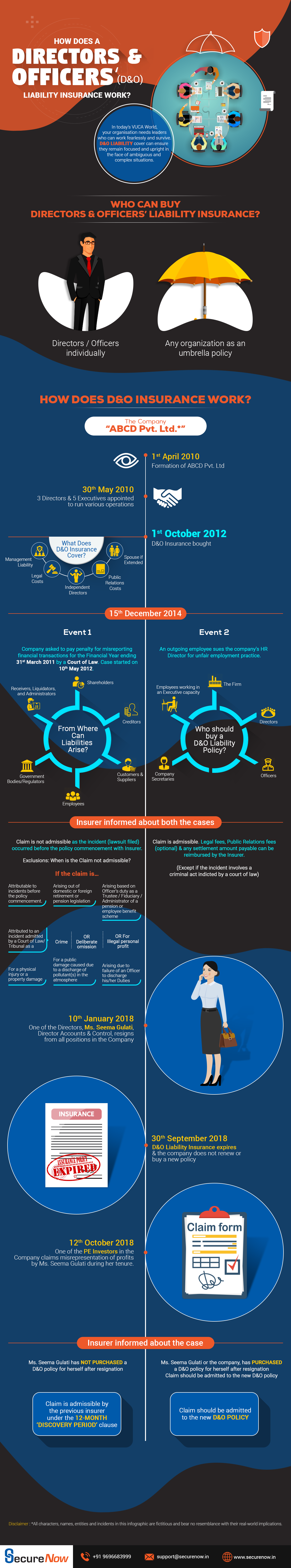

Directors & Officers Liability Insurance or D&O policy is a type of insurance that provides financial protection for directors and officers of a company in the event that they are sued for wrongful actions or decisions made in their capacity as corporate leaders. The policy covers the cost of legal defense, as well as any damages or settlements that may be awarded.

The directors and officers insurance typically covers both the company and its directors and officers, and may include coverage for securities claims, regulatory investigations, and derivative suits. It may also include coverage for criminal proceedings and fines. To purchase D&O insurance, a company typically works with an insurance broker or agent to assess the level of risk and determine the appropriate coverage. The premium for the policy is based on factors such as the size of the company, the industry in which it operates, and the level of risk involved.

When making a claim, the company or the directors and officers will have to show that the wrongful actions or decisions were made in good faith and not with intent to cause harm. The insurance company will then investigate the claim, and provide defense and pay any settlements or judgments. It is worth noting that D&O Insurance policies may have some exclusions, such as fraud, illegal acts, and other intentional wrongful conduct, so it’s important to read the policy and understand the scope of coverage and the exclusions.