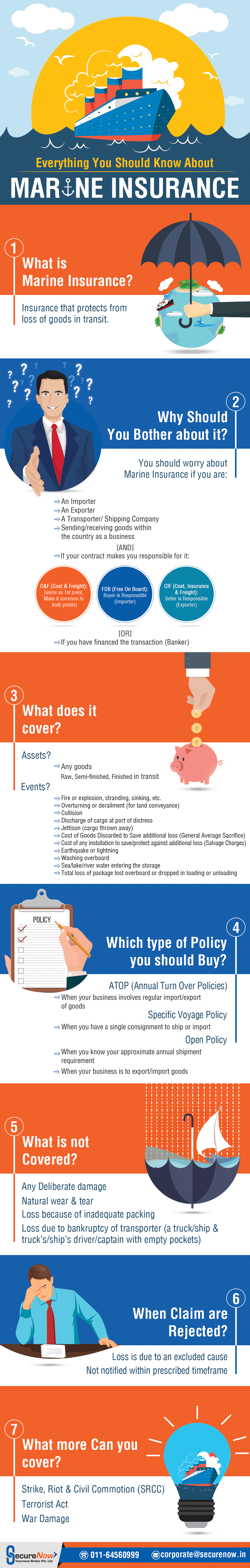

Marine insurance policy plays a very important role in safeguarding business interests of import export firms. See the infographic to know the type of covers available for different trade activities, the perils that such insurance will cover and not cover, and the add on perils that you can buy by paying an extra premium for complete protection.

Marine insurance or marine policy is a type of insurance that covers losses and damages to ships, cargo, and other maritime-related assets. It is designed to protect businesses and individuals that operate in the maritime industry. It covers losses caused by events such as storms, accidents, piracy, and even war. Marine insurance policies can be customized to fit the specific needs of the insured and can include coverage for the ship itself, as well as its cargo and any liabilities that may arise during transit. Policies can also include additional coverage for loss of profits, freight and demurrage. To obtain marine insurance, one typically needs to provide details about the ship, its voyage, and the cargo being transported. It’s important to work with an insurance agent who specializes in marine insurance to ensure you have the marine cargo insurance you need.

Marine insurance definition – It is a type of insurance policy that provides coverage for goods and vessels in transit by sea, air, or land. When it comes to buying marine insurance, there are different types of policies available in the market that cater to the specific needs of different types of businesses.

One of the most popular types of marine insurance is cargo insurance. This type of policy is designed to protect the goods being transported by sea, air, or land from damage, loss, or theft during transit. The coverage provided by cargo insurance can vary depending on the type of policy purchased, but generally, it covers risks such as fire, theft, and natural disasters.

Another type of marine insurance is hull insurance. This type of policy provides coverage for the vessel itself and its machinery and equipment against damage or loss caused by accidents, natural disasters, or malicious acts. Hull insurance is typically purchased by shipowners and is essential to protect their investment in the vessel.

Lastly, marine liability insurance is another important type of marine insurance. This type of policy provides coverage for third-party liability claims arising from the use of the vessel, such as damage to other vessels or property, personal injury, or environmental damage.

Marine insurance is typically purchased by individuals or businesses that are involved in marine-related activities, such as shipping, transportation, and logistics. This includes cargo owners, freight forwarders, ship owners, charterers, and marine contractors, among others.

Marine insurance provides coverage against a range of risks and threats that are unique to the marine industry, including damage to cargo, hull damage, and liability for environmental damage. It is especially important for businesses involved in international trade, where goods are transported across different countries and oceans.

In short, if you or your business is involved in any marine-related activities, it is important to consider purchasing marine insurance to protect yourself against the risks and uncertainties of the marine industry.

In summary, the type of marine insurance and corresponding marine benefits that one should buy depends on their specific needs and the nature of their business. Cargo insurance is important for businesses that transport goods, while hull insurance is essential for shipowners. Marine liability insurance is important for businesses that operate vessels and want to protect themselves from third-party liability claims. It is recommended to consult with an insurance expert to determine the most suitable marine insurance policy for your needs.

Click here to know more on – What is Marine Insurance?

About The Author

Simran

MBA Insurance and Risk

With extensive experience in the insurance industry, Simran is a seasoned writer specializing in articles on marine insurance for SecureNow. Drawing from 5 years of expertise in the field, she possesses a comprehensive understanding of the complexities and nuances of marine insurance policies. Her articles offer valuable insights into various aspects of marine insurance, including cargo protection, hull insurance, and liability coverage for marine-related risks. Renowned for their insightful analysis and informative content, Simran is committed to providing readers with actionable information that helps them navigate the intricacies of marine insurance with confidence.