In our increasingly digital world, safeguarding your digital life is paramount. Welcome to our infographic guide on the crucial features of a Personal Cyber Insurance Policy or cyber risk insurance. We’ll explore the essentials you need to protect your online presence and financial assets. From data breach coverage to cyber extortion protection, let’s navigate the key aspects that ensure your peace of mind in the digital age.

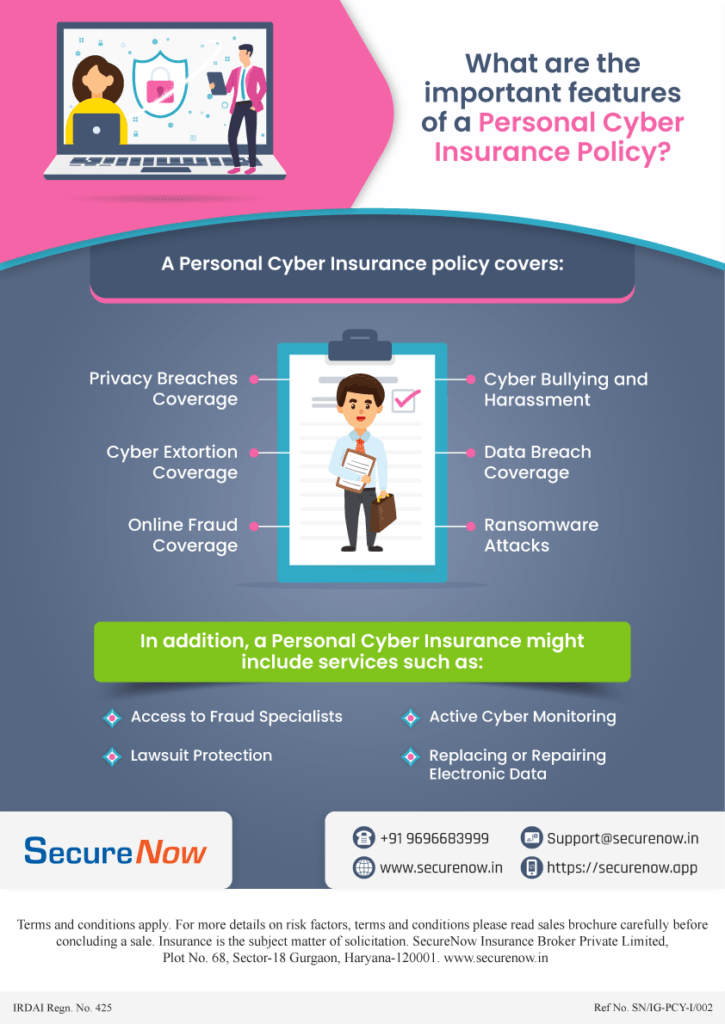

What are the important features of a Personal Cyber Insurance Policy?

A Cyber Risk Insurance covers:

- Privacy Breaches Coverage: Protects against privacy breaches and violations, offering support in case personal information is exposed.

- Cyber Bullying and Harassment: Covers incidents of online harassment and cyberbullying, providing assistance and legal support.

- Cyber Extortion Coverage: Safeguards against cyber extortion, ensuring financial support in ransom demands.

- Data Breach Coverage: Helps mitigate the financial consequences of data breaches, including notification and recovery costs.

- Online Fraud Coverage: Provides protection against online fraud, offering reimbursement for fraudulent transactions.

- Ransomware Attacks: Offers financial support and expert assistance in recovering from ransomware attacks.

- Access to Fraud Specialists: Grants access to professionals who specialize in fraud prevention and resolution.

- Active Cyber Monitoring: Monitors online activity for potential threats, enhancing early detection and prevention.

- Lawsuit Protection: Provides legal support and coverage for legal expenses in case of cyber-related lawsuits.

- Replacing or Repairing Electronic Data: Covers costs associated with replacing or repairing electronic data damaged or lost due to cyber incidents.

As you consider a Personal Cyber Insurance Policy, remember that tailoring features to your needs is essential. Prioritize what matters most, from identity theft protection to ransomware coverage, to maximize your policy’s value. Your careful selection ensures comprehensive coverage and effective defense against the evolving cyber threats we face today.

Make an informed decision and secure your Personal Cyber Insurance with the right features. For any queries related to insurance protection for cyber frauds in India, contact us at +91 96966 83999 or email us at support@securenow.in.

The below infographic explains important features of Personal Cyber Insurance, empowering you to make informed choices and safeguard your digital life effectively.

Written By-

Karuna Sharma

MBA Insurance Management

She has a wealth of experience in the insurance industry, Karuna is a seasoned writer specializing in articles on personal cyber insurance for SecureNow. Drawing from 12 years of expertise in the field, she possesses a comprehensive understanding of the intricate landscape of cyber risks faced by individuals. Her articles provide invaluable insights into the importance of personal cyber insurance coverage, addressing the evolving threats in the digital realm and offering practical advice on mitigating risks. Renowned for their clarity and expertise, Karuna is committed to delivering informative and engaging content that empowers readers to protect themselves against cyber threats.