Factory and Warehouse insurance is a valuable add-on for an industrial setup involved in the manufacturing and/or storage of goods. It helps in covering for financial loss due to damage to goods, buildings, or machinery in and outside the premises.

What is Covered Under the Factory and Warehouse Insurance?

Factory and warehouse insurance helps you to cover sudden losses incurred due to damage to the store or the stock stored in it. This also includes all the losses incurred during the movement of the stuff as well. Comprehensive insurance covers content coverage, edifice coverage, money insurance, stock coverage, production interlude, and civil liability coverage. (see figure)

Depending on the type of policy any or all of the following can be covered:

Which Damage Causing Events A Warehouse Policy Covers?

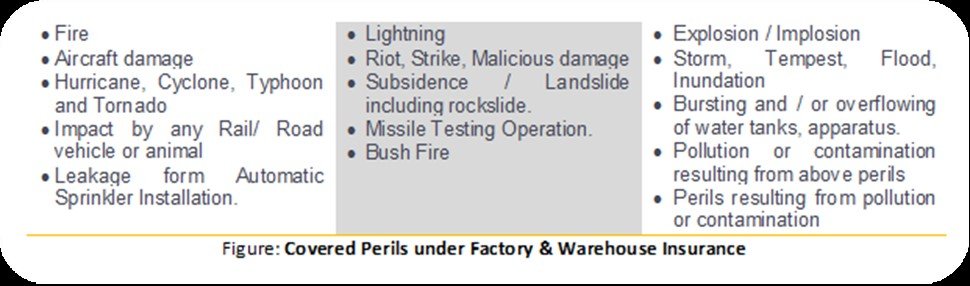

This is an area easily missed out on while purchasing warehouse and factory premises. Business owners should take extra care in understanding the events that are covered under the such policy to avoid future disappointments with the claim. The best way to secure your satisfaction is to thoroughly enquire about the covered ‘perils’ (as the events are known in the insurance language) with the insurer.

Following are the general ‘Perils’ that find coverage under this policy:

Types of Factory and Warehouse Insurance Policy

Depending on what is insured and other features of the policy, these policies can be classified as given under:

- Comprehensive Cover: Includes all types of covers available for Factory & Warehouse premises

- Valued Policy: Issued for materials for which market value cannot be ascertained

- Floating Policy: Issued when the same property frequently changes location

- Replacement &Reinstatement Policy: Pays the cost of replacement or reinstatement of the insured asset

- Specific Policy: Provides cover only up to a specific amount, usually less than the property value

You may notice that a serious peril, burglary/theft, is not listed in the list of covered perils. It is because there are separate policies available for it. Additionally, this peril and some others can be bought as riders to the original fire and allied risk policies. Compare different Factory & Warehouse insurance plans to choose the best at SecureNow.

Additional Costs Covered

In the aftermath of a fire or other damaging accidents at the factory or warehouse, the firm may need to consult surveyors and architects to rebuild and repair the damage, including the removal of debris from the site. These additional costs can also be insured under the same policy by taking riders.

However, these costs may be paid by the insurer after certain conditions are met, for example, if the value exceeds a certain amount (excess clause) or up to a certain amount (a certain percentage of the total sum assured).

Paying Reduced Premium

Several measures can be taken to decrease the amount of premium payable on such policies, such as automatic fire extinguishers, additional security measures, etc. which are considered by the insurer for premium discounts.

Our workplace, our business, our factory, and our warehouse, are a part of our lives. Therefore, proper care of these places is necessary. Apart from some of the regular benefits, there is an option to pick some add-on benefits as well depending upon the requirement.

Online insurance providers like SecureNow give an opportunity to choose the best insurance from one single place with the advantage of easy processing. Also, opting for insurance online has become a lot more fruitful. Availability of options, various quotes, secure processing, and extra support are some of the added features offered by online insurance agencies.

Therefore, get in-depth knowledge about any property and factory-related insurance plans before picking the right one for you. After all, your factory is an essential part of your business. Insurance not only provides funds in the time of need but also keeps your mind stress free. With just a small amount, you get an opportunity to reimburse your sudden losses easily after any accidental damage or loss.

Also, stock movement can result in some damage, which can be safeguarded by taking up the right insurance. So, stop waiting and get online, do deep research on policies and pick the best one for your work premises.