Published in Mint on May 11 2015

What would you call a product that is sold for 15 years but discontinued after just five? What would you call an industry that is unable to keep customers holding on to a product that was sold for the long term but is stopped midway? In India, we’d call this the life insurance industry, which is displaying signs of huge churn—losing customers on one hand, and trapping new ones on the other. A look at a single metric, which the insurance regulator releases, clearly points to large-scale malpractice in the industry. Here’s a closer look.

Life insurance is a long-term contract and the costs are built keeping this in mind. Costs of a 15- or 20-year product are front loaded on the assumption that the policyholder will stay the course for the full term of the policy. However, the latest persistency numbers released by the insurance regulator point out that the industry on an average is unable to retain even a third of its customers at the end of five years of a policy.

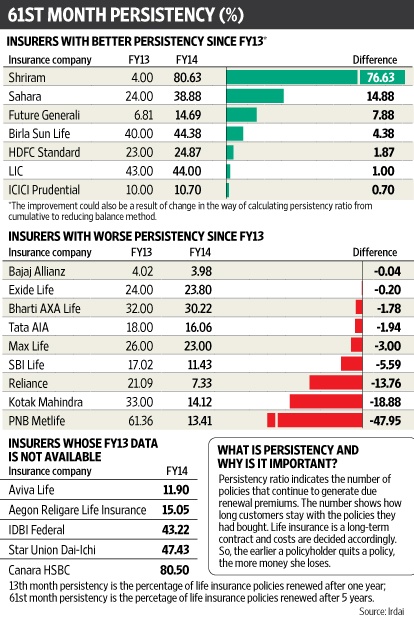

How long customers stay with their policies is determined by the persistency ratio, which indicates the number of policies that continue to generate renewal premiums that are due to be paid. The global level for 61st month persistency is around 65%. “Almost the entire industry has lower than 50% persistency in the 61st month. This means that half the policyholders left within five years. Internationally, this is over 65% on an average,” said Kapil Mehta, executive director, SecureNow Insurance Broker Pvt. Ltd.

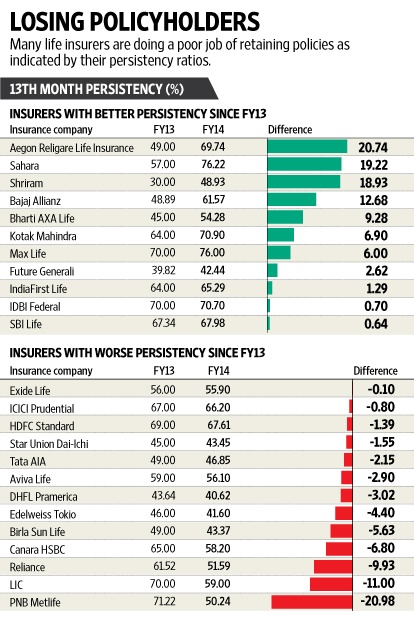

Even the 13th month persistency ratio doesn’t look promising. According to the latest handbook of statistics published by Insurance Regulatory and Development Authority of India (Irdai) for financial year (FY) 2014, persistency ratios for the 13th month fell for 13 of the 24 life insurance companies. “This is a concern because the 13th-month lapses are particularly costly for buyers, and this should have been on an upward trend by now,” said Mehta.

Poor persistency is primarily the result of policyholders surrendering or lapsing their policies midway. This behaviour is largely caused by poor sales practices followed by the insurance industry. “Poor persistency is mainly on account of lapses. A lapse occurs at the point of sale when a policy is mis-sold or bought with poor understanding,” said Vighnesh Shahane, chief executive officer and whole-time director, IDBI Federal Life Insurance Co. Ltd.

Before we discuss why life insurers in India are unable to retain policyholders, and what poor persistency means for you, let’s start with understanding how this ratio is calculated.

Persistency calculation

Persistency ratio shows the leakages in year-on-year renewals of life insurance policies and can be calculated both in terms of the amount of premium and the number of policies. Irdai, in its handbook of statistics, has looked at this ratio based on the number of policies because it believes that if persistency is calculated based on premium, the number gets skewed if one policy with a large premium gets lapsed. Leakages on account of death or maturity are not factored in, so this ratio primarily indicates leakages on account of lapse or surrender.

Insurers calculate the persistency ratio in two ways. The first method is to calculate persistency on a cumulative balance basis. This method calculates the leakages of the policy from the base year or the year in which the policies were sold. So, if the insurer sold 100 policies and 70 of these were renewed after a year or in the 13th month, the 13th month persistency will be 70%. After the second year, or in the 25th month, if 60 policies were renewed, the 25th month persistency will be 60%. If renewal after three years or in the 37th month is only for 50 policies, the 37th month persistency ratio will be 50%.

The numbers reported in the Irdai handbook are for different cohorts of policies. For instance, the 13th month persistency is of policies sold a year ago whereas the 61st month persistency ratio is of policies sold five years back.

Even as these are different groups, persistency ratios under the cumulative balance method normally decreases in the subsequent years, so the number for the 25th month will be lower than that for the 13th month. But there could be a minor variation. “It’s a possibility that persistency of 25th or 37th month may look better simply because these are calculated on different cohorts of policies—25th month being policies sold two years ago and 37th month being policies sold three years back. But this difference will be rather gradual on a cumulative balance basis,” said V. Viswanand, senior director and chief operations officer, Max Life Insurance Co. Ltd. “A sharp variation, especially upwards, could perhaps mean that the ratio is calculated on a reducing balance basis,” added Viswanand.

The other method—reducing balance—calculates the leakage from the preceding year and not from the base year. In the example taken earlier, the 13th month persistency will continue to be 70% but the 25th month persistency will be 85% as 60 of the 70 policies in the 13th month got renewed in the 25th month. Similarly, the 37th month persistency will be 83%.

The challenge with the reducing balance method is that it can show firms with poor performance in better light. For instance, in the example above, despite losing half the policies by the third year, the persistency ratio stands at 83%.

Insurers have used the reducing balance method to report persistency in the past and despite Irdai standardizing that the calculation should only be on cumulative balance basis, some insurers continue to report it on a reducing balance basis.

For instance, insurers such as Canara HSBC Oriental Life Insurance Co. Ltd and Shriram Life Insurance Co. Ltd have reported their persistency numbers on a reducing balance basis. “The directive was issued in January last year; reporting didn’t change till June. So, we have reported persistency ratio for FY14 in reducing balance. But, subsequently, we would be moving to the cumulative balance basis as directed by Irdai,” said John Holden, whole time director and chief executive officer, Canara HSBC Oriental Bank of Commerce Life Insurance Co. Ltd.

What the numbers say

Looking at the 13th month persistency ratios, a quick calculation of average ratios suggests that the industry has been able to retain just about 58% of the policies. Life Insurance Corp. of India (LIC), which has the largest market share, has retained only 59% of the policies. In fact, eight companies have not been able to retain even half the policies by the 13th month. The companies that feature towards the top have been able to retain only up to 76% of policies.

However, these numbers may not tell the complete truth. “Irdai has allowed insurers to factor in single-premium policies to calculate persistency, but this can distort the picture since single-premium policies don’t lapse as they are fully paid for. They will be reported as non-persistent only when they are surrendered. Insurers with a high percentage of single-premium policies may report a better persistency ratio. Hence, it is better to have a mechanism where persistency and surrenders are reported separately,” said Viswanand.

The 13th month average number compares poorly with the global average. “Going by global reports, 13th month persistency in countries in OECD (Organisation for Economic Co-operation and Development), 13th month persistency is close to 90%. For 61st month, it is 60-65%,” added Viswanand.

If you think insurers have done a bad job in the 13th month, the 61st month persistency ratio is even more shocking as the average for the industry is about 28%, excluding LIC, for which it is 44%. This means that insurers have managed to retain less than a third of the policies they sold five years back.

Given that some insurers have reported their ratios on a reducing balance basis, the average of 28% could be an overstatement. In fact, some insurers have persistency records in single digits. Bajaj Allianz Life Insurance Co. Ltd, for example, has retained only 4% of the policies that it sold five years ago. It’s followed by Reliance Life Insurance Co. Ltd at 7%. “The persistency numbers are definitely something to worry about, but for us, the poor persistency is out of our channel mix,” said Anup Rau, chief executive officer and executive director, Reliance Life Insurance. “Our third-party channels, such as brokers and corporate agents, have a very weak persistency record. This skews our overall numbers,” Rau added.

Whose money is lost?

Poor persistency is largely reflective of the hygiene standards of the industry. But insurers also hold the way life insurance products are constructed responsible. “Ulips (unit-linked insurance plans) that were sold six years ago had a feature that allowed policyholders to exit after three years, and most of these did not have surrender penalties after the 5th year. This led to customers prematurely closing these policies rather than staying longer with them,” said Snehil Gambhir, chief operating officer, Aviva Life Insurance India Co. Ltd.

LIC, however, feels consumer behaviour is responsible. “Some of the factors that can be attributed to low persistency are unexpected change in policyholder’s financial position, uncertainty in job market and failure to pay premiums on time,” the insurer said in an email response. “Some policies have auto-cover facility and policyholders have the option to pay premiums as per their convenience. This is not reflected in persistency ratios,” it added.

Even as persistency is important for insurers to make money, heavy penalties on early exits and lapses ensures that they still made money. It’s the policyholder who loses money invested. In 2010, Irdai stepped in to cap surrender penalties in Ulips, which is what the industry was selling till then (the cap is maximum of Rs.6,000 in the first year to Rs.2,000 in the fourth year, and nil thereafter). The industry moved to selling traditional plans, prompting the regulator to review these as well. But even under the new regulations, traditional plans continue to have high exit charges in the initial years. So, you lose money if you quit a traditional plan midway.

Insurers are hopeful that the FY15 numbers will look positive considering that the product regulations were made effective from January last year, forcing insurers to focus on persistency. Insurance is a long-term business in which customers and the industry benefits if the policies are held for long. But given the poor persistency performance, huge costs and fat commissions, customers haven’t benefited in a meaningful way, while insurers and distributors have.