A trade credit insurance policy is a robust insurance policy which has been specifically designed to secure the lifeblood of many companies— the sales ledger.

Nothing is sold until the payment is received by the seller. In a situation, where credit has been extended, however, customers are unable to pay within the agreed terms and conditions. It can have a serious impact on the finances then the non-payment could be due to factors. Like war, riot, terrorism, etc.; which may have prevented the buyer from making payment.

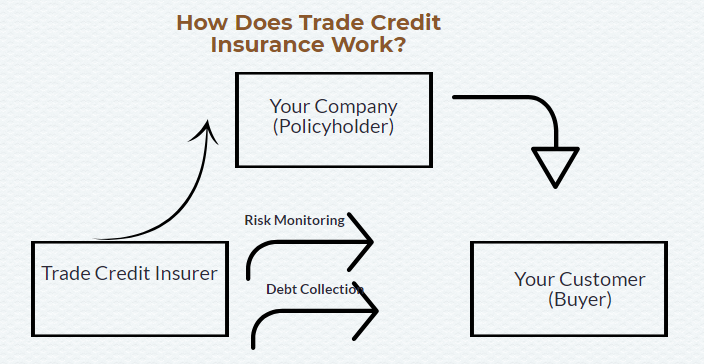

As non-payment of debt can greatly hamper your business finances, especially its working capital, here trade credit insurance can help. This insurance policy covers various risks of non-payments which may arise from both domestic and international trade. Here the insurer would pay for claims against the unpaid invoices. If your buyer can’t make payment, you will be insured and indemnified up to the limit as specified in the policy. In certain situations, the insurer can also arrange for the collection of debts, as per the need.

How do Trade Credit Insurance Policies work?

When you approach the trade credit insurance policy company, the insurer will make use of the standard actuarial techniques for assessing the risk and deciding premium. The insurer will consider various aspects like the size of the trade, claim history, trade sector of the insured, etc.; and gather information about buyers through different mediums like a public record, visit the customer’s office, receipt of financial statements, past due records, etc.

On basis of this assessment, the insurance company will decide credit limit for each buyer with whom the policyholder trades. It is the maximum credit limit which can be owed by a buyer at one point in time. You should stay away from extending credit to that company or buyer before the point, as it would be the maximum limit that you will be able to get on your credit insurance if they default. Here, the limit may vary depending on the buyer’s or company’s ongoing behaviour and fortunes. Some of the factors which can affect the premium of a trade credit insurance policy are:

- Number of customers you are dealing with

- Your trade sector

- History of bad debts

In most of the cases, the insurer keeps updating the policyholder with the information which they have uncovered about their customer’s financial decisions. It will assist them in making decisions about their ongoing dealings with them.

Read more: What Is Trade Credit Insurance Policy

At any point during the tenure of the policy, the policyholder can request for the additional coverage for trade concerning any of its buyer, if there is a requirement. Upon receiving the request for the additional coverage, the insurer will evaluate the risk of increasing the coverage and will either approve or refuse to extend the credit limit. Similarly, you can request a credit limit for a new customer with whom you are going to do business.

Which Businesses Should Buy Trade Credit Policy?

In the case of small business, a single case of buyer’s insolvency can have a serious impact on the finances, thus, bringing down their growth rate. Credit insurance gives protection against such catastrophic events. As a result, it’s essential for overall resilience of your company and the sector to have best trade credit insurance.

Larger businesses, on the other hand, may likely to extend long credit period to its different buyers. If one buyer defaults payment, the business may be able to absorb the losses, however, if multiple buyers do not pay money, it could have an adverse effect.

Trade credit policy is therefore important for all businesses that extend credit to its buyers. It could be the deciding factor in survival and sinking.

Having worked with businesses all sizes and types, SecureNow is a specialist when it comes to trade credit insurance policy. As such we can help you find the right kind of cover as per your business requirements.

About The Author

Anjali

MBA Finance

Anjali is a seasoned expert with 7 years of experience in the insurance industry. Specializing in Trade Credit Insurance, she brings a wealth of knowledge and insights to SecureNow’s blogs and articles. With a deep understanding of risk management and financial protection, Anjali is dedicated to helping businesses navigate the complexities of trade credit insurance. Throughout her career, she has been committed to educating and empowering business owners and stakeholders with practical advice and actionable strategies. Her writing is characterized by clarity, thorough research, and a passion for making complex insurance topics accessible to all readers. Whether you’re a small business owner or a large corporation, Anjali‘s articles are designed to provide you with the expertise you need to make informed decisions and safeguard your financial future.