Published in Mint on Apr 19 2016

What are the chances that a poorly understood and badly sold life insurance policy will run its course? Pretty slim, according to the life insurance industry experience in India. Poor selling practices—long-term policies being sold as short-term policies, lack of communication of policy benefits, poor understanding of costs, risks and returns and lack of comparison—have resulted in many customers choosing to cut losses by lapsing policies, which results in poor persistency metrics.

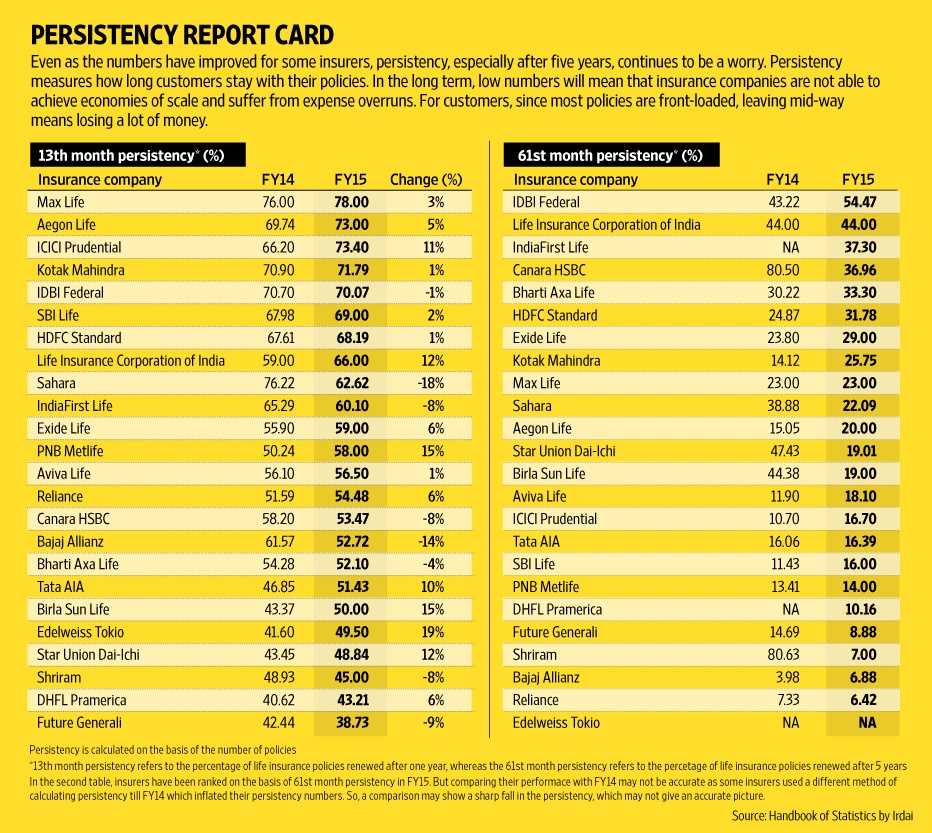

Persistency measures how long customers stay with their policies, by looking at the number of renewal premiums. According to figures of financial year 2015, as reported by the insurance regulator in its handbook of statistics, the industry, on an average, reported a persistency of 59% in the 13th month, i.e., after a year of sale. In other words, out of 100, just 59 policies got renewed. In fact, the average persistency for the 61st month is about 22%, which means by the end of the fifth year, only 22 policies got renewed.

India compares badly with the rest of the world. The 13th month persistency in member countries of Organisation for Economic Co-operation and Development is above 90% and about 65% for the 61st month.

For insurance, persistency is a key driver. So, a poor show hurts long-term prospects. “Depending upon the products and embedded surrender costs, insurers may make profits for the short term. But over the long-term, low persistency means not being able to achieve economies of scale and continued expense overruns,” said Sanket Kawatkar, principal and consulting actuary, life insurance (India), Milliman India Pvt. Ltd.

Poor persistency affects customers as well since insurance products are typically front loaded. So, if you discard it in a couple of years, you lose a lot of money (in traditional plans) due to high surrender costs.

Insurers don’t hold shoddy sales practices as the only reason for low persistency. Others, such as ticket size, also have an effect.

Method of calculation

Persistency ratio shows the leakages in year-on-year renewals of life insurance policies. It can be calculated both in terms of amount of premiums and number of policies. In its handbook, the Insurance Regulatory and Development Authority of India (Irdai) has considered the number of policies as it feels the persistency on premium gets skewed if one policy with a large premium gets lapsed. Leakages on account of death or maturity are not factored, but single-premium policies and paid-up policies are included. Single-premium policies don’t lapse since the money is paid upfront. A sizeable portfolio of these may give an insurer better persistency. But paid-up policies have a surrender value. These don’t lapse but are kept in force to the extent of the paid-up sum assured or reduced sum assured. But these categories dilute persistency numbers. “If you only look at policies that are due to get renewal premiums, persistency numbers will be sharper. Those that don’t need further payments don’t really reflect persistency,” said Vighnesh Shahane, whole time director and chief executive officer, IDBI Federal Life Insurance Co. Ltd.

Current rules dictate that persistency has to be calculated on an absolute basis. This method calculates the leakages of the policy from the base year or the year of sale. For instance, if the insurer sold 100 polices and 70 policies got renewed after a year or in the 13th month, the 13th month persistency would be 70%. After the second year or in the 25th month, if 60 policies got renewed then the 25th month persistency would be 60%.

Persistency reported in the handbook is of different cohorts of policies. The 13th month persistency represents policies sold a year back, 25th month persistency represent policies sold two years back and so on. Even as these are different cohorts, persistency ratios under the absolute method normally decreases in the subsequent years.

Report card

In terms of 13th month persistency, 16 insurers improved their track record in FY15 compared to 11 in FY14. But the average has improved by just a percentage point from 58% to 59% in FY15. “Performance gap is only increasing as some companies are focussing on improving their persistency intelligently. Even then, the overall numbers are not encouraging,” said Kapil Mehta, co-founder, SecureNow Insurance Broker Pvt. Ltd. “Since the industry has moved to selling traditional plans, poor persistency means that customers, despite high surrender charges, are willing to lapse policies. This indicates that customers are buying without understanding the product and the industry is still focusing aggressively on first-year sale,” he added.

We haven’t considered the weighted average, although that way the numbers will improve as they will tend to gravitate towards the persistency performance of insurers that have large market shares. For instance the Life Corporation of India (LIC), which has the highest market share, reported a 13th month persistency ratio of 66%, while this is 70% for some of the top private insurers (see table).

The picture is worse at 61 months. A back of the envelope average calculation shows that the industry was able to retain 22 out of 100 policies sold five years back, losing a huge 78 policies on the way. We haven’t compared these numbers with FY14 because in FY14 some insurers were still reporting persistency on a reducing balance basis. This method shows persistency to be better since it takes the previous year as the base. “Our 13th month persistency is improving, but why the 61st month remains low is because these were policies sold before February 2010. They were largely Ulips (unit-linked insurance plans), which, according to our experience, are not easily understood by customers. Further, we had a large proportion of third-party channels such as brokers and corporate agents who didn’t do a great job of explaining Ulips. But now we have changed our channel mix and product mix with over 80% of the business being traditional so our persistency should improve,” said Anup Rau, chief executive officer and executive director, Reliance Life Insurance Co. Ltd.

Insurers expect the 61st number to improve drastically in FY16. “Policies sold post-2010 (when product reforms kick started) have shown better persistency, which is evident in the improvement of 25th, 37th and 49th month persistency figures. The 61st month persistency still reflects policies that were sold before 2010. Hence, this will also improve after a year,” said Anuj Agarwal, chief executive officer and managing director, Bajaj Allianz Life Insurance Co. Ltd.

Why the low levels?

Other than the fact that customers do not understand their policies or buy them for the right reasons, insures attribute poor persistency to certain other parameters such as the ticket size. “We have observed that big tickets policies don’t tend to lapse as customers are more conscious of surrender costs. And given they are investing huge sums of money, they take time to understand the policies,” said Shahane. Insurers are, in fact, increasing their ticket size. “The average ticket size for private insurers is now Rs.35,000, which is a significant improvement from just Rs.14,000 four years ago. The increase will help improve persistency,” said V. Viswanand, senior director and chief operations officer, Max Life Insurance Co. Ltd.

Insurers such as Shriram Life Insurance Co. Ltd attribute poor persistency to the fact that it sells primarily to rural areas where ticket sizes are small and incomes irregular.

Frequency of premium payment also has a bearing. “The quarterly and monthly premium modes show poor persistency in comparison to the annual mode. Our annual premium policies have a persistency of 97%,” added Shahane.

According to insurers, age and incomes also have an impact. “Policies sold to those in mid-30s tend to be more persistent than the ones sold to someone in the 20s. Also, the degree of affluence is a factor. Those with income levels of more than Rs.10 lakh a year tend to be more persistent irrespective of the nature of product they have purchased,” added Viswanand.

What about the channel or product mix? “Whether it’s traditional plans or Ulips, persistency experience is typically the same. However, in the case of channel mix, the experience may vary only slightly. Banks tend to have long-term customers and are able to sell higher ticket sizes, so the persistency levels may be better,” said Subrat Mohanty, senior executive vice-president, HDFC Standard Life Insurance Co. Ltd. “We also sell health plans, which typically have lower persistency. That has impacted our overall numbers,” he added.

Industry response

Poor persistency has brought the focus on distribution. While some, including the Sumit Bose committee report on measures to curb misselling, recommend a flat commission structure—as opposed to front loaded, as is the case now—some think otherwise. “To make distribution more professional, one has to remunerate agents adequately at the time of sale. But there should be no room for indiscipline and distributors need to be penalised severely, which will, over time, weed out unprofessional distributors,” said Kawatkar.

The industry also needs to work on transparency and disclosures. “If traditional plans give 3-4% returns, it needs to be explained. Customers have to understand and distributors should be able to communicate the costs, benefits and risks of a policy,” said Mehta.

Poor persistency, among other things, reveals the fact that distribution has to improve. “Conventional distribution channels have a long way to go, but newer channels such as the online medium have good persistency. Contrary to popular belief that price wars has led to poor persistency of online terms plans, we have realised that if you give customers some value-add, they stay with the policy. Our online policies have a persistency of about 94%,” said Amit Kumar Roy, chief distribution officer, Aegon Life Insurance Co. Ltd.

Unless disclosures improve, you would be better off with policies that you understand well in terms of costs, risks, return expectation and exits, and are able to compare.