Group Health Insurance in Other Cities

Group Health Insurance in

Pune

Group Health Insurance in

Mumbai

Group Health Insurance in

Ahmedabad

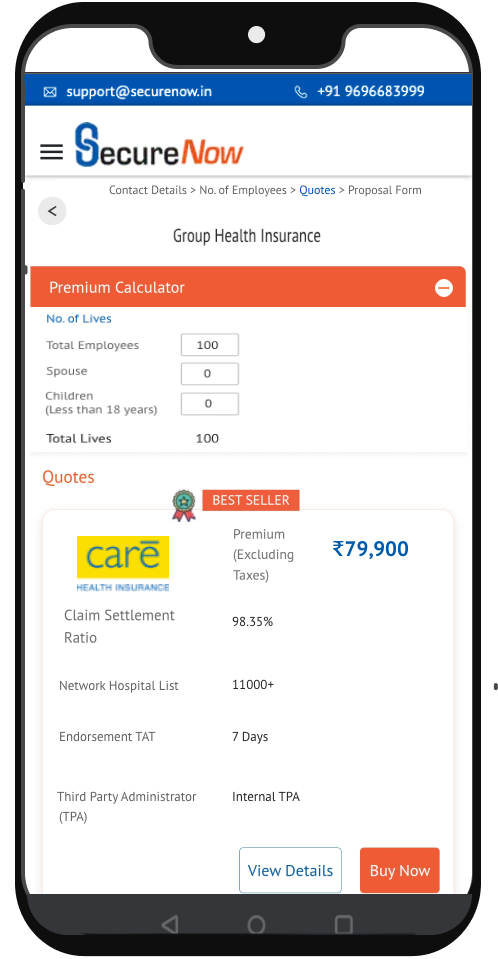

(Excluding Taxes)

Customise benefits based on your budget.

Customise benefits based on your budget.

Key Account Manager

Mobile App:Cashless eCard and Reimbursement eClaims

Claim status on app

HR Dashboard

All feature of Bronze

General Physician Video consultation: 2 per employee

wellness webinar: 1 per month

Quarterly premium client engagement call

All feature of Silver

Specialist Video consultation: 2 per employee

Basic health check-up on 9 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for self, spouse, and 2 children (max age:40)

Claims support for personal health insurance plans

All feature of Gold

Specialist Video consultation: 4 per employee

Advanced health check-up on 25 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for Father and Mother (max age:70-for top 10% of employees)

Buy Now Pay Later OPD Upto 10K per employee

Senior Citizen helpline

Key Account Manager

Mobile App:Cashless eCard and Reimbursement eClaims

Claim status on app

HR Dashboard

All feature of Bronze

General Physician Video consultation: 2 per employee

wellness webinar: 1 per month

Quarterly premium client engagement call

All feature of Silver

Specialist Video consultation: 2 per employee

Basic health check-up on 9 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for self, spouse, and 2 children (max age:40)

Claims support for personal health insurance plans

All feature of Gold

Specialist Video consultation: 4 per employee

Advanced health check-up on 25 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for Father and Mother (max age:70-for top 10% of employees)

Buy Now Pay Later OPD Upto 10K per employee

Senior Citizen helpline

See More

Bangalore, a developing metropolis in India, is famous for its IT industry and rapid urbanisation. However, to this, some health challenges, from environmental pollution and all the related diseases to life-threatening illnesses, the citizens of Bangalore do deal with every other major enemy.

Complications owing to air pollution and imbalances in the records of one's blood sugar also take place and lead to respiratory problems in Bangalore, making it difficult for people to cope with one another by living with diabetes and cardiovascular problems. Bangalore is in the habit of giving frequent invitations in the health care profession and increasingly surging medical expenses. Citizens of Bangalore are compelled, now more than ever, to invest in a reasonable health insurance policy.

Costs of hospitalization in Bangalore normally range from 80,000 to1,50,000 per admission. Such costs warrant some health insurance. To palliate healthcare costs, group health insurance policy is presently provided as added benefits by employers within Bangalore.

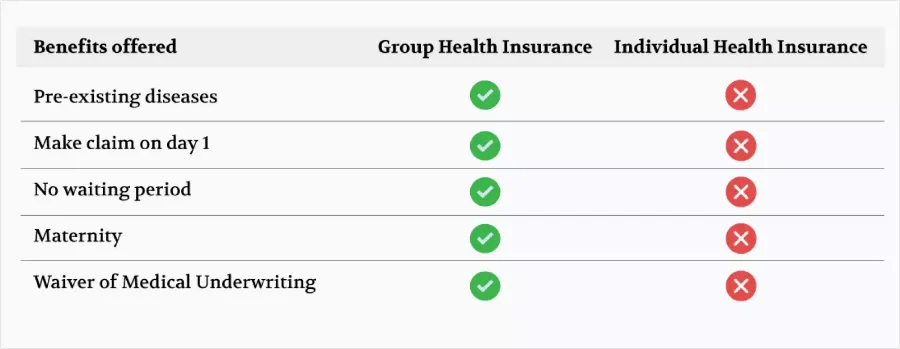

Group health insurance policies drafted by the employer in Bangalore are among the most important policies for individuals. They provide total medical insurance to employees and their families under one umbrella plan. The policies generally cover hospitalisation and pre- and post-hospitalisation expenses. Some may even cover maternity and pre-existing illnesses. The leading health insurance providers in Bangalore cover major hospitals like Manipal Hospitals, Fortis, and Narayana Health. They also provide cashless hospitalisation. All these benefits together help employees receive treatment without any financial anxieties.

A group health insurance policy in Bangalore is cheaper than an individual health plan. The risks spread uniformly among a larger group. Besides, the group medical insurance in Bangalore covers employees' families. People covered may also be wives, dependent children, and employees' parents. Some policies can even extend to cover in-laws. The tax benefits make it appealing to both employers and employees. Other advantages concerning tax breaks on employer contributions include that plans can be adapted to meet employees' needs. Group health insurance policies are a win-win for both employers and employees.

Here are the key tax benefits associated with group health insurance policies:

This is the process for a claim for a group health insurance policy in Bangalore:

When choosing group health insurance for their employees, employers should consider various factors, including special benefits, cost, and the flexibility of the health insurance plan itself. SecureNow offers complete and affordable solutions and supple support, enabling businesses to manage employee health benefits efficiently.

When selecting one of the best group health insurance plans in Bangalore, employers need to consider various factors. Look for details like the type of coverage, cost, and benefits offered. Many top health insurance companies in Bangalore offer customised plans. These plans are tailored to suit businesses of various sizes. Companies like SecureNow provide an excellent platform. We are known for being an affordable and flexible group of health insurance options. We cater to all the specific needs of Bangalore-based businesses.

Group Health Insurance in

Pune

Group Health Insurance in

Mumbai

Group Health Insurance in

Ahmedabad