Group Health Insurance in Other Cities

Group Health Insurance in

Pune

Group Health Insurance in

Mumbai

Group Health Insurance in

Bangalore

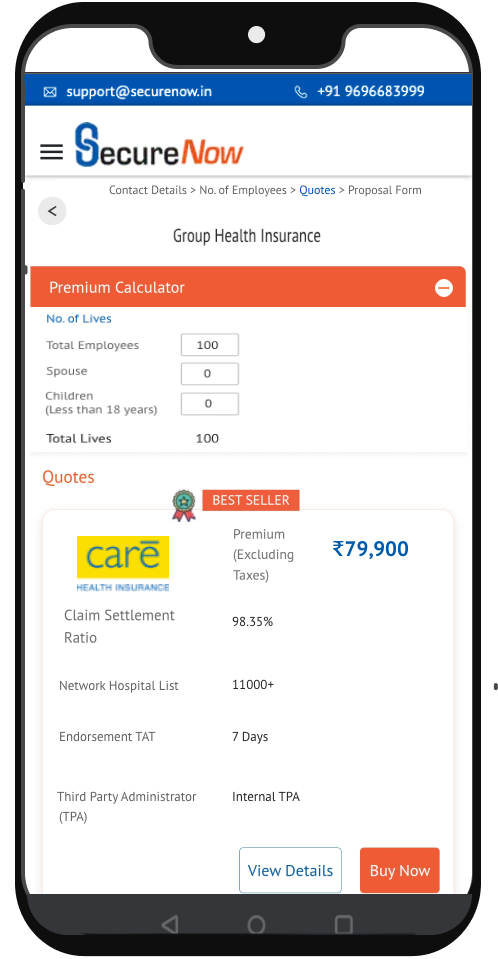

(Excluding Taxes)

Customise benefits based on your budget.

Customise benefits based on your budget.

Key Account Manager

Mobile App:Cashless eCard and Reimbursement eClaims

Claim status on app

HR Dashboard

All feature of Bronze

General Physician Video consultation: 2 per employee

wellness webinar: 1 per month

Quarterly premium client engagement call

All feature of Silver

Specialist Video consultation: 2 per employee

Basic health check-up on 9 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for self, spouse, and 2 children (max age:40)

Claims support for personal health insurance plans

All feature of Gold

Specialist Video consultation: 4 per employee

Advanced health check-up on 25 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for Father and Mother (max age:70-for top 10% of employees)

Buy Now Pay Later OPD Upto 10K per employee

Senior Citizen helpline

Key Account Manager

Mobile App:Cashless eCard and Reimbursement eClaims

Claim status on app

HR Dashboard

All feature of Bronze

General Physician Video consultation: 2 per employee

wellness webinar: 1 per month

Quarterly premium client engagement call

All feature of Silver

Specialist Video consultation: 2 per employee

Basic health check-up on 9 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for self, spouse, and 2 children (max age:40)

Claims support for personal health insurance plans

All feature of Gold

Specialist Video consultation: 4 per employee

Advanced health check-up on 25 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for Father and Mother (max age:70-for top 10% of employees)

Buy Now Pay Later OPD Upto 10K per employee

Senior Citizen helpline

See More

Ahmedabad is the largest city of Gujarat. It is known for its rapid growth in industries. It has a colourful culture with buzzing city life. With the growth of the city, access to quality health care is becoming even more critical. Payscale on health is on the rise in Ahmedabad; hence it is a backup for an individual and his family when it comes to health. Many employers wish to provide group health insurance in Ahmedabad to their employees. Also, the search is for the best medical coverage in this busy lifestyle. This guide shows why group health insurance is necessary in Ahmedabad.

Ahmedabad has several leading hospitals in the market today such as Apollo Hospital, Sterling Hospital, Zydus Hospital, offering excellent healthcare services. But, this all comes at a cost, especially in private hospitals. A modest hospitalisation can set you back a few lakhs. In this situation, group health insurance becomes mission-critical as you are assured that all hospitalisation expenses will be covered. Therefore, it is essential to have a good health insurance policy in Ahmedabad.

Here are the top 3 points to determine a good group health insurance in Ahmedabad

One of the significant advantages of health insurance is the tax benefits it provides u/s 80D of the Income Tax Act. Both individual and group health insurance policies in Ahmedabad are eligible for tax deductions. Thus, you can claim tax deductions of up to INR 25,000 for yourself and your family. For senior citizens, this limit goes up to INR 50,000.

Employers providing group health insurance in Ahmedabad can also benefit from tax deductions. Premiums paid towards employees' health insurance are treated as business expenses, thus reducing the company's taxable income.

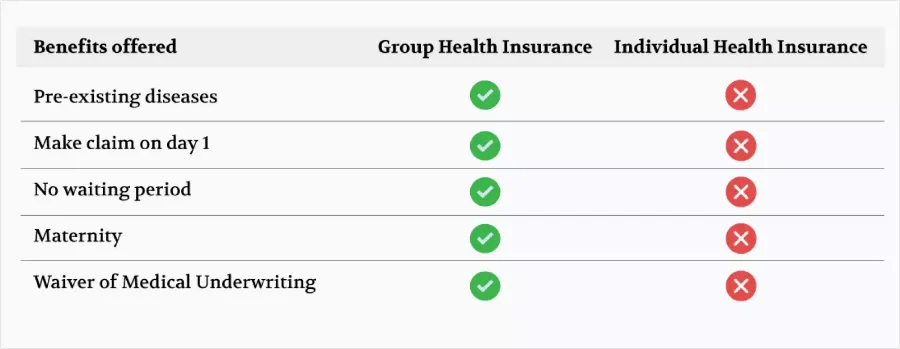

Providing group health insurance for employees has become a norm for businesses in Ahmedabad. Not only does it attract and retain top talent, but it also enhances productivity. It reduces absenteeism due to health issues. Companies can choose from a variety of group medical insurance policies that offer extensive coverage. It can include hospitalisation, critical illness, maternity, and outpatient treatments.

The flexibility of group health insurance policies allows companies to customise coverage according to the size and needs of their workforce. For instance, a startup with a younger employee base may focus on outpatient and wellness benefits. An established company might prioritise coverage for dependents and critical illnesses.

Benefit for the family:

A group family mediclaim policy in Ahmedabad can be your financial shield against unexpected healthcare costs. These policies cover hospitalisation, surgeries, and even daycare treatments. They can offer cashless claims at a network of hospitals.

However, a family can choose an individual health insurance plan as well, over and above the group insurance coverage. When selecting a mediclaim policy for the family in Ahmedabad, consider coverage for:

The best mediclaim policies also provide coverage for routine health check-ups and alternative treatments like Ayurveda or homoeopathy, which is popular in Gujarat.

Understanding the claim process is essential to making the most of your health insurance policy. In Ahmedabad, the claim process typically follows these steps:

1. Cashless claims process:

2. Reimbursement claims process:

Choosing the ideal mediclaim policy in Ahmedabad requires a detailed assessment of several factors, such as policy features and costs. SecureNow is a leading platform for acquiring group health insurance, offering businesses a comprehensive, affordable, and flexible solution. With its robust support system, SecureNow streamlines the management of organisations' employee health benefits.

Group Health Insurance in

Pune

Group Health Insurance in

Mumbai

Group Health Insurance in

Bangalore