Group Health Insurance in Other Cities

Group Health Insurance in

Pune

Group Health Insurance in

Mumbai

Group Health Insurance in

Ahmedabad

Group Health Insurance in

Bangalore

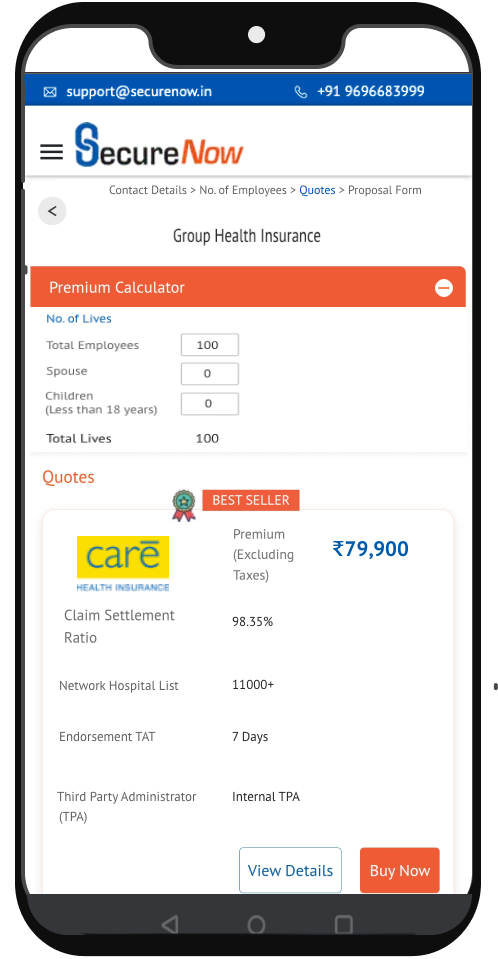

(Excluding Taxes)

*Terms & conditions apply

Customise benefits based on your budget.

Customise benefits based on your budget.

Key Account Manager

Mobile App:Cashless eCard and Reimbursement eClaims

Claim status on app

HR Dashboard

All feature of Bronze

General Physician Video consultation: 2 per employee

wellness webinar: 1 per month

Quarterly premium client engagement call

All feature of Silver

Specialist Video consultation: 2 per employee

Basic health check-up on 9 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for self, spouse, and 2 children (max age:40)

Claims support for personal health insurance plans

All feature of Gold

Specialist Video consultation: 4 per employee

Advanced health check-up on 25 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for Father and Mother (max age:70-for top 10% of employees)

Buy Now Pay Later OPD Upto 10K per employee

Senior Citizen helpline

Key Account Manager

Mobile App:Cashless eCard and Reimbursement eClaims

Claim status on app

HR Dashboard

All feature of Bronze

General Physician Video consultation: 2 per employee

wellness webinar: 1 per month

Quarterly premium client engagement call

All feature of Silver

Specialist Video consultation: 2 per employee

Basic health check-up on 9 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for self, spouse, and 2 children (max age:40)

Claims support for personal health insurance plans

All feature of Gold

Specialist Video consultation: 4 per employee

Advanced health check-up on 25 parameters

Top-up insurance of 10 lacs Sum assured with 5 lacs Deductible for Father and Mother (max age:70-for top 10% of employees)

Buy Now Pay Later OPD Upto 10K per employee

Senior Citizen helpline

See More

Group health insurance is a policy that provides medical insurance to a large number of people. These people are typically employees or members of an organization. The policy holder, often the employer or organization, buys the plan and pays the fees. The group members get the policy's advantages.

A group health plan or group mediclaim policy aims to provide affordable healthcare coverage. It serves a broad demographic, ensuring availability for large section of people.

These plans typically offer comprehensive Group Medical Coverage, including preventive care, medical procedures, prescription drugs, and other healthcare services.

Group health insurance for employees may include added perks like wellness programs and health education. It may also grant access to tele-medicine services.

Many companies offer employer-sponsored health insurance as one example of medical insurance for employees. In this plan, the employer pays some of the premium and the employee pays the rest from their salary.

Employee group health insurance covers various medical services like doctor visits, hospital stays, prescription drugs, and preventive care. Some plans may also include dental and vision coverage.

Professionals or trade associations offer association health insurance to their members, which is another example of group health plan. These plans provide affordable health coverage. They provide group insurance for small business and to self-employed individuals not covered by conventional employer-sponsored plans.

We can tailor group health insurance plans to meet the group's needs. These plans may offer various coverage options and cost-sharing agreements. But these plans may not have the same rules and protections as regular health insurance plans.

Here are the steps to understand how group health insurance works and how to obtain it.

Insurance companies design group health insurance plans for groups of people who want to obtain health coverage together. Here are some examples of who might consider purchasing a group health insurance plan-

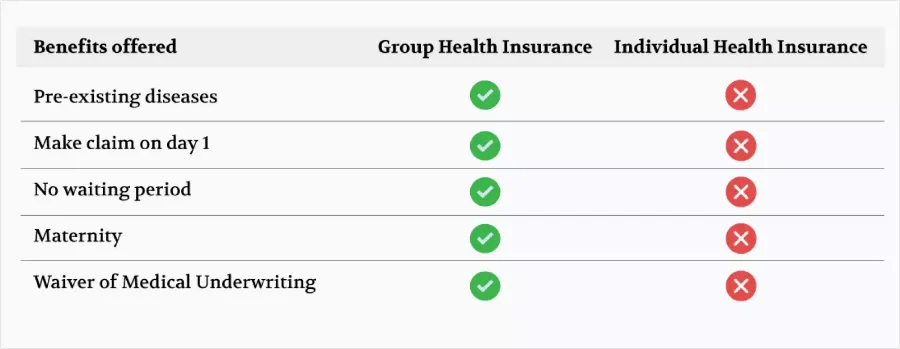

Below given is the curated list of the benefits offered under group medical insurance for employees in India:

Group Health Insurance in

Pune

Group Health Insurance in

Mumbai

Group Health Insurance in

Ahmedabad

Group Health Insurance in

Bangalore