thrissur-based 30-year-old school teacher, is planning to move to Saudi Arabia in June this year, with her four-month-old son and five-year-old daughter to join her husband there. Though she is looking forward to the move, she is worried about winding up things here. “Apart from the packing, there is so much to do. I also have to take stock of all the financial products,” said Narayanan.

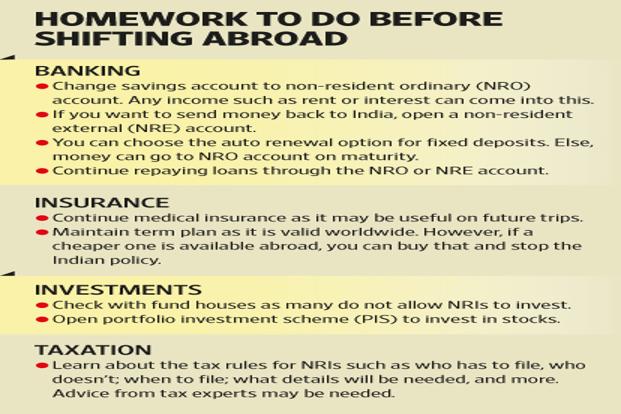

Here is a list of a few basic financial instruments that need attention before and after you leave if your residential status will eventually change to non-resident Indian (NRI).

Banking

Since banks are where most of an individuals’ transactions take place, we will start here. Make a list of all the products that you have with banks.

Savings account: If you are expecting some income to be generated in India, such as rent, dividend, interest, or others, these will have to be deposited into a non-resident ordinary (NRO) account. So, you need to convert your savings account to an NRO account. “Inform the bank about you moving to another country. The conversion happens as soon as you do so,” said K.A. Babu, head-retail business, Federal Bank Ltd.

If you want to send money back to India after moving, you will need to open a non-resident external (NRE) account. “You can open this account even before leaving the country, based on your visa and work permit. You will have to submit a self-attested copy of your work visa with the application form informing your residential status change,” said S. Sampath Kumar, head-NRI banking, HDFC Bank Ltd. You will also have to submit documents to become know-your-customer (KYC) rules compliant. “Once the KYC is done, it takes 24-48 hours for an NRE account to get activated. Interest earned on this account is not taxable,” said Babu.

Process to open NRE and NRO accounts (both are rupee accounts) varies across banks.

Fixed, recurring deposits: Check the maturity dates. Some banks give a default auto renewal option. Others credit the money into your account. What about recurring deposit? “Monthly investments can continue from your NRO account,” Kumar said. Remember to check the details of the bank where the amount is expected to be credited. You don’t want to shut it and then realize that on the fixed deposit’s maturity, the money had to be credited here. Also, if a recurring deposit is ongoing, make sure that there is sufficient money in the required account to fund the instalments.

Loans and credit cards: You can continue repaying loans through the NRO or NRE account. In case of credit cards, you can either surrender them or maintain for future visits in India. “Many are not aware that credit card bills can be paid only through an NRO account and not an NRE account,” said Kumar. Also, it’s better to not use the Indian credit card abroad due to the costs attached to overseas expenses.

Insurance

It is imperative to have insurance irrespective of where you live. “If you are moving abroad, continue your medical insurance in India. This is because though medical insurance taken in India is valid only here, it may be helpful if you plan to come back or are here on a trip,” said Rahul Aggarwal, chief executive officer, Optima Insurance Brokers Pvt. Ltd.

With life insurance, you can either continue with the existing term plan or discontinue it after you buy one in the new country of residence. “Once you start getting regular income aboard, you can opt for a term insurance plan there. Generally, term plans are cheaper overseas. In places such as Europe, Singapore and Dubai, the premium for term plan is 20% cheaper than in India. Once the term cover gets activated, you can discontinue the life cover that you bought in India,” said Aggarwal. “In the US, premium for term plans are 30-40% cheaper. Term plans are valid is all countries no matter where you bought it,” said Kapil Mehta, managing director, SecureNow Insurance Broker Pvt. Ltd. Do remember that you will have to take a mediclaim in that country as well.

“If you have a property in India, continue with the home insurance,” said Mehta.

Investments

This is another area where you may have multiple products— mutual funds, stocks, small savings, bonds, and others. Here’s how these will be treated for a person moving abroad.

Mutual funds: Update your KYC because “for a change of address, this is required,” said Srikanth Meenakshi, co– founder and chief operations officer, FundsIndia.com. Ongoing systematic investment plans can continue with money from an NRO account. “But do remember that not all fund houses allow you to invest from abroad when your status changes to NRI. For instance, if you are going to Canada or the US, many fund houses will ask you to redeem the entire investment. But some allow you to hold,” added Srikanth. Since rules differ across fund houses, it is better to check with each to avoid a rude shock later.

Small savings: If you have invested in Public Provident Fund (PPF), you can continue the existing account. “But as an NRI, you won’t be able to open a new PPF account, for example,” said Anil Rego, a Bengaluru-based financial planner.

Shares and bonds: “You can invest or trade in stocks only through the portfolio investment scheme (PIS) of the RBI (Reserve Bank of India). If you have all the documents, then we take 48-72 hours to name and tag your account as PIS,” said Kumar. The time taken to open PIS account and transfer the existing shares can vary.

If you have corporate fixed deposits and bonds, you can continue holding them till maturity. Ensure that you have completed the procedure so that the maturity amount gets routed to your active NRO account.

Taxation

Tax rules for resident Indians and NRIs differ in some ways. Therefore, learn about them before the transition. If you have many assets, you may need to take the advice of tax experts.

“Though there may be higher tax deducted at source on investment products for NRIs, tax liability is the same for residents and NRIs. There are benefits on certain categories of interest income depending on tax treaties,” said Gautam Nayak, chartered accountant.

Some of the basic rules that you should be aware of are that the way you are taxed depends on your residential status based on the number of days spent in India or abroad. There are two categories. One, if you are in India for more than 182 days during the financial year. Two, if you are in India for 60 days or more during the year and 365 days or more during the previous four financial years. In both these cases, you will be regarded as a tax resident of India.

You should be aware of these rules in advance so that you know when to file tax return (when there is taxable income in India) or disclose details of assets. “There are beneficial provisions in Indian tax laws for NRIs, which can be used,” said Rakesh Nangia, chartered accountant and managing partner, Nangia & Co.

Also, before leaving India, you may need clearance from the tax authorities. “Depending on whether the individual is domiciled in India or not, she may be required to obtain a no-objection certificate from the tax authorities in India in the prescribed forms (30B or 30C),” said Nangia. The certificate proves that taxes have been paid.

You may also have to file return of income to show details of assets abroad. “Irrespective of whether you have taxable income or not, from financial year 2012-13, every resident and resident not ordinarily resident (RONR) having any asset (including financial interest in any entity) located abroad or signing authority in any account located abroad has to furnish a return of income disclosing details of such assets,” said Nangia. The return of income can be filed online through the income tax website.

These are some of the money matters that have to be taken care of before moving abroad. Be aware and informed of the effect the shift will have on your money, and at least this part of the transition will be smooth.