Group Health Insurance in Other Cities

Group Health Insurance in

Mumbai

Group Health Insurance in

Ahmedabad

Group Health Insurance in

Bangalore

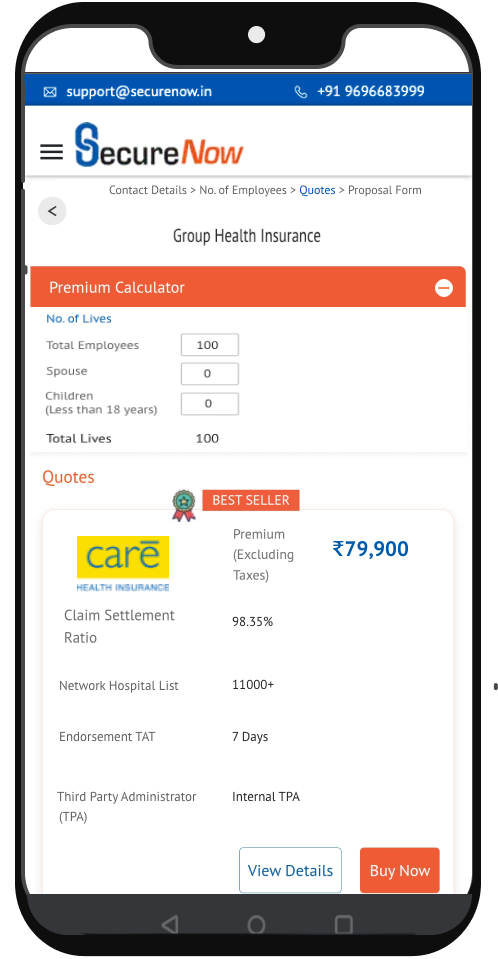

(Excluding Taxes)

Customise benefits based on your budget.

Customise benefits based on your budget.

Key Account Manager

Mobile App:Cashless eCard and Reimbursement eClaims

Claim status on app

HR Dashboard

All feature of Bronze

General Physician Video consultation: 2 per employee

wellness webinar: 1 per month

Quarterly premium client engagement call

All feature of Silver

Specialist Video consultation: 2 per employee

Basic health check-up on 9 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for self, spouse, and 2 children (max age:40)

Claims support for personal health insurance plans

All feature of Gold

Specialist Video consultation: 4 per employee

Advanced health check-up on 25 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for Father and Mother (max age:70-for top 10% of employees)

Buy Now Pay Later OPD Upto 10K per employee

Senior Citizen helpline

Key Account Manager

Mobile App:Cashless eCard and Reimbursement eClaims

Claim status on app

HR Dashboard

All feature of Bronze

General Physician Video consultation: 2 per employee

wellness webinar: 1 per month

Quarterly premium client engagement call

All feature of Silver

Specialist Video consultation: 2 per employee

Basic health check-up on 9 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for self, spouse, and 2 children (max age:40)

Claims support for personal health insurance plans

All feature of Gold

Specialist Video consultation: 4 per employee

Advanced health check-up on 25 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for Father and Mother (max age:70-for top 10% of employees)

Buy Now Pay Later OPD Upto 10K per employee

Senior Citizen helpline

See More

Individuals and families living in Pune face many health challenges, just like any other city in India. Some health challenges in Pune include air pollution, lifestyle diseases, vector-borne diseases, waterborne diseases, and critical illnesses like cancer. Water-borne diseases like diarrhoea, hepatitis, and typhoid have affected more than 5200 people in Pune in June this year. Rising medical expenses make healthcare in Pune unaffordable without insurance, with average hospitalisation costs in Pune ranging from INR 100,000 to INR 150,000 per stay. These challenges underline the critical need for comprehensive health insurance in Pune. To make health insurance affordable to individuals and provide additional benefits, employers use group health insurance policies to their advantage.

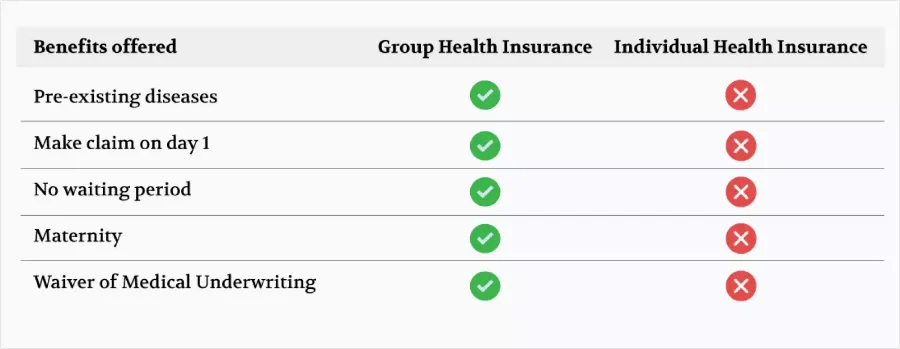

Group health insurance policies in Pune refer to employer-sponsored health insurance designed to provide medical coverage to employees and their dependents under a single plan. This group health insurance policy for employees typically covers hospitalisation, pre- and post-hospitalization expenses, surgical procedures, pre-existing illnesses, maternity, and sometimes critical illness benefits. The best mediclaim policy in Pune comes with cashless hospitalisation options at a network of hospitals, including top hospitals like Apollo, Jehangir Hospital, Ruby Hall Clinic, and Sahyadri Hospitals.

Group health insurance for employees is cost-effective compared to individual health insurance plans, as the risk is spread across a larger group. Group medical insurance typically covers the employees, their spouses, dependent children, parents, and parents-in-law. Some policies can also offer coverage for extended family members dependent on an employee. Employers also enjoy tax benefits when providing such insurance. The option to customise benefits the employees with additional covers and add-ons.

The following are the tax benefits offered by the group medical insurance plans:

The group health insurance claim process generally follows these steps:

A. Cashless Claim Process for Group Health Claims:

B. Reimbursement Claim Process for Group Health Claims:

Choosing the best mediclaim policy in Pune requires the employer to consider many things, including features, costs, etc. SecureNow is the best platform for buying group health insurance as it offers businesses a comprehensive, affordable, and flexible solution with robust support, making it easier to manage health benefits for their employees.

SecureNow is a reliable partner for businesses looking to provide robust health benefits to their teams. Connecting with us for policy offers various benefits for companies and organisations seeking comprehensive health coverage for their employees. Here are key reasons to consider:

Group Health Insurance in

Mumbai

Group Health Insurance in

Ahmedabad

Group Health Insurance in

Bangalore