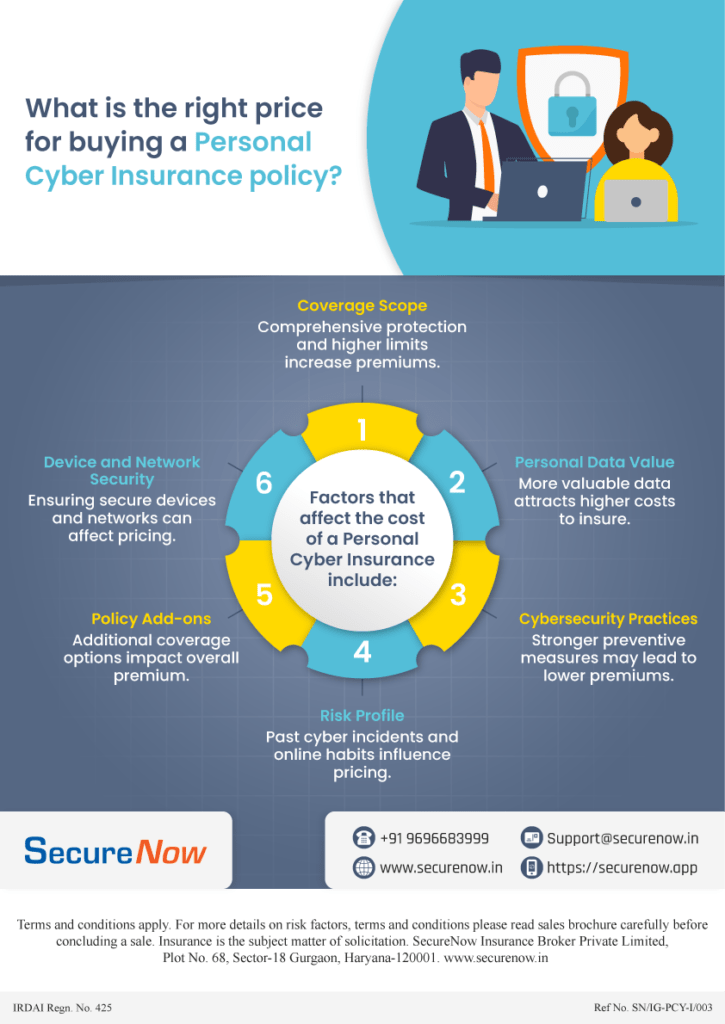

Unlocking the right price for your Personal Cyber Insurance or Personal Cyber Fraud Insurance is a balance between protection and affordability. Premium amounts for personal cyber insurance can vary significantly among insurers due to various contributing factors. In this infographic, we unveil the key factors that influence the cost of your coverage. Discover how to make an informed decision that shields your digital world without breaking the bank. What is the right price for buying a Personal Cyber Insurance policy?

Factors that affect the cost of a Personal Cyber Insurance include:

- Coverage Scope: The breadth of protection and higher limits you choose significantly impact premiums, offering greater security at a cost.

- Personal Data Value: Insuring more valuable data comes with higher premiums, reflecting the increased financial risk.

- Cybersecurity Practices: Implementing robust preventive measures, such as regular software updates and security protocols, can lead to lower insurance premiums.

- Risk Profile: Your history of cyber incidents and online habits influences pricing, with riskier behavior resulting in higher premiums.

- Policy Add-ons: Opting for additional coverage options, like ransomware protection or identity theft coverage, will affect your overall premium.

- Device and Network Security: Maintaining secure devices and networks can positively impact pricing, reducing the risk of cyber incidents and lowering premiums.

Thus, to keep personal cyber insurance premiums low, individuals can practice strong cybersecurity, choose coverage wisely, maintain secure devices, and adopt safe online habits while avoiding high-risk activities. A well-considered policy isn’t just about security; it’s also about savings. By tailoring your coverage to your needs, you can protect your digital assets effectively while keeping your budget intact. Invest wisely in a policy that offers peace of mind and financial prudence.

Should you have any inquiries or require assistance, please don’t hesitate to contact us either by dialing +91 96966 83999 or sending an email to support@securenow.in. We’re here to help.

The below infographic explains contributing factors that affect cost of personal cyber insurance policy:

Written By-

Karuna Sharma

MBA Insurance Management

She has a wealth of experience in the insurance industry, Karuna is a seasoned writer specializing in articles on personal cyber insurance for SecureNow. Drawing from 12 years of expertise in the field, she possesses a comprehensive understanding of the intricate landscape of cyber risks faced by individuals. Her articles provide invaluable insights into the importance of personal cyber insurance coverage, addressing the evolving threats in the digital realm and offering practical advice on mitigating risks. Renowned for their clarity and expertise, Karuna is committed to delivering informative and engaging content that empowers readers to protect themselves against cyber threats.