Group Health Insurance in Other Cities

Group Health Insurance in

Pune

Group Health Insurance in

Ahmedabad

Group Health Insurance in

Bangalore

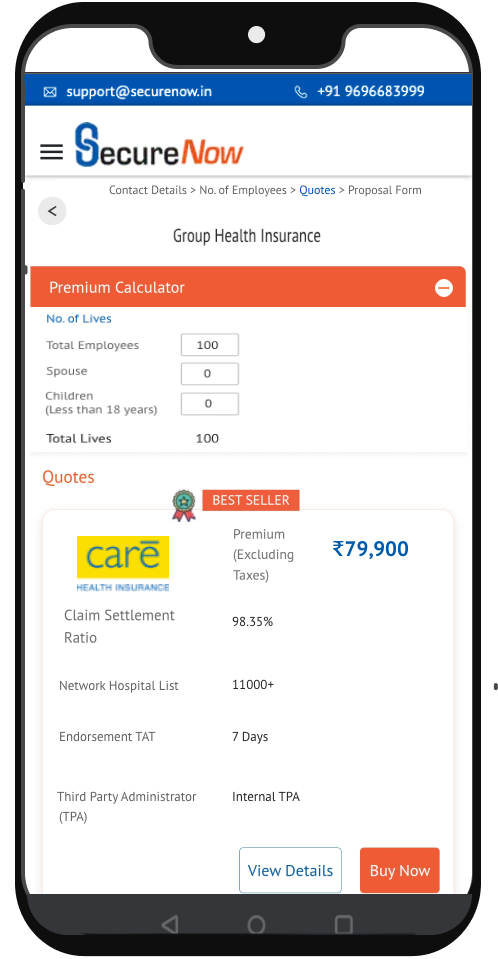

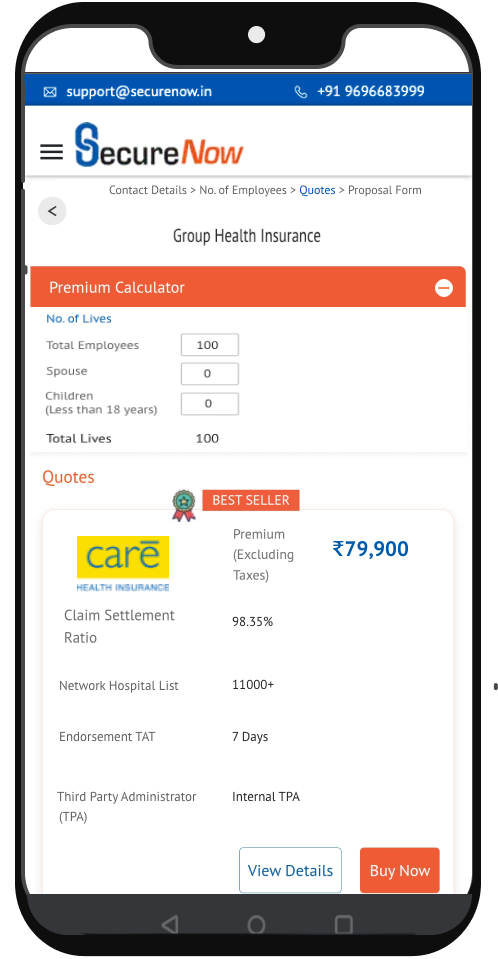

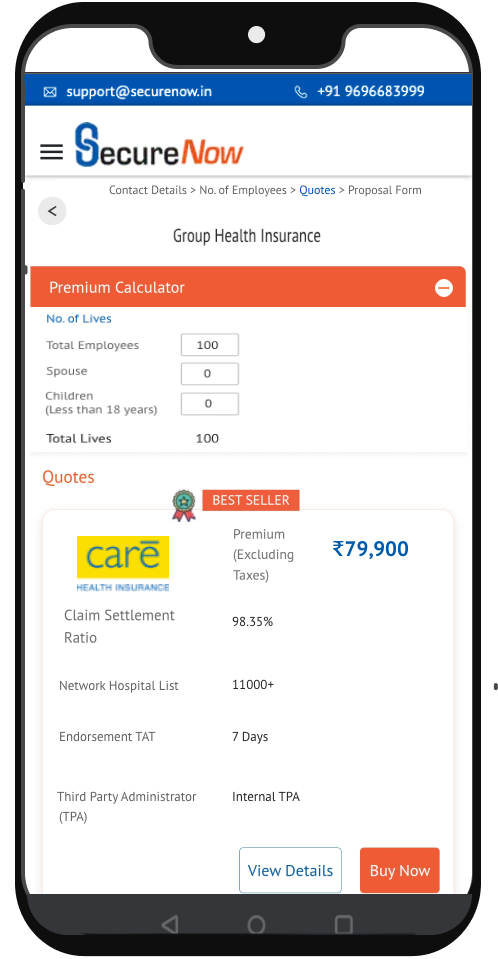

(Excluding Taxes)

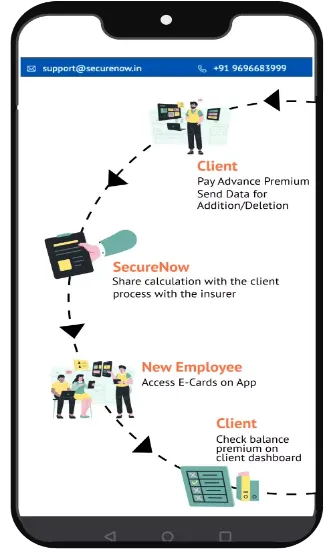

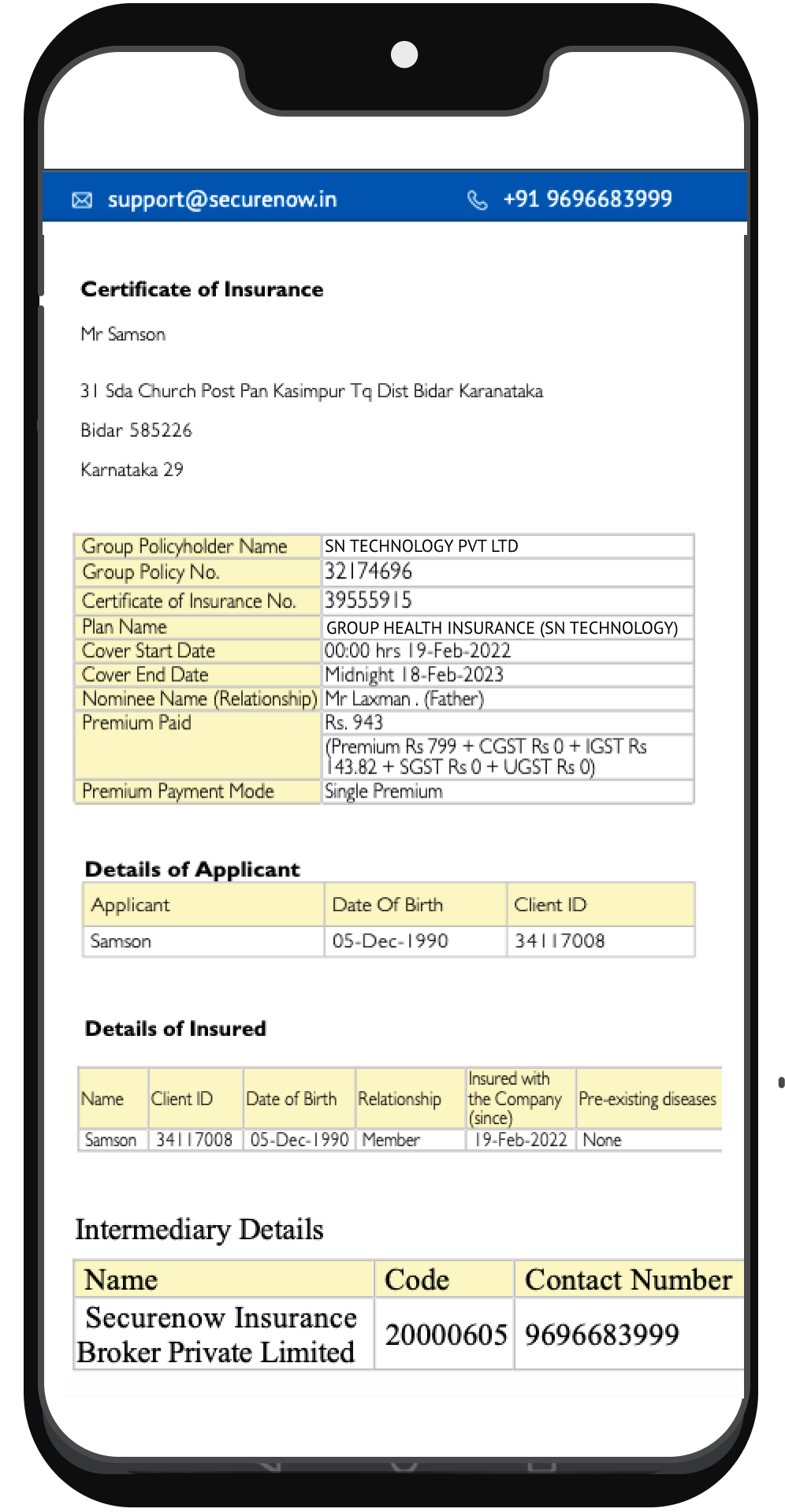

Online policy copy

Online policy copy Instant risk confirmation

Instant risk confirmation Experienced medico-legal panel

Experienced medico-legal panel Single point interface for claims

Single point interface for claims Renewal reminders

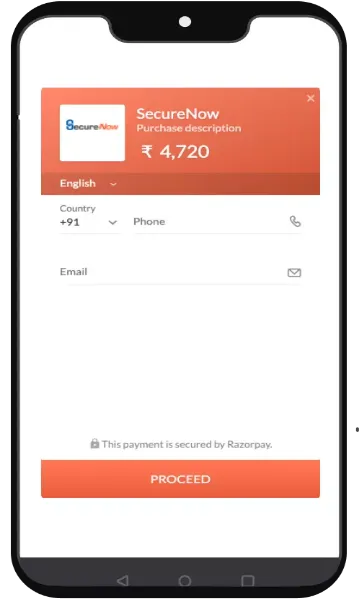

Renewal reminders Digital proposal form and payment

Digital proposal form and paymentCustomise benefits based on your budget.

Customise benefits based on your budget.

Key Account Manager

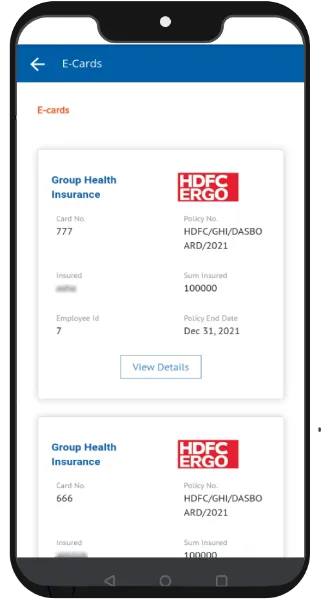

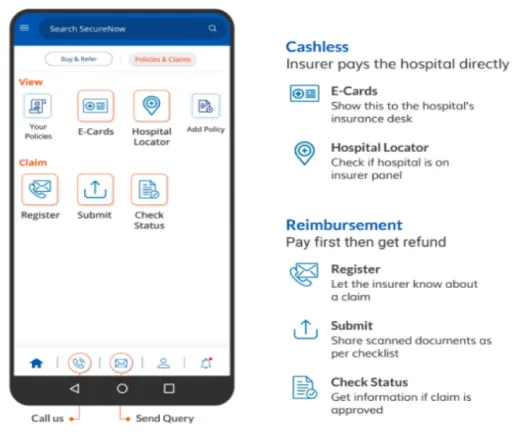

Mobile App:Cashless eCard and Reimbursement eClaims

Claim status on app

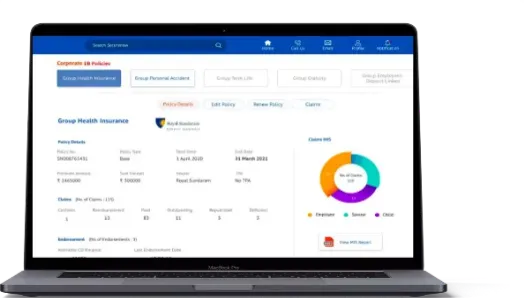

HR Dashboard

All feature of Bronze

General Physician Video consultation: 2 per employee

wellness webinar: 1 per month

Quarterly premium client engagement call

All feature of Silver

Specialist Video consultation: 2 per employee

Basic health check-up on 9 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for self, spouse, and 2 children (max age:40)

Claims support for personal health insurance plans

All feature of Gold

Specialist Video consultation: 4 per employee

Advanced health check-up on 25 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for Father and Mother (max age:70-for top 10% of employees)

Buy Now Pay Later OPD Upto 10K per employee

Senior Citizen helpline

Key Account Manager

Mobile App:Cashless eCard and Reimbursement eClaims

Claim status on app

HR Dashboard

All feature of Bronze

General Physician Video consultation: 2 per employee

wellness webinar: 1 per month

Quarterly premium client engagement call

All feature of Silver

Specialist Video consultation: 2 per employee

Basic health check-up on 9 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for self, spouse, and 2 children (max age:40)

Claims support for personal health insurance plans

All feature of Gold

Specialist Video consultation: 4 per employee

Advanced health check-up on 25 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for Father and Mother (max age:70-for top 10% of employees)

Buy Now Pay Later OPD Upto 10K per employee

Senior Citizen helpline

See More

Mumbai is the financial capital of India. It is known for its fast-paced lifestyle. It also brings along an extensive healthcare system and increasing medical expenses. The city’s population often faces health challenges due to pollution. Many citizens face lifestyle diseases and critical illnesses. The importance of health insurance has grown significantly. It is one of the best ways to ensure health coverage in Mumbai. One of the most popular health insurance policies in Mumbai is group health insurance. These plans only provide employees with comprehensive health coverage. Also, they offer significant benefits to employers.

Health insurance in Mumbai is essential due to several health challenges the city faces. Mumbai City has a dense population. It is also coupled with high pollution levels. It exposes residents to numerous diseases. Rising healthcare costs in Mumbai also make hospitalisation unaffordable for many. On average, a hospitalisation in Mumbai can cost between INR 80,000 to INR 2,00,000 depending on the condition. As such, having the best mediclaim policy in Mumbai becomes a necessity.

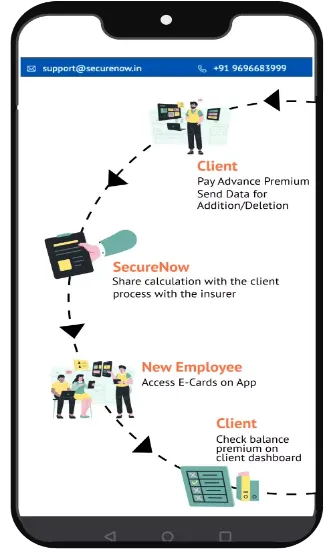

One of the most effective solutions for businesses to provide health coverage to their employees is by opting for group health insurance policies. These policies easily cover the company’s employees. Also, many policies extend to their dependents as well.

Group health insurance policies are designed to provide medical coverage to employees under a single plan. These policies are highly beneficial for both the employer and the employee. They typically cover hospitalisation, pre- and post-hospitalisation expenses, maternity, and, in some cases, critical illness. The best mediclaim policies in Mumbai offer cashless hospitalisation across a network of hospitals. It includes prominent ones like Lilavati Hospital, Kokilaben Dhirubhai Ambani Hospital, and Hinduja Hospital.

Employers in Mumbai prefer group medical insurance due to its cost-effectiveness. It spreads the risk across a large pool of people. This also results in lower premiums. Moreover, it allows employees to enjoy extensive health coverage without having to bear the full cost themselves.

Group health insurance plans in Mumbai offer tax benefits for both employers and employees.

Group health insurance policies come with an easy claim process. It is a suitable option for employees to avail of medical benefits when required.

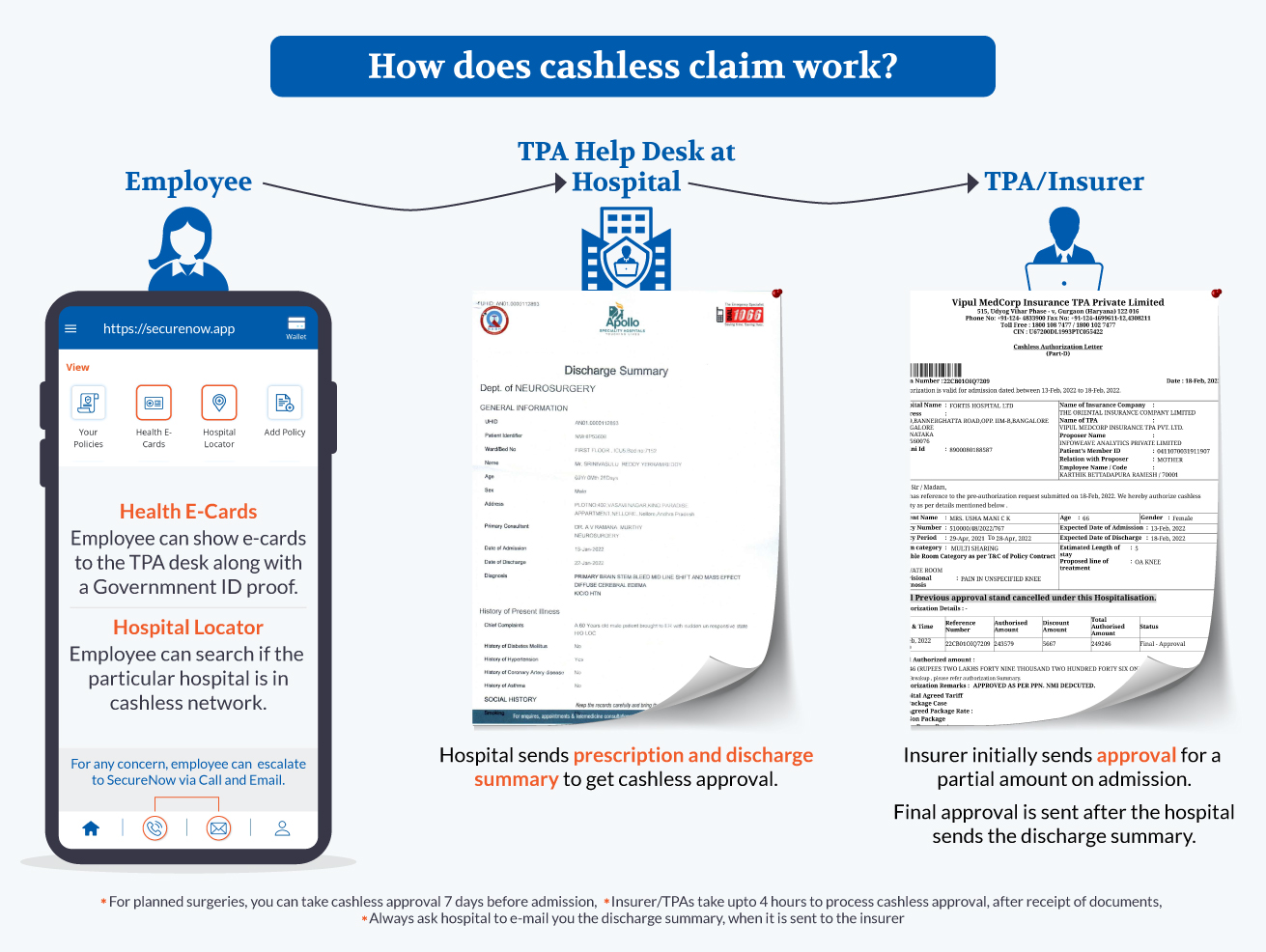

1. Cashless claim process:

Employees can avail of cashless treatment at network hospitals by following these steps:

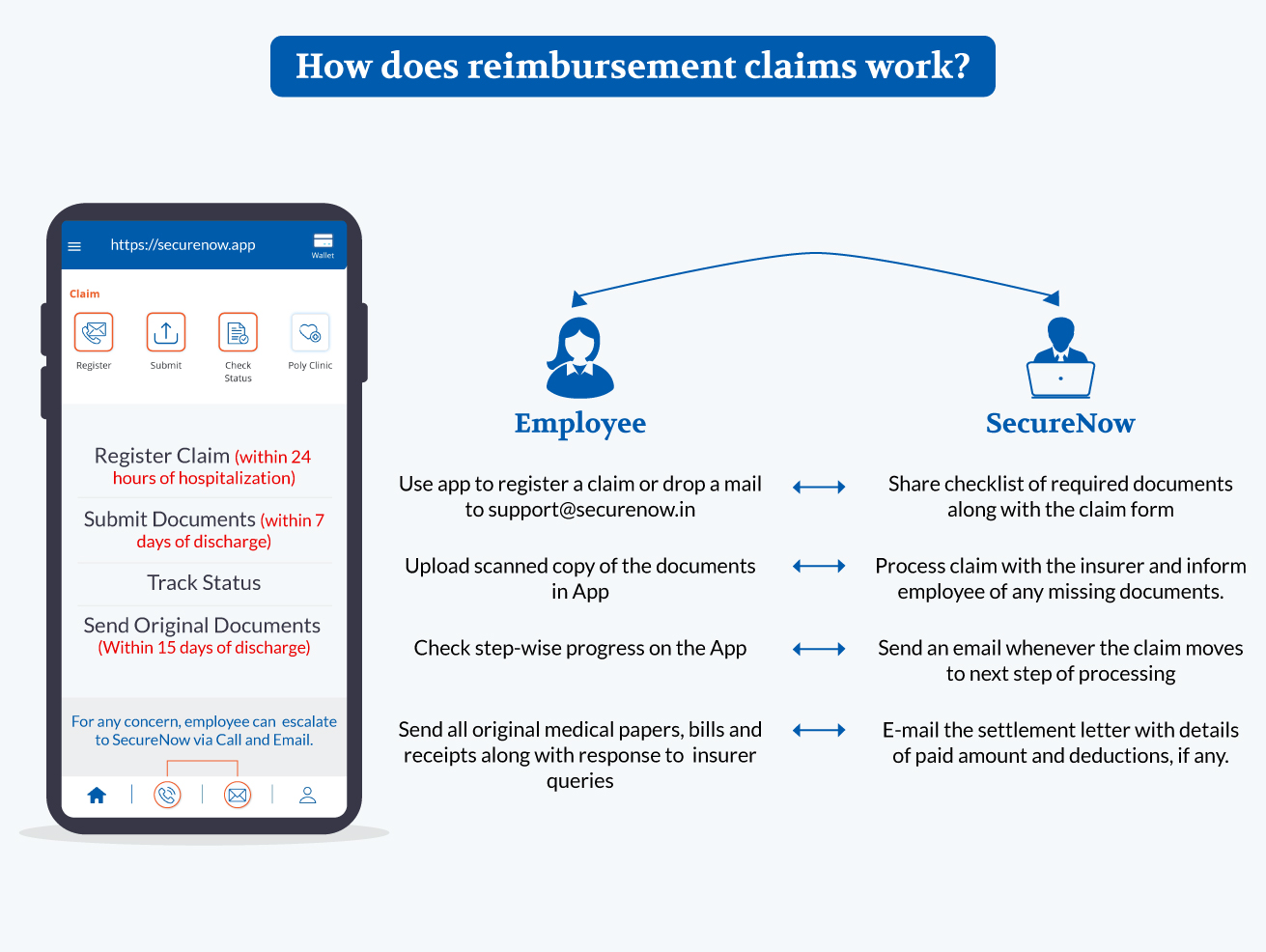

2. Reimbursement claim process:

If the treatment is availed at a non-network hospital, employees can follow the reimbursement claim process:

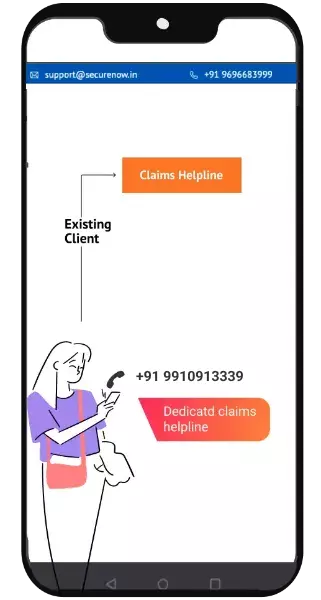

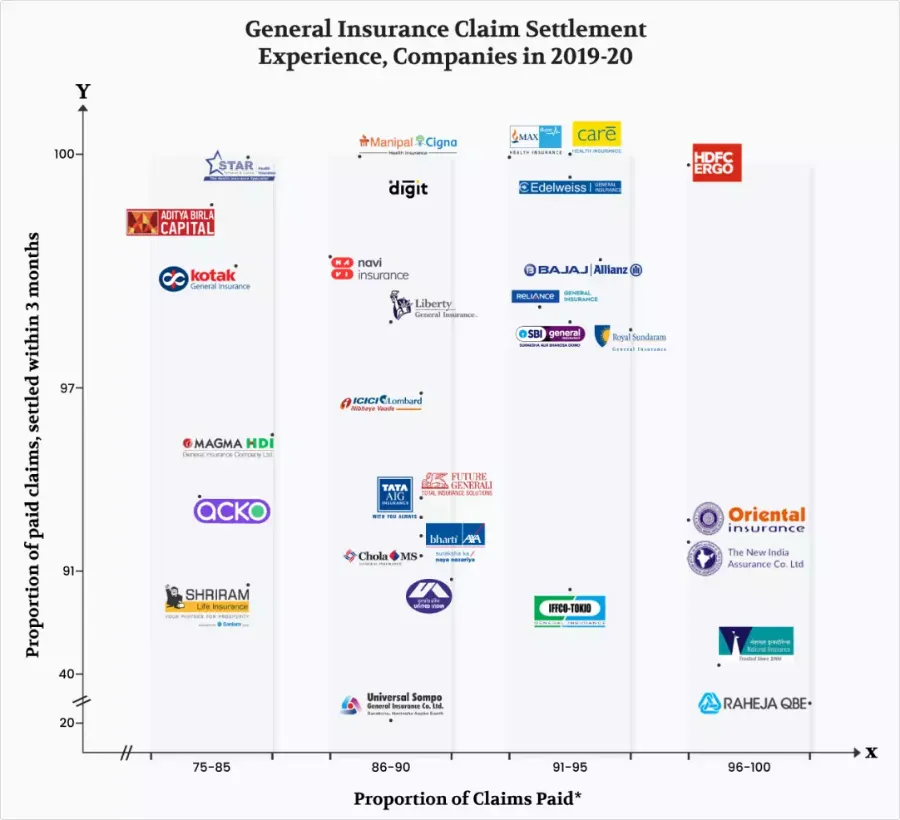

Selecting the optimal mediclaim policy in Mumbai necessitates a thorough evaluation of various factors, including policy features and costs. SecureNow stands out as the premier platform for procuring group health insurance, providing businesses with a comprehensive, cost-effective, and adaptable solution. With its strong support system, SecureNow simplifies the management of organisations' employee health benefits.

SecureNow is a trusted partner for businesses in Mumbai. It is the best option for people seeking the best health insurance solutions for their employees. Here’s why:

Group health insurance policies offer an excellent solution for businesses in Mumbai to provide health coverage to their employees. By choosing the right policy through SecureNow, employers can ensure that their team enjoys comprehensive medical benefits while also benefiting from tax deductions and cost-effective premiums.

Group Health Insurance in

Pune

Group Health Insurance in

Ahmedabad

Group Health Insurance in

Bangalore

Archit Arun

Our employees are really happy with the services SecureNow offers. We had asked them to organize a Yoga session for our employees and it was a huge success. Thank you SecureNow and all its employees for all the efforts. Keep up the good work!

Shivangi Gupta

The SecureNow App is really convenient to lodge and track claims. The team is also quite helpful when it comes to resolving issues aqnd queries.

Sakshi Dixit

We've been working with SecureNow for a few years now and I like the value-added services they provide. Their App has this Poly Clinic where you can book free video consultations with reputed medical practitioners. This is an amazing initiative and we also appreiate the numerous wellness camps that the've arranged for us.

Rajnish

I've had a group health insurance policy from SecureNow for over a year now, and it's been a great experience. The customer service is responsive and helpful.

Rajesh

SecureNow's group health insurance policy has been fantastic for our small business. We’ve saved money and the coverage is excellent. Highly recommend!

Mansi

We switched to SecureNow for our company's group health insurance policy and couldn’t be happier. Easy to set up and the benefits are top-notch.

Krunal

As a small business owner, finding affordable group health insurance policy was challenging until we found SecureNow. Great rates and service!

Yashwant

The group health insurance policy from SecureNow is comprehensive and affordable. Our employees are pleased with the coverage options.

Taran

SecureNow’s group health insurance policy has been a lifesaver for our company. The process was smooth, and the support team is always available.

Nilesh

Very satisfied with the group health insurance policy from SecureNow. The coverage is great and the customer support is always helpful and friendly.

Himesh

Switching to SecureNow for our group health insurance policy was a great decision. The policy is affordable and meets all our needs perfectly.

Sheetal

Our company has been using SecureNow for our group health insurance policy for a few months, and we’re very pleased. Excellent coverage and service.

Lavesh

SecureNow offers a great group health insurance policy. Our employees are happy with the coverage, and the costs are reasonable. Thumbs up!

Vishesh

I was impressed with the group health insurance policy from SecureNow. The enrollment process was quick and easy, and the coverage is extensive.

Srikant

The group health insurance policy from SecureNow is exactly what our company needed. Affordable and comprehensive coverage. Highly recommended!

Jyoti

SecureNow has provided us with an excellent group health insurance policy. The team is professional, and the benefits are exactly what we needed.

Meenakshi

We’ve had a wonderful experience with SecureNow’s group health insurance policy. The coverage is great and the customer service is exceptional.

Vanshika

SecureNow’s group health insurance policy has been great for our employees. They appreciate the comprehensive coverage and the easy claims process.

Shivani

Great group health insurance policy from SecureNow. The coverage options are extensive, and the customer service is always available to help.

Hitesh

Our experience with SecureNow’s group health insurance policy has been very positive. The coverage is great, and it’s very affordable for our team.

Dipen

We’re very happy with the group health insurance policy from SecureNow. The team is responsive, and the coverage is exactly what we were looking for.

Ishant

SecureNow has provided our company with an excellent group health insurance policy. The setup was easy, and the coverage meets all our needs.

Bhavika

I highly recommend SecureNow for group health insurance policy. The benefits are fantastic, and their customer support is always there to help.

Chiranjit

Our company's leadership highly recommends SecureNow's group insurance policy for its reliability and flexibility.

Raman

SecureNow's group health insurance for employees has made managing employee benefits a breeze for our HR department.

Santosh

The support team at SecureNow has been incredibly helpful in guiding us through our group insurance policy.

Dileep

I highly recommend SecureNow for group medical insurance. They made the process seamless and hassle-free.

Parul

Securing group health insurance through SecureNow was a smart decision for my business. Their plans are comprehensive and affordable.

Prakash

I found exactly what I needed with SecureNow's group health insurance options. They offer flexibility and extensive coverage.

Umakant

SecureNow's customer service team was fantastic in guiding me through the process of selecting the right Group Insurance Policy.

Bhupendra

I'm impressed by SecureNow's commitment to providing the best group medical insurance solutions. Thank you for your excellent service!

Rohit

I appreciate SecureNow's dedication to finding the best group health insurance solution for my business. They truly prioritize their clients' needs.

Aklesh

SecureNow's group health insurance options provide excellent value for money. I'm grateful for their expertise in guiding us through the selection process.

Amit

Our team loves the comprehensive coverage of our group insurance policy from SecureNow!

Aarush

Group insurance policy is a game-changer for our company's employee benefits package. Thanks, SecureNow!

Harshit

SecureNow's group insurance policy is top-notch, providing peace of mind for our entire team.

Teena

The simplicity and efficiency of SecureNow's group insurance policy make it a must-have for any business.

Ankur

With SecureNow's group insurance policy, our employees feel valued and supported in every way.

Rishi

Couldn't be happier with the flexibility and affordability of our group insurance policy from SecureNow.

Ishita

Our company's HR department swears by SecureNow's group insurance policy for its ease of use.

Akhil

SecureNow's group insurance policy has exceeded our expectations in every aspect. Highly recommended!

Lalit

Kudos to SecureNow for their excellent customer service and personalized approach to our group insurance policy.

Tarun

We appreciate the seamless integration of SecureNow's group insurance policy into our benefits package.

Nisha

SecureNow's group insurance policy offers the perfect balance of coverage and cost-effectiveness.

Ajay

Our experience with SecureNow's group insurance policy has been nothing short of fantastic.

Yogesh

The online portal for managing SecureNow's group insurance policy is user-friendly and intuitive.

Hansh

Our team feels safer and more secure with SecureNow's group insurance policy in place.

Harish

SecureNow's group insurance policy has made a significant difference in our company's employee satisfaction levels.

Shweta

Thanks to SecureNow's group insurance policy, our employees can focus on their work without worrying about healthcare costs.

Karan

SecureNow's group insurance policy has become an indispensable part of our company's benefits package.

Nakul

The peace of mind that comes with SecureNow's group insurance policy is invaluable to our team.

Lokesh

We've been impressed by SecureNow's commitment to providing tailored solutions with their group insurance policy.

Eshwar

SecureNow's group insurance policy offers excellent coverage options at competitive rates.

Rajesh

We recently had the pleasure of purchasing Group Health Insurance from SecureNow and must say that our experience has been pretty good.

Dhruv

We recently bought group medical insurance from securenow, and it was a very easy and simple process to buy. We really appreciate it.

Rajendra

The renewal process for group mediclaim is very simple and fast by securenow. The team is very efficient in their work.

Sangeetha

The group insurance policy options were flexible and tailored to my specific needs. Thanks, SecureNow.

Prabhu

We have connected with securenow for the last three years for group health insurance for employees. And it is a wonderful journey as we always get the best premium plans at affordable price.

Alok

Securenow is the perfect place to buy group insurance policy for employees. The team is very supportive and helpfull.

Dhruva

We got the best premium plans for group insurance for employees from Securenow.

Shiv

SecureNow has amazing deals and great premiums. We recently bought a group mediclaim policy for employees and it has amazing coverage. Love it.

Dinesh

The group health insurance we bought covers a whole range of things. A lot of things in a single place with really low premiums. It is an amazing deal.Thanks, Securenow.

Vinay

We connected with securenow to buy an affordable group health insurance for employees and we did find several good plans within our budget.

Suraj

One of our workers recently submitted a claim under his group mediclaim coverage, and he said that SecureNow made the procedure very simple and convenient.

Manoj

We never received a better quotation for a group insurance coverage than this one. Recommendable SecureNow.

Jagan

Securenow always provide best and affordable plans for group health insurance.

Anthony

When purchasing a group insurance policy from SecureNow, I had an amazing experience.

Gurpreet

We received a fantastic discount on group medical insurance from SecureNow.

Ujjwal

For the last five years that I have worked with Securenow, I have had no concerns about their group medical insurance plans or costs.

Ashok

We bought group health insurance from SecureNow as it was an easy procedure and they have several plans that worked for us. Thanks, SecureNow.

Pushpa

Thanks, SecureNow for making the claim process of group medical insurance so easy and smooth.

Vinay

The team of securenow is very concerned about their clients, as we connect them to group mediclaim. Keep it up, team.

Gaurav

It is a wonderful experience to connect with securenow for Group Insurance Policy.

Arjun kumar

I am more than happy with the way my group health insurance claim was settled by the team of SecureNow.

Aditya sinha

Marvelous online service. It's very fast and easy. Group medical insurance policy is issued instantly. Great.

Kabir chauhan

There are many insurance brokers in the market but SecureNow is the only choice for Group Mediclaim.

Ishaan krishnawat

We are looking for an insurance broker for the group insurance policy of our employees and we find SecureNow which fulfills our all requirements.

Aditi Rao

The best and most affordable premium plans of group health insurance for employees are provided by SecureNow.

Ananya Khanna

Got the group insurance policy for employees as fast as I even don't think. Thanks, SecureNow

Lakshmi Pandey

Wonderful experience while buying group insurance for employees from SecureNow.

Pranav rastogi

It was a very nice and friendly gesture from the team of SecureNow when we connected with them for the group mediclaim policy for employees.

Kavya jha

Thank you so much SecureNow for making the process of buying group health insurance so convenient.

Arnav joshi

We bought a group medical insurance from SecureNow and it was a great deal for us.

Ayaan Khan

Recently one of our employees claimed his group mediclaim policy and according to him, SecureNow made it a very easy and convenient process.

Sanjay Sharma

I must say that the team of SecureNow is very concerned about their customers. They help me a lot with my group insurance policy.

Rohan Bhardwaj

A friend told me about SecureNow for group health insurance for employees and it is a perfect recommendation.

Advik

We take group insurance policy for employees from Securenow and once again comes with great deals as always.

Ishani

It was our first time buying group insurance for employees and SecureNow's team assisted us very well.

Arun

SecureNow has well-spoken members in their team with proper information about group mediclaim policy for employees.

Rohit

It felt worth every penny I spent on group health insurance as I got the best and most affordable premium plans.

Arya

The renewal process is very easy for group medical insurance of SecureNow.

Darsh

I got the approval of my group mediclaim in just a couple of hours.

Navya

We got our group insurance policy from SecureNow in just a limited time.

Viraj

We bought group health insurance for employees and also got comprehensive benefits from SecureNow.

Gayatri

We have to thank SecureNow for their amazing support with us for group insurance policy for employees.

Vivaan

I am really satisfied with the coverage plans of group insurance for employees.

Shivansh

We have had a group mediclaim policy for employees with SecureNow for a while, and they've been wonderful. They offer competitive rates and have a local agent available always to answer our questions.

Anshul

We buy group health insurance for our staff from the team of SecureNow. They provided us with the best quotes and helped us to finalize the deal.

Rajat

I've been working with Securenow for the last five years and I do not doubt their premiums and plans for group medical insurance.

Sachin

We buy group mediclaim policy for our employees and our experience was wonderful just because of the supportive staff of SecureNow.

Freddy

I had a wonderful experience with SecureNow for buying a group insurance policy.

Purvi

We buy group health insurance for employees at an affordable price from SecureNow.

Kajal

It is a hassle-free process to buy group insurance policy for employees through SecureNow. It's appreciable.

Tarun

We were looking to buy group insurance for employees and SecureNow stands out in our expectations

Taniya

We are committed to the safety of our employees, and like us, SecureNow is committed to providing the best group mediclaim policy for employees. It's a nice gesture by their team.

Trisha

One of our employees recently claimed his group health insurance and his experience was fantastic with the support of a team of SecureNow.

Rishab

The team of SecureNow is well-experienced in making the buying process of group medical insurance smooth and hassle-free.

Simmy

We were unable to finalize the group mediclaim policy for our staff, so we approached SecureNow's team and they understood our concerns and provided us with the best plans.

Yash

It is the best quote for a group insurance policy we have had until now. Recommendable SecureNow.

Harshita

We got the affordable plans for the group health insurance for employees of our organization.

Arnab

It is an outstanding experience with SecureNow while buying a group insurance policy for employees.

Brijesh

SecureNow is the best in the industry to buy group insurance for employees.

Hiren

Connecting with Securenow to buy a group mediclaim policy for employees is recommended.

Nikita

Best and Affordable plans for group health insurance.

Archita

We connect to SecureNow for group medical Insurance and now all our policies are in their hand.

Akshit

I am happy to have the group mediclaim with the minimum time and without any problem.

Tanvi

We always rely on SecureNow for the best and most reliable premium plans for the Group Insurance Policy.

Bhatia Group

I recently switched to SecureNow for group health insurance of my employees, and I'm delighted. The coverage is comprehensive, and the premiums are reasonable. They make it easy to manage policies online for me.

M/S G.K. Enterprise

I've had group medical insurance with SecureNow for a while, and they've been wonderful. They offer competitive rates and have a local agent available always to answer my questions.

NKS Consultants

SecureNow truly cares about its customers. Recently one of my employees made a claim for his group mediclaim. And I get to know that their claims process is hassle-free, and they make sure you get back on your feet quickly after a covered loss.

Arjun Choudhary

I can't say enough about the incredible service provided by SecureNow. They took the time to understand my unique needs for my group insurance policy and found me the perfect packages at the best rates. Highly recommended!

Jagan Enterprise

I've been working with them for years, and they consistently deliver personalized service and competitive insurance options of group health insurance for employees. Their expertise and dedication have made insurance decisions stress-free.

Amphitech Media

The team at SecureNow is exceptional. They work diligently to find cost-effective solutions while prioritizing my interests. I trust their expertise in group insurance policy for employees and appreciate their proactive approach.

N&S Enterprise

SecureNow commitment to transparency and unbiased advice is refreshing. They have helped me secure comprehensive coverage for group insurance for employees, all while staying within my budget.

Computer Tech Solutions

As a small business owner, I rely on SecureNow for all my commercial insurance needs. They helped me to finalize the group mediclaim policy for employees. Their team is responsive, well-informed, and proactive, making them an indispensable partner.

Ashok

I've been with SecureNow for years, and they have consistently provided excellent service. Their claims process is straightforward, and the customer support is impressive.

Rahul Taneja

I appreciate the transparency of SecureNow. They explain the insurance policies clearly and help me make informed decisions. Their commitment to customer education sets them apart.

Simran Chopra

SecureNow has a wide range of policy options to fit various needs. Their staff is knowledgeable, and I've always felt like a valued customer. Highly recommended!

Anshuman Agrawal

I've been a customer for many years, and SecureNow has consistently provided reliable coverage. Their online tools make managing policies and payments a breeze.

Abhishek Rawat

I was overwhelmed by the insurance choices out there, but SecureNow simplified the process. Their knowledge and guidance helped me make informed decisions and secure the right coverage.

Ashmika

SecureNow has provided invaluable assistance during a complex insurance claim. Their expertise and advocacy made the claims process seamless. I'm grateful for their support.

Samridhi Chauhan

I have worked with several insurance brokers over the years, and SecureNow stands out. Their commitment to customer satisfaction, coupled with their extensive industry knowledge, sets them apart.

Paramjeet Kaur

It was easy to buy group health insurance from Securenow's website PLUS customer support was amazing as well. All my doubts were cleared promptly. Thankyou.

Aniket Sharma

Filing a health insurance claim with securenow was an efficient ans straightforward process. Their advance app make cliam registartiona and document submission very easy. Really impressed with the tech solution they have to offer.

Shri Hanumantha Buildtech

We beleive Securenow Brokers helped us get the best Group Health insurance cover in India. They made things so easier for us, by understang our need and suggest an optimal plan. There also have tieup with so many insurers..

AC INFOTEX PVT LTD

Securenow offered an impressive range of insurance options from leading insurers. I appreciated the comprehensive details avalable for each policy which helped me to take the better decisions. Thankyou.

Vinod Kashyap

Securenow's customer support executives are very helpful. We had contacted them to buy a reliable group health insurance policy for our firm. They not only suggested us the best plans as per oury needs but also helped us pay the premium via reliable and secured gateway.

Shri Balaji Udyog

Securenow's efficient claims process was impressive. In case of any claims, our employees are able to get their claims registered, documents submitted and track progress of the calim online on their app. This allowing them to focus on their recovery without worrying about financial aspects.Thankyou.

HiTechPro Industries

It is necessary invertment and totally worth it. Thanks.

Aricon Marine Consultants

Thankyou securenow for providing optimized plan at affordable premium rates to us. It was a pocket-freindly policy purchase.

Deneva India

Buying group health insurance policy for employees online was so easy with securenow. We bought Reliance General Insurance Health Insurance Policy online from them. They also have wellness programs that we would like to avail. Overall the purchasing process was very convenient. Thanks SN!

bhavesh anand

We have been purchased GHI from Securenow since lat 3-4 yrs. Group health insurance rates they offer are very competitive and affordable. Thankyou Securenow!

Spectrun Visios

The customer care service of the Securenow is very good. While buying group health insurance for small business I run, i was helped at each step of buying process. Their customer support team is always accessibel and had helped clear all my doubts. regarding the plan.

ABANI MOHANTY

I purchased group mediclaim policy with the help of Securenow recently and i am so much satisfied with the plan. The application process was easy and efficient. Thy made the typically complex task of insurance buying look so seamless. Thanks to their expert guidance!

N Square Autonation

Securenow provides quite affordable group health insurance plans to their customers. I bought Manipal Cigna health insurance plan from their website. I found it befitting my need & budget. Satisfied with the purchase.

Jaishree Gupta

My association with insurance broker- Securenow is new. I switched insurer this year, as in the past I used to renew the policy paying a higher premium amount. Follwowing the advise of Securenow, I was able to save a reasonable amount on the premoum this year. All the Best, team Securenow!

C.D.S.Das

Purchasing the group insurance policy from Securenow was very easy. Their website is intuitive, and the application process is very user friendly. Their support team was incredibly helpfu and accessiblt at every step.

HARI PRASAD

I checked the various websites offering group health insurance plans for small businesses, but they all were all charging through the nose. Then I happened to check WWW.SECURENOW.IN , where I was able compared different policies and plans. The comparison is very easy. I had some queires for which I had requested a call back. I got to speak to their epert who guided me during the online buying journey.

Rajaram Chopdar

I got great deals on www.securenow.in. Highly recommend their service!

Ansh Enterprises

Very quick response tiime by Securenow team. We called their Customer Care and my query was resolved in first call itself. Don't know about the claims as none has arisen so far. As There Has Been None, Hopefully That Too Will Be Hassle Free.

Rinki

If you are looking for the best group health insurance company with excellent support all through, I suggest you go try put Securenows expert advise. I have lots of appreciation, the way they helped us get best policy & also save some money. Thnx Securenow..

RMS Enterprises

Securenow offers hassle free buying. It helps compare business group health insurance plans of multiple insurance companies and then advises you which would be best for you. Their app is very efficient ans help us get all the updated line like employee health card, provided option to add/delete members, and also able to track claim status. We largely had smooth exxperience for claims as well.

Sanjana Arora

Most fitting group health insurance! Its the best plans from SecureNow, offering great coverage for our employees.

ExImport Enterprises

Excellent group health insurance policy with comprehensive coverage for members. Highly recommended this corporate health insurance plans!

Veena Mohan

Group mediclaim policy provided by SecureNow offer good group health coverage, ensuring our employees' peace of mind.

Madan Joshi

Happy to have group insurance for employees offering excellent coverage.

Ess Key Pvt. Ltd.

We are very much impressed by the group medical insurance policy,offering fantastic benefits for our team's well-being.

Heral Mehta

Best group insurance policy for employees by Securenow!

Mahesh

We bought mediclaim policy from SecureNow.The process was easy & fast. Looking forward to a long association.

A.R. Housing

Outstanding Corporate health insurance! It's a valuable and strategic investment in our employees' health and happiness, providing them with top-notch medical coverage.

Hridesh Singh

Thank you for heling us buy suitabke group mediclaim policy..

Adil Nawaz

Thrilled with SecureNow's Group health insurance for employees. It promotes a healthy work environment, keeps them motivated.

ICONMA PROFESSIONAL SERVICES AND SOLUTIONS PRIVATE LIMITED

Excellent Service and we have decided to go with this service provider with our renewal. No issues with the policy servicing as well as some urgent troubleshooting. Thanks SecureNow.

Alka Gupta

My organization always bought health insurances directly from insurers. The renewal process and claim settlement was also tiresome for me as an HR. Since last year we've bought our health insurance policy from SecureNow. They not only helped us compare quotes and choose from those but also helped us with the claims.

Nidhi Verma

I am an HR and we've been working with SecureNow for 3 years now. SecureNow provides a lot of value added services such as wellness sessions and webinars and our employees also have had good experience with the SecureNow team.

Sucheta Katiyar

Registering for claims via the SecureNow App is very easy. SecureNow had organized an employee orientation session for our employees to explain about the health insurance benefits where they introduced us to their App. Now we have registered for the App and each one of us is using it to record claims and track claims.

Yogendra kumar Singh

I like the services provided by SecureNow, starting from policy placement to claim processing. The RMs are very proactive and helpful. We've personal interactions with the claim team of SecureNow that goes out of the way, sometimes, to help our employees for their claims.

Manishankar Pandey

You can trust SecureNow with your group health insurance. They'll give you competitive quotes and full support throughout.

Sujeet Kumar Sinha

We have a lot of health insurance claims in our organization. The SecureNow team really handles them well, I must say. We also have a lot of employees who join us every month. SecureNow organizes employee benefit sessions for them and clarifies all their group health insurance related queries. Really appreciate their efforts.

Dinesh Thapa

SecureNow has dedicated RMs and dedicated servicing teams for managing our health insurance policies. The team is reachable and had gone out of the way, sometimes, to help us if there is an emergency. As an HR, I really like how SecureNow has created such a good team and has built great rapport with network hospitals to give us good facilities.

Archit Arun

Our employees are really happy with the services SecureNow offers. We had asked them to organize a Yoga session for our employees and it was a huge success. Thank you SecureNow and all its employees for all the efforts. Keep up the good work!

Shivangi Gupta

The SecureNow App is really convenient to lodge and track claims. The team is also quite helpful when it comes to resolving issues aqnd queries.

Sakshi Dixit

We've been working with SecureNow for a few years now and I like the value-added services they provide. Their App has this Poly Clinic where you can book free video consultations with reputed medical practitioners. This is an amazing initiative and we also appreiate the numerous wellness camps that the've arranged for us.

Rajnish

I've had a group health insurance policy from SecureNow for over a year now, and it's been a great experience. The customer service is responsive and helpful.

Rajesh

SecureNow's group health insurance policy has been fantastic for our small business. We’ve saved money and the coverage is excellent. Highly recommend!

Mansi

We switched to SecureNow for our company's group health insurance policy and couldn’t be happier. Easy to set up and the benefits are top-notch.

Krunal

As a small business owner, finding affordable group health insurance policy was challenging until we found SecureNow. Great rates and service!

Yashwant

The group health insurance policy from SecureNow is comprehensive and affordable. Our employees are pleased with the coverage options.

Taran

SecureNow’s group health insurance policy has been a lifesaver for our company. The process was smooth, and the support team is always available.

Nilesh

Very satisfied with the group health insurance policy from SecureNow. The coverage is great and the customer support is always helpful and friendly.

Himesh

Switching to SecureNow for our group health insurance policy was a great decision. The policy is affordable and meets all our needs perfectly.

Sheetal

Our company has been using SecureNow for our group health insurance policy for a few months, and we’re very pleased. Excellent coverage and service.

Lavesh

SecureNow offers a great group health insurance policy. Our employees are happy with the coverage, and the costs are reasonable. Thumbs up!

Vishesh

I was impressed with the group health insurance policy from SecureNow. The enrollment process was quick and easy, and the coverage is extensive.

Srikant

The group health insurance policy from SecureNow is exactly what our company needed. Affordable and comprehensive coverage. Highly recommended!

Jyoti

SecureNow has provided us with an excellent group health insurance policy. The team is professional, and the benefits are exactly what we needed.

Meenakshi

We’ve had a wonderful experience with SecureNow’s group health insurance policy. The coverage is great and the customer service is exceptional.

Vanshika

SecureNow’s group health insurance policy has been great for our employees. They appreciate the comprehensive coverage and the easy claims process.

Shivani

Great group health insurance policy from SecureNow. The coverage options are extensive, and the customer service is always available to help.

Hitesh

Our experience with SecureNow’s group health insurance policy has been very positive. The coverage is great, and it’s very affordable for our team.

Dipen

We’re very happy with the group health insurance policy from SecureNow. The team is responsive, and the coverage is exactly what we were looking for.

Ishant

SecureNow has provided our company with an excellent group health insurance policy. The setup was easy, and the coverage meets all our needs.

Bhavika

I highly recommend SecureNow for group health insurance policy. The benefits are fantastic, and their customer support is always there to help.

Chiranjit

Our company's leadership highly recommends SecureNow's group insurance policy for its reliability and flexibility.

Raman

SecureNow's group health insurance for employees has made managing employee benefits a breeze for our HR department.

Santosh

The support team at SecureNow has been incredibly helpful in guiding us through our group insurance policy.

Dileep

I highly recommend SecureNow for group medical insurance. They made the process seamless and hassle-free.

Parul

Securing group health insurance through SecureNow was a smart decision for my business. Their plans are comprehensive and affordable.

Prakash

I found exactly what I needed with SecureNow's group health insurance options. They offer flexibility and extensive coverage.

Umakant

SecureNow's customer service team was fantastic in guiding me through the process of selecting the right Group Insurance Policy.

Bhupendra

I'm impressed by SecureNow's commitment to providing the best group medical insurance solutions. Thank you for your excellent service!

Rohit

I appreciate SecureNow's dedication to finding the best group health insurance solution for my business. They truly prioritize their clients' needs.

Aklesh

SecureNow's group health insurance options provide excellent value for money. I'm grateful for their expertise in guiding us through the selection process.

Amit

Our team loves the comprehensive coverage of our group insurance policy from SecureNow!

Aarush

Group insurance policy is a game-changer for our company's employee benefits package. Thanks, SecureNow!

Harshit

SecureNow's group insurance policy is top-notch, providing peace of mind for our entire team.

Teena

The simplicity and efficiency of SecureNow's group insurance policy make it a must-have for any business.

Ankur

With SecureNow's group insurance policy, our employees feel valued and supported in every way.

Rishi

Couldn't be happier with the flexibility and affordability of our group insurance policy from SecureNow.

Ishita

Our company's HR department swears by SecureNow's group insurance policy for its ease of use.

Akhil

SecureNow's group insurance policy has exceeded our expectations in every aspect. Highly recommended!

Lalit

Kudos to SecureNow for their excellent customer service and personalized approach to our group insurance policy.

Tarun

We appreciate the seamless integration of SecureNow's group insurance policy into our benefits package.

Nisha

SecureNow's group insurance policy offers the perfect balance of coverage and cost-effectiveness.

Ajay

Our experience with SecureNow's group insurance policy has been nothing short of fantastic.

Yogesh

The online portal for managing SecureNow's group insurance policy is user-friendly and intuitive.

Hansh

Our team feels safer and more secure with SecureNow's group insurance policy in place.

Harish

SecureNow's group insurance policy has made a significant difference in our company's employee satisfaction levels.

Shweta

Thanks to SecureNow's group insurance policy, our employees can focus on their work without worrying about healthcare costs.

Karan

SecureNow's group insurance policy has become an indispensable part of our company's benefits package.

Nakul

The peace of mind that comes with SecureNow's group insurance policy is invaluable to our team.

Lokesh

We've been impressed by SecureNow's commitment to providing tailored solutions with their group insurance policy.

Eshwar

SecureNow's group insurance policy offers excellent coverage options at competitive rates.

Rajesh

We recently had the pleasure of purchasing Group Health Insurance from SecureNow and must say that our experience has been pretty good.

Dhruv

We recently bought group medical insurance from securenow, and it was a very easy and simple process to buy. We really appreciate it.

Rajendra

The renewal process for group mediclaim is very simple and fast by securenow. The team is very efficient in their work.

Sangeetha

The group insurance policy options were flexible and tailored to my specific needs. Thanks, SecureNow.

Prabhu

We have connected with securenow for the last three years for group health insurance for employees. And it is a wonderful journey as we always get the best premium plans at affordable price.

Alok

Securenow is the perfect place to buy group insurance policy for employees. The team is very supportive and helpfull.

Dhruva

We got the best premium plans for group insurance for employees from Securenow.

Shiv

SecureNow has amazing deals and great premiums. We recently bought a group mediclaim policy for employees and it has amazing coverage. Love it.

Dinesh

The group health insurance we bought covers a whole range of things. A lot of things in a single place with really low premiums. It is an amazing deal.Thanks, Securenow.

Vinay

We connected with securenow to buy an affordable group health insurance for employees and we did find several good plans within our budget.

Suraj

One of our workers recently submitted a claim under his group mediclaim coverage, and he said that SecureNow made the procedure very simple and convenient.

Manoj

We never received a better quotation for a group insurance coverage than this one. Recommendable SecureNow.

Jagan

Securenow always provide best and affordable plans for group health insurance.

Anthony

When purchasing a group insurance policy from SecureNow, I had an amazing experience.

Gurpreet

We received a fantastic discount on group medical insurance from SecureNow.

Ujjwal

For the last five years that I have worked with Securenow, I have had no concerns about their group medical insurance plans or costs.

Ashok

We bought group health insurance from SecureNow as it was an easy procedure and they have several plans that worked for us. Thanks, SecureNow.

Pushpa

Thanks, SecureNow for making the claim process of group medical insurance so easy and smooth.

Vinay

The team of securenow is very concerned about their clients, as we connect them to group mediclaim. Keep it up, team.

Gaurav

It is a wonderful experience to connect with securenow for Group Insurance Policy.

Arjun kumar

I am more than happy with the way my group health insurance claim was settled by the team of SecureNow.

Aditya sinha

Marvelous online service. It's very fast and easy. Group medical insurance policy is issued instantly. Great.

Kabir chauhan

There are many insurance brokers in the market but SecureNow is the only choice for Group Mediclaim.

Ishaan krishnawat

We are looking for an insurance broker for the group insurance policy of our employees and we find SecureNow which fulfills our all requirements.

Aditi Rao

The best and most affordable premium plans of group health insurance for employees are provided by SecureNow.

Ananya Khanna

Got the group insurance policy for employees as fast as I even don't think. Thanks, SecureNow

Lakshmi Pandey

Wonderful experience while buying group insurance for employees from SecureNow.

Pranav rastogi

It was a very nice and friendly gesture from the team of SecureNow when we connected with them for the group mediclaim policy for employees.

Kavya jha

Thank you so much SecureNow for making the process of buying group health insurance so convenient.

Arnav joshi

We bought a group medical insurance from SecureNow and it was a great deal for us.

Ayaan Khan

Recently one of our employees claimed his group mediclaim policy and according to him, SecureNow made it a very easy and convenient process.

Sanjay Sharma

I must say that the team of SecureNow is very concerned about their customers. They help me a lot with my group insurance policy.

Rohan Bhardwaj

A friend told me about SecureNow for group health insurance for employees and it is a perfect recommendation.

Advik

We take group insurance policy for employees from Securenow and once again comes with great deals as always.

Ishani

It was our first time buying group insurance for employees and SecureNow's team assisted us very well.

Arun

SecureNow has well-spoken members in their team with proper information about group mediclaim policy for employees.

Rohit

It felt worth every penny I spent on group health insurance as I got the best and most affordable premium plans.

Arya

The renewal process is very easy for group medical insurance of SecureNow.

Darsh

I got the approval of my group mediclaim in just a couple of hours.

Navya

We got our group insurance policy from SecureNow in just a limited time.

Viraj

We bought group health insurance for employees and also got comprehensive benefits from SecureNow.

Gayatri

We have to thank SecureNow for their amazing support with us for group insurance policy for employees.

Vivaan

I am really satisfied with the coverage plans of group insurance for employees.

Shivansh

We have had a group mediclaim policy for employees with SecureNow for a while, and they've been wonderful. They offer competitive rates and have a local agent available always to answer our questions.

Anshul

We buy group health insurance for our staff from the team of SecureNow. They provided us with the best quotes and helped us to finalize the deal.

Rajat

I've been working with Securenow for the last five years and I do not doubt their premiums and plans for group medical insurance.

Sachin

We buy group mediclaim policy for our employees and our experience was wonderful just because of the supportive staff of SecureNow.

Freddy

I had a wonderful experience with SecureNow for buying a group insurance policy.

Purvi

We buy group health insurance for employees at an affordable price from SecureNow.

Kajal

It is a hassle-free process to buy group insurance policy for employees through SecureNow. It's appreciable.

Tarun

We were looking to buy group insurance for employees and SecureNow stands out in our expectations

Taniya

We are committed to the safety of our employees, and like us, SecureNow is committed to providing the best group mediclaim policy for employees. It's a nice gesture by their team.

Trisha

One of our employees recently claimed his group health insurance and his experience was fantastic with the support of a team of SecureNow.

Rishab

The team of SecureNow is well-experienced in making the buying process of group medical insurance smooth and hassle-free.

Simmy

We were unable to finalize the group mediclaim policy for our staff, so we approached SecureNow's team and they understood our concerns and provided us with the best plans.

Yash

It is the best quote for a group insurance policy we have had until now. Recommendable SecureNow.

Harshita

We got the affordable plans for the group health insurance for employees of our organization.

Arnab

It is an outstanding experience with SecureNow while buying a group insurance policy for employees.

Brijesh

SecureNow is the best in the industry to buy group insurance for employees.

Hiren

Connecting with Securenow to buy a group mediclaim policy for employees is recommended.

Nikita

Best and Affordable plans for group health insurance.

Archita

We connect to SecureNow for group medical Insurance and now all our policies are in their hand.

Akshit

I am happy to have the group mediclaim with the minimum time and without any problem.

Tanvi

We always rely on SecureNow for the best and most reliable premium plans for the Group Insurance Policy.

Bhatia Group

I recently switched to SecureNow for group health insurance of my employees, and I'm delighted. The coverage is comprehensive, and the premiums are reasonable. They make it easy to manage policies online for me.

M/S G.K. Enterprise

I've had group medical insurance with SecureNow for a while, and they've been wonderful. They offer competitive rates and have a local agent available always to answer my questions.

NKS Consultants

SecureNow truly cares about its customers. Recently one of my employees made a claim for his group mediclaim. And I get to know that their claims process is hassle-free, and they make sure you get back on your feet quickly after a covered loss.

Arjun Choudhary

I can't say enough about the incredible service provided by SecureNow. They took the time to understand my unique needs for my group insurance policy and found me the perfect packages at the best rates. Highly recommended!

Jagan Enterprise

I've been working with them for years, and they consistently deliver personalized service and competitive insurance options of group health insurance for employees. Their expertise and dedication have made insurance decisions stress-free.

Amphitech Media

The team at SecureNow is exceptional. They work diligently to find cost-effective solutions while prioritizing my interests. I trust their expertise in group insurance policy for employees and appreciate their proactive approach.

N&S Enterprise

SecureNow commitment to transparency and unbiased advice is refreshing. They have helped me secure comprehensive coverage for group insurance for employees, all while staying within my budget.

Computer Tech Solutions

As a small business owner, I rely on SecureNow for all my commercial insurance needs. They helped me to finalize the group mediclaim policy for employees. Their team is responsive, well-informed, and proactive, making them an indispensable partner.

Ashok

I've been with SecureNow for years, and they have consistently provided excellent service. Their claims process is straightforward, and the customer support is impressive.

Rahul Taneja

I appreciate the transparency of SecureNow. They explain the insurance policies clearly and help me make informed decisions. Their commitment to customer education sets them apart.

Simran Chopra

SecureNow has a wide range of policy options to fit various needs. Their staff is knowledgeable, and I've always felt like a valued customer. Highly recommended!

Anshuman Agrawal

I've been a customer for many years, and SecureNow has consistently provided reliable coverage. Their online tools make managing policies and payments a breeze.

Abhishek Rawat

I was overwhelmed by the insurance choices out there, but SecureNow simplified the process. Their knowledge and guidance helped me make informed decisions and secure the right coverage.

Ashmika

SecureNow has provided invaluable assistance during a complex insurance claim. Their expertise and advocacy made the claims process seamless. I'm grateful for their support.

Samridhi Chauhan

I have worked with several insurance brokers over the years, and SecureNow stands out. Their commitment to customer satisfaction, coupled with their extensive industry knowledge, sets them apart.

Paramjeet Kaur

It was easy to buy group health insurance from Securenow's website PLUS customer support was amazing as well. All my doubts were cleared promptly. Thankyou.

Aniket Sharma

Filing a health insurance claim with securenow was an efficient ans straightforward process. Their advance app make cliam registartiona and document submission very easy. Really impressed with the tech solution they have to offer.

Shri Hanumantha Buildtech

We beleive Securenow Brokers helped us get the best Group Health insurance cover in India. They made things so easier for us, by understang our need and suggest an optimal plan. There also have tieup with so many insurers..

AC INFOTEX PVT LTD

Securenow offered an impressive range of insurance options from leading insurers. I appreciated the comprehensive details avalable for each policy which helped me to take the better decisions. Thankyou.

Vinod Kashyap

Securenow's customer support executives are very helpful. We had contacted them to buy a reliable group health insurance policy for our firm. They not only suggested us the best plans as per oury needs but also helped us pay the premium via reliable and secured gateway.

Shri Balaji Udyog

Securenow's efficient claims process was impressive. In case of any claims, our employees are able to get their claims registered, documents submitted and track progress of the calim online on their app. This allowing them to focus on their recovery without worrying about financial aspects.Thankyou.

HiTechPro Industries

It is necessary invertment and totally worth it. Thanks.

Aricon Marine Consultants

Thankyou securenow for providing optimized plan at affordable premium rates to us. It was a pocket-freindly policy purchase.

Deneva India

Buying group health insurance policy for employees online was so easy with securenow. We bought Reliance General Insurance Health Insurance Policy online from them. They also have wellness programs that we would like to avail. Overall the purchasing process was very convenient. Thanks SN!

bhavesh anand

We have been purchased GHI from Securenow since lat 3-4 yrs. Group health insurance rates they offer are very competitive and affordable. Thankyou Securenow!

Spectrun Visios

The customer care service of the Securenow is very good. While buying group health insurance for small business I run, i was helped at each step of buying process. Their customer support team is always accessibel and had helped clear all my doubts. regarding the plan.

ABANI MOHANTY

I purchased group mediclaim policy with the help of Securenow recently and i am so much satisfied with the plan. The application process was easy and efficient. Thy made the typically complex task of insurance buying look so seamless. Thanks to their expert guidance!

N Square Autonation

Securenow provides quite affordable group health insurance plans to their customers. I bought Manipal Cigna health insurance plan from their website. I found it befitting my need & budget. Satisfied with the purchase.

Jaishree Gupta

My association with insurance broker- Securenow is new. I switched insurer this year, as in the past I used to renew the policy paying a higher premium amount. Follwowing the advise of Securenow, I was able to save a reasonable amount on the premoum this year. All the Best, team Securenow!

C.D.S.Das

Purchasing the group insurance policy from Securenow was very easy. Their website is intuitive, and the application process is very user friendly. Their support team was incredibly helpfu and accessiblt at every step.

HARI PRASAD

I checked the various websites offering group health insurance plans for small businesses, but they all were all charging through the nose. Then I happened to check WWW.SECURENOW.IN , where I was able compared different policies and plans. The comparison is very easy. I had some queires for which I had requested a call back. I got to speak to their epert who guided me during the online buying journey.

Rajaram Chopdar

I got great deals on www.securenow.in. Highly recommend their service!

Ansh Enterprises

Very quick response tiime by Securenow team. We called their Customer Care and my query was resolved in first call itself. Don't know about the claims as none has arisen so far. As There Has Been None, Hopefully That Too Will Be Hassle Free.

Rinki

If you are looking for the best group health insurance company with excellent support all through, I suggest you go try put Securenows expert advise. I have lots of appreciation, the way they helped us get best policy & also save some money. Thnx Securenow..

RMS Enterprises

Securenow offers hassle free buying. It helps compare business group health insurance plans of multiple insurance companies and then advises you which would be best for you. Their app is very efficient ans help us get all the updated line like employee health card, provided option to add/delete members, and also able to track claim status. We largely had smooth exxperience for claims as well.

Sanjana Arora

Most fitting group health insurance! Its the best plans from SecureNow, offering great coverage for our employees.

ExImport Enterprises

Excellent group health insurance policy with comprehensive coverage for members. Highly recommended this corporate health insurance plans!

Veena Mohan

Group mediclaim policy provided by SecureNow offer good group health coverage, ensuring our employees' peace of mind.

Madan Joshi

Happy to have group insurance for employees offering excellent coverage.

Ess Key Pvt. Ltd.

We are very much impressed by the group medical insurance policy,offering fantastic benefits for our team's well-being.

Heral Mehta

Best group insurance policy for employees by Securenow!

Mahesh

We bought mediclaim policy from SecureNow.The process was easy & fast. Looking forward to a long association.

A.R. Housing

Outstanding Corporate health insurance! It's a valuable and strategic investment in our employees' health and happiness, providing them with top-notch medical coverage.

Hridesh Singh

Thank you for heling us buy suitabke group mediclaim policy..

Adil Nawaz

Thrilled with SecureNow's Group health insurance for employees. It promotes a healthy work environment, keeps them motivated.

ICONMA PROFESSIONAL SERVICES AND SOLUTIONS PRIVATE LIMITED

Excellent Service and we have decided to go with this service provider with our renewal. No issues with the policy servicing as well as some urgent troubleshooting. Thanks SecureNow.

Alka Gupta

My organization always bought health insurances directly from insurers. The renewal process and claim settlement was also tiresome for me as an HR. Since last year we've bought our health insurance policy from SecureNow. They not only helped us compare quotes and choose from those but also helped us with the claims.

Nidhi Verma

I am an HR and we've been working with SecureNow for 3 years now. SecureNow provides a lot of value added services such as wellness sessions and webinars and our employees also have had good experience with the SecureNow team.

Sucheta Katiyar

Registering for claims via the SecureNow App is very easy. SecureNow had organized an employee orientation session for our employees to explain about the health insurance benefits where they introduced us to their App. Now we have registered for the App and each one of us is using it to record claims and track claims.

Yogendra kumar Singh

I like the services provided by SecureNow, starting from policy placement to claim processing. The RMs are very proactive and helpful. We've personal interactions with the claim team of SecureNow that goes out of the way, sometimes, to help our employees for their claims.

Manishankar Pandey

You can trust SecureNow with your group health insurance. They'll give you competitive quotes and full support throughout.

Sujeet Kumar Sinha

We have a lot of health insurance claims in our organization. The SecureNow team really handles them well, I must say. We also have a lot of employees who join us every month. SecureNow organizes employee benefit sessions for them and clarifies all their group health insurance related queries. Really appreciate their efforts.

Dinesh Thapa

SecureNow has dedicated RMs and dedicated servicing teams for managing our health insurance policies. The team is reachable and had gone out of the way, sometimes, to help us if there is an emergency. As an HR, I really like how SecureNow has created such a good team and has built great rapport with network hospitals to give us good facilities.

Archit Arun

Our employees are really happy with the services SecureNow offers. We had asked them to organize a Yoga session for our employees and it was a huge success. Thank you SecureNow and all its employees for all the efforts. Keep up the good work!

Shivangi Gupta

The SecureNow App is really convenient to lodge and track claims. The team is also quite helpful when it comes to resolving issues aqnd queries.

Sakshi Dixit

We've been working with SecureNow for a few years now and I like the value-added services they provide. Their App has this Poly Clinic where you can book free video consultations with reputed medical practitioners. This is an amazing initiative and we also appreiate the numerous wellness camps that the've arranged for us.