There are many types of risks, depending on the context, and since we are covering insurance here, we’ll talk about the risk categories for insurance.

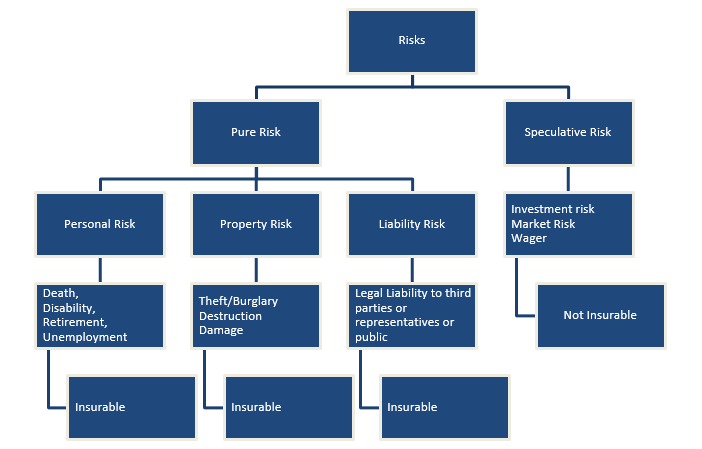

In insurance risks are classified as follows:

How to manage the risks?

All risks can be managed in any or multiple of the following ways:

- Avoidance

- Retention

- Transfer

Transfer & Retention of Risks

As shown in the diagrams ‘Pure Risks’ are insurable and can be managed through insurance. This is called risk transfer, as the risk bearer can transfer or share the loss with the insurer by paying a nominal amount as premium.

But you may not be able to transfer the insurable risks always.

If the risk has following characteristics it is advised that you retain it, as insurers may refuse to cover the same or the cost of insurance will be exorbitantly high:

- It is a certain risk (bound to occur during action)

- It is too frequent in nature (occurs frequently like the risk of catching flu is very high in some parts of the country)

- It is too small (the cost of administration of policy could be higher than the risk)

Therefore, it can be noted that only the risks with the following characteristics can be managed by transfer or insured against:

- Uncertain to occur

- Loss Value is high enough to warrant transfer or sharing of it

Risk Avoidance

Whatever the case, whether you decide to retain the risk or transfer it to an insurer, precautions should be taken to avoid the risk. Even if a risk has been transferred to an insurer, and it is found that the risk bearer did not take sufficient precaution to avoid it, the insurer may lawfully reject the claim.

Case on Risk Types and Their Management

Gunjan Fashion Waves Pvt. Ltd. is a fashion clothing manufacturer and distributor. The owner Srijan Daruwala knows very well that fashion industry is one of the riskiest industries and unless he can develop great survival ability in his business it’ll be wound up with a small setback.

Srijan is looking to reduce cost and boost the efficiency of the operations of his firm. He hires a consultancy firm, KBL Engineers & Designers, to audit the ops and suggest improvements.

KBL presents a plan to improve efficiency and bounce-back capability of the firm. Apart from the operations related inputs, KBL offers following thoughts on Gunjan’s future course:

Risk Avoidance:

- An automatic fire extinguishing system should be installed in the factory and warehouse premise.

- A burglary alarm should be installed along with CCTVs to monitor any suspicious activity

- Guards are already there but do not have the facility to contact police of fire brigade directly from the premises

- Training programmes should be introduced for employee safety and health

- Worker engagement should be increased to gauge any workforce issue beforehand

Risk Retention:

- Needs to create a sinking fund for the machineries

- Some of the machineries for dying of cloth and stitching are facing technological changes, and Gunjan must be prepared to replace them if a new more efficient technology comes in the market

- An emergency fund should be created to counter the raw material (cotton) price volatility (a formula for the same was also given)

Transfer of Risk:

- Gunjan needs to insure the warehouse for cotton and stock

- The factory or the machines should be insured

- The shipments are so far insured as per the request of buyers, however, often Gunjan had to offer a replacement for the damaged goods. Gunjan needs to compulsorily shift to CIF policy to cover all shipments and recover the cost of replacement if the buyer refuses to accept damaged goods.

- Employees and workers should be covered by group health and workmen compensation insurance to inculcate better loyalty and motivation among them.

- Srijan may also consider buying a group term cover to offer financial security to employees’ family as well.

About The Author

Mayank Sharma

MBA Finance

He is a professional who brings extensive knowledge and expertise to the field of group health insurance. He has dedicated 7years to helping individuals and businesses navigate the complexities of insurance. Having worked closely with numerous clients and insurance providers, he deeply understands the nuances of group health insurance policies. With a reputation for providing insightful and informative content, he leverages his industry experience to educate readers about the importance of group health insurance and its benefits. Through their articles, Mayank Sharma aims to empower individuals and businesses to make informed decisions about their healthcare coverage, ultimately promoting healthier and more secure communities.