Directors and officers of any company hold responsible and powerful positions and the decisions of these key personnel can impact every aspect of their firm or business. These key decision-makers are often personally held liable for any alleged breach of duty or negligence. Over the last years, many IT companies have grown to achieve large scales of operation and turnover in India. IT company key decision-makers face a variety of challenges related to cybercrimes, shareholders, regulatory litigations, investors, talent management, cost management, competition, and customers. There can also be potential litigations against the entity itself. With challenges continuing to broaden, having an adequate amount of directors’ and officers’ liability insurance coverage can be the correct way to manage risk.

What is directors’ and officers’ insurance?

Directors’ & officers’ liability insurance offers liability cover for key decision-makers of the company to protect themselves against litigations that may result from their managerial decisions. D&O policy also provides coverage to the company for its liabilities towards reimbursing claims against directors and officers. The coverage is also offered to the entity itself in case of securities claims. Basically, directors’ and officers’ insurance is a complex policy with many layers. The policy can be customized based on the industry and the company-specific requirements.

Additional Read: Who are covered under directors & officers (D&O) liability insurance policy?

D&O insurance for IT companies

In today’s increasingly competitive environment, directors and officers of IT companies face some unique industry-specific risks and challenges. For a Tech company to evolve and cope with the competition, it is important to have a capable management team that can provide strong insights for business growth, capital investment, customer and employee management, etc. without having to worry about personal financial threats. Companies alone may not be able to reimburse the directors and officers when they face lawsuits due to some of their bold decisions. Hence, it is important to have D&O liability insurance coverage as a second line of defense to attract the best industry talents to take the company’s key decisions.

Additional Read: How D&O policy help you attract new talent?

Directors and officers claims in IT companies

Directors’ and officers’ claims may arise from various sources. As the technology industry is steadily growing and evolving to keep up with the competition, fresh challenges constantly emerge for key decision-makers. Here are some of the challenges faced by information technology companies’ key decision-makers that may lead to directors’ and officers’ claims.

- Changing regulatory landscape: As innovation is a constant thing for tech companies, the sector experiences many changes in the regulatory landscape which provide business opportunities but also result in new threats. IT companies’ key decision makers are required to make constant decisions to offer innovative products and find ways to meet customer needs in new ways each time. This requires the management to have strategic engagement with the regulators to work towards their goals. As regulations and policies can impact the performance and growth prospects of the company, key decision-makers need to take business decisions keeping in mind the regulatory changes and emerging policies. However, the decisions can have adverse impacts which can put directors and officers at great risk of regulatory claims. Having directors’ and officers’ insurance policies can be the ideal solution to protect the decision-makers and encourage them to take fearless business decisions.

- Cutting-edge competition: As the IT sector is experiencing a fast-paced growth environment, competition is on the rise. Every IT company needs to remain competitive to survive and grow. This promotes the key decision makers of the IT company to strategize newer ways to compete each time. This definitely exposes them to greater risk of directors’ and officers’ claims from the competitors.

- Cyber securities risk: Cybercrimes are constantly rising in the technology space. Cyber securities risks faced by IT companies are no longer treated as purely technical risks. Cyber securities breaches involving large companies that make headlines every now and then are considered to be the result of improper cyber risk management plans laid by the key personnel of the company. Hence, increasing cyber securities risk can put IT companies’ key decision-makers at legal risk.

- Securities class action: The rising trend of securities litigation in the IT sector has made it imperative for the key decision-makers of the company to have directors’ and officers’ insurance coverage. Securities class action lawsuits can come from investors against the directors and officers for not acting in their fiduciary responsibilities on grounds of breach of trust.

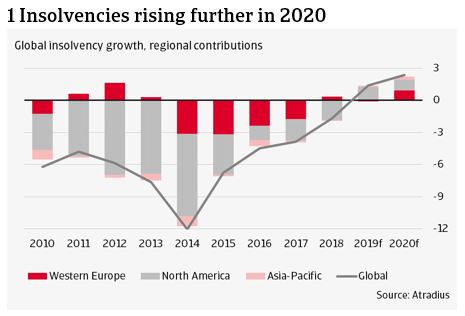

- Insolvencies: Elevated competition and the inability to produce newer products and offerings have triggered many insolvencies in the technology sector. With deteriorating profit margins and reduced demand i.e. sales, the sector has been experiencing an increasing trend of insolvencies as well. This puts the key decision-makers of the company at greater exposure to litigation risks. As per a recent economic research report by Atradius Group the insolvency rate is expected to accelerate throughout 2020 as a result of the COVID-19 outbreak.

Here is their projection chart

- Employment practices: Temporary business disruptions, restricted travel and the new ways of working needed in businesses during 2020 amid the COVID-19 crisis may lead to more serious problems in the near future. With the international market hard hit, IT companies need to prepare themselves for financial risks and other impacts due to the current situation. Some of these decisions can end up attracting employment practices claims such as wrongful termination and discrimination etc.

Managing and mitigating risk is the biggest challenge for the management of any company. With the global pandemic crisis, more specifically IT companies’ key decision makers are prompted to take some tough decisions in the year 2020 which will potentially expose them to a greater risk of litigation that can be highly expensive and long-running. Having adequate directors and officers’ insurance policy coverage can be a practical way to safeguard themselves.

About The Author

Rajesh

MBA Finance

With a wealth of expertise in the insurance realm, Rajesh is a distinguished writer specializing in articles focusing on directors and officers insurance for SecureNow. Boasting 9 years of experience in the industry, he profoundly understands the complexities surrounding directors and officers liability coverage. Their articles delve into the intricacies of D&O insurance, providing readers with invaluable insights into risk mitigation strategies and policy considerations. Renowned for their comprehensive knowledge and attention to detail, Rajesh is dedicated to delivering informative and engaging content that empowers individuals and businesses to navigate the complexities of insurance with confidence.